Oct

2023

Is the 60/40 dead?

DIY Investor

22 October 2023

It is important for investors to focus not on where returns have been, but instead where they could be going in the months and years ahead – writes Meera Pandit

Since emerging from the Financial Crisis, a 60/40 portfolio of U.S. stocks and bonds has earned a whopping 11.5% average annual return. However, 2022 has been a particularly challenging year for the 60/40, which declined 16.1% in the first half of the year. This has prompted the question—is the 60/40 dead?

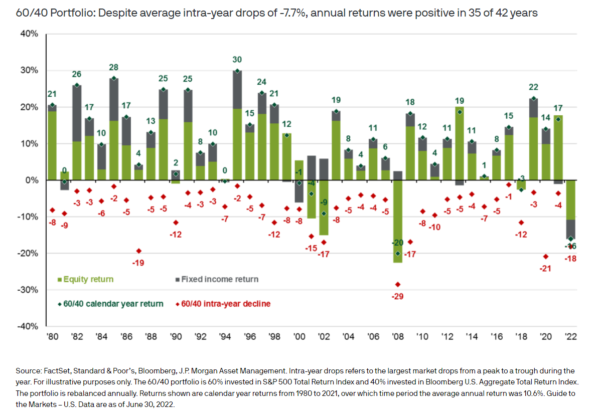

Although returns this year have been unsettling to say the least, a double-digit decline in the 60/40 portfolio is not unheard of. Since 1980, there have been nine instances in which the 60/40 fell more than 10% within a given year. Yet, investors who were patient with their portfolios were often rewarded with a rebound. In five of those years, returns still ended the year positive. In eight of the nine instances, returns the following calendar year were positive, with an average return of over 17%.

While it has been a painful ride down, the reset in valuations creates opportunity for subsequent returns. If we look at a valuation measure of the 60/40 based on blending the earnings yield (inverse of P/E ratio) on stocks and the yield-to-worst on bonds (higher = less expensive), valuations have cheapened from 3.5% to start the year to 5.3% at the end Q2. These lower starting valuations imply an average annualized return over the next decade of 6.1% compared to just 2.6% to start the year.

The near-term environment for stocks and bonds could continue to be challenging with the Fed aggressively raising rates to tame inflation. However, it is likely that most if not all of the Fed rate hiking cycle will be behind us by the end of the year. Bonds have struggled while rates have risen, but as investor concerns shift to slowing growth, there is scope for yields to fall. Stocks may face additional headwinds as earnings expectations are revised down, but significant repricing has already occurred. Therefore, it is important for investors to focus not on where returns have been, but instead where they could be going in the months and years ahead.

60/40 portfolio intra-year declines vs. calendar year returns

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management.

Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide.

To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP

Brokers Commentary » Brokers Latest » Commentary » Equities » Equities Commentary » Equities Latest » Fixed income Commentary » Fixed income Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.