Feb

2020

Markets: Is it time to run away?

DIY Investor

2 February 2020

On 17 January, the three major US stock market indices closed at record highs. There seems little on the horizon to worry investors on the economic front, with broad expectations that rates will continue to remain ‘lower for longer’.

However, one can always find something to worry about: the excessive leverage found everywhere in the global financial system, climate change, coronavirus or Middle East tensions (as well as myriad others) are all potential sources of the next market setback or bear phase.

Against this background, perhaps Falstaff’s warning is apposite – discretion is the better part of valour. But, if investors are tempted to try to reduce risk within their portfolios, how is this best achieved? Two of our analysts give their opinions on the best route to achieve lower overall risk.

Shifting to defensive equity strategies balances the risks better at this time

“As long as the music is playing, you’ve got to get up and dance.” Chuck Prince, Citigroup Chief Executive, July 2007

With the benefit of hindsight it may be tempting fate to quote Mr Prince, given the subsequent events, but his advice remains salutary.

Possibly it is even more relevant in the post-crisis world than it was at the time it was offered.

‘As long as the music is playing, you’ve got to get up and dance’

Whilst it is tempting to try to time markets, few (possibly no-one?) has ever managed to do it successfully on a consistent basis.

Doomsters routinely predict many more market crashes than ever materialise.

For long-term investors, I believe staying invested is likely to be a much more successful investment strategy. It is also a lot easier to do!

In fact, research we published last September demonstrates that long-term outperformance in investment trusts has come from a surprisingly low number of months: missing those months would mean you miss out on any alpha.

That risk is another reason to stay invested, and to be wary of trying to sell the top and buy back in at the bottom.

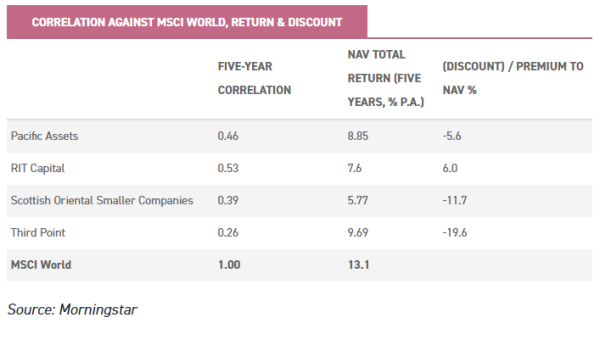

That said, it is certainly possible to reduce risks by re-allocating to equity funds which are more defensive – either structurally, or because the manager may be cautiously positioned at the current stage in the cycle.

The advantage of the latter is that the equity market beta of the fund may be dynamic.

While the trust might be defensive now, if market conditions change and the manager believes that valuations have become more attractive, they might be expected to either shift the exposure of the portfolio, or take on gearing.

Either action (assuming they have correctly interpreted the data) might be expected to deliver a strong subsequent performance as the market stabilises and perhaps recovers.

‘currently defensive, but have a track record of strongly outperforming equity markets over the long term’

Several managers spring to mind who are currently defensive, but have a track record of strongly outperforming equity markets over the long term.

Adding to these defensively positioned equity managers should reduce the overall beta of the portfolio.

However as they run equity portfolios they are still offering upside potential in any rally or rebound; unlike some of the alternatives which my colleague suggests might be used for diversification.

In other words, taking this approach avoids having to both time the move into defensive assets and time the move out.

Uncorrelated strategies are the key to riding out a storm

“My centre is yielding. My right is retreating. Situation excellent. I am attacking.” Ferdinand Foch

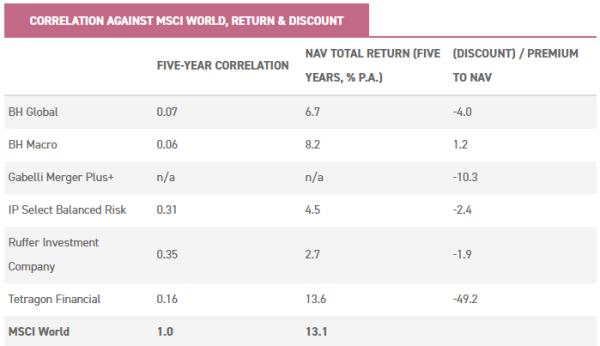

I believe the key to keeping one’s head above water, and ensuring the worst does not happen in a bear market, is diversification. As Harry Markowitz is alleged to have said: “Diversification is the only free lunch in investing”.

‘Diversification is the only free lunch in investing’

Bonds have traditionally been a balanced portfolio’s ying to equity’s yang.

However, with interest rates seemingly anchored on the floor and with bond markets still suffering the effects of years of QE, it is possible that bonds could be positively correlated with equity markets in a serious sell-off, and therefore could perhaps be considered a poor (or at least, expensive) diversifier.

So what are the alternatives for those wishing to boost diversification, but without adding to fixed income exposure?

We have all learned plenty since the global financial crisis, when some alternative asset/absolute return funds’ NAVs provided a reasonably uncorrelated return.

However share prices (and ensuing discounts) during the GFC were very much correlated to the equity plunge. This meant much of the diversifying effect was lost for shareholders.

This time round the listed funds typically have much tighter discount policies, which should mean that NAV returns are more likely to be reflected in share price returns.

In my view, the benefits of having a fund that delivers returns which are uncorrelated to equities are clear: the portfolio as a whole will have better risk adjusted returns.

Lower correlation (and higher fund volatility) means that investors have to own proportionately less of the investment to create the same diversification effect.

It is important to note that some asset classes are considered uncorrelated to equity markets, including real assets and private equity.

However, it is also worth remembering that an asset that appears uncorrelated to equity markets – perhaps because it is only revalued on a quarterly or half yearly basis – may not in truth be as uncorrelated as the statistics show.

‘the time to seek exposure to any such strategy is surely now, following a period of relatively low daily volatility’

As with anything, it is worth comparing apples with apples. As such, in the selection below I have considered only investments or strategies where the underlying investments are traded relatively frequently (with at least a weekly or monthly NAV calculation).

Several of the constituents of the AIC Flexible sector could be considered diversifying strategies, despite having equities as part of their portfolio. However, other places to look include investment strategies which do not have any equity exposure at all.

I would add that several trusts in our selection offer the potential for portions of their portfolio to generate outsized returns in an environment where volatility picks up.

Put and call options, for instance, have historic volatility as a pricing input; with recent volatility subdued, a pick could easily see a significant upward revaluation.

Given the outsized upside potential that this strategy offers, relative to the cost, the time to seek exposure to any such strategy is surely now, following a period of relatively low daily volatility.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN 480590), registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.