Sep

2023

Is there anything positive about China?

DIY Investor

11 September 2023

After the last two weeks of turmoil in the property sector, Chinese policymakers have reacted with a number of announcements, hoping to provide much-needed support to the market.

Please find below our latest thoughts on China:

- Confidence in China has reached such a depressed point that investors are desperately seeking to know what, if anything, looks positive.

- Indeed, China A-shares have seen significant outflows of 90 billion renminbi in August. This is the largest monthly outflow since the launch of the Stock Connect scheme. Northbound flows are typically used as an indicator of international investors’ participation, and clearly this investor base is concerned.

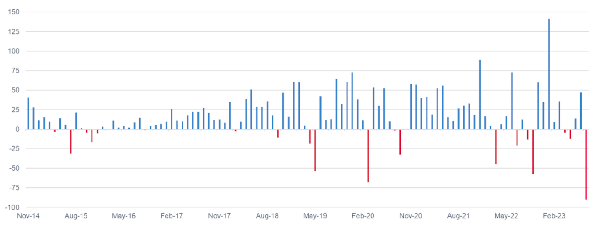

Chart 1: Monthly northbound net buying / selling through Stock Connect (RMB bn)

Source: Wind, Allianz Global Investors, as of 31 August 2023.

- So, are there any positive signals? We believe there are some meaningful positive indicators. After the last two weeks of turmoil in the property sector – with Country Garden missing two coupon payments and Evergrande filing for bankruptcy in the US – Chinese policymakers have reacted with a number of announcements, hoping to provide much-needed support to the market.

- For example, the PBoC, China’s central bank, announced a cut to the 1-year loan prime rate of 10bps. China has also halved the stamp-duty on securities transactions, marking the first reduction since 2008. Beyond this, it has cut minimum margin trading requirements, lengthened stock trading hours, and extended tax relief measures for small businesses.

- On the property front, top regulators issued nationwide guidance to loosen key hurdles on first-home mortgages and extend tax incentives for housing upgraders by two years. Since then, all four tier-1 cities have pledged to roll out support measures. Downpayment ratios have been cut in an effort to prop up home upgrade demand. Meanwhile, some provinces like Zhengzhou and Nanjing have announced more local housing stimulus package.

- The market has had some recovery this week. But obviously the question is – will it be sustainable?

- Ultimately, we believe investors need to come to terms with the reality that a big bang stimulus in the property sector is unlikely.

- China is undergoing structural reforms to wean its economy off the property sector given the structural change in demographics, where slowing population growth means that fewer houses will be needed in the future, as well as the unsustainable leverage built up in the sector.

- More importantly, with property and the related sectors estimated to account for roughly 30% of China’s overall GDP, as the sector goes hand in hand with consumption (~60% of household assets are held in property1) and construction (with the infrastructure buildout and related building materials supply chain), the question arises again – how is China going to make up to the gap of contributions to economic growth if property is no longer the driver?

- Multiple new growth drivers are needed. For instance, it is estimated that the auto sector including the fast-growing new energy vehicles (NEVs) accounts for around 10% of China’s GDP.2 To offset the slowing property sector, we basically need multiple NEV-like success stories, not only in manufacturing but also in the expansion of service sectors to make up the gap.

- Innovation and technological advancement, across a broad range of areas, including not only NEVs, but also semiconductors, AI, big data & digitalisation, industrial upgrading, innovative drug discovery and others will continue to be areas that China grows and promotes. These initiatives are critically important for China amid geopolitical tensions to build up its own technological capabilities.

- Relating to this topic, Huawei launched its first 5G phone – Mate60 Pro – on its official website this week. This is one of the most eye-catching launches for Huawei after its smartphone business was hammered by US trade sanctions and its CFO was arrested in Vancouver a few years back.

- Perhaps this explains why there was no prominent launch event, and there is also limited information about the phone on the official website; for example, there is no mention of which processor the phone uses. It seems that Huawei wants to keep this low profile.

- It is also reported that the new model runs on Huawei’s latest Harmony 4.0 operating system and can access its self-developed Pangu AI model. If this is true, it is strong evidence of Huawei’s continued technology upgrade even with the backdrop of US sanctions.

- Negativity bias is certainly playing out in the China equity markets this year, but that does not mean that there are no green shoots. It only means that they are being overlooked. We believe there are still bright spots related to policy and innovation across an array of areas. We know China can develop globally market-leading products and services. But, we also know that as with any transition, there will be “teething pains” as China’s economic growth moderates to a more sustainable level.

1 Source: Goldman Sachs Investment Research, 23 Aug 2023 Republic of China.

2 Source: Data based on portfolio manager’s estimates and historical data from National Bureau of Statistics of China and World Bank

Leave a Reply

You must be logged in to post a comment.