Feb

2021

ISA Season: The importance of buying earners*

DIY Investor

7 February 2021

*With sincere apologies to fans of Victorian literature

March is traditionally considered ‘ISA season’, when UK investors focus on their annual ISA allowance and are encouraged to ‘use it or lose it’.

‘investment trusts within ISAs are an excellent way to benefit from the power of compounding over the long term’

As we highlighted in our article last year, investment trusts within ISAs are an excellent way to benefit from the power of compounding over the long term, without worrying about the tax consequences of whether you are receiving capital gains or dividend income.

Our analysis last year showed that the top ten compounding trusts – since Personal Equity Plans or PEPs (the precursor to ISAs) were first introduced – come from a very wide range of asset classes. We determined that the distinguishing factors between them were manager skill and the unique ability, afforded by the structure, for investment trust managers to truly invest with a longer-term horizon than the open-ended competition.

Decision time

Faced with the decision of where to invest fresh money, it always pays to take a long-term view of opportunities – as well as avoiding the temptation to time the market.

Nonetheless over the past few years, it is widely recognised that equity market gains have been largely and increasingly driven by a narrow cadre of mega-cap technology stocks.

While it may make sense to continue to run existing investments, or funds exposed to them, could adding this year’s ISA to the same themes be seen, in time, as over-egging the pudding?

Many commentators are predicting that with ultra-low interest rates, low inflation and muted global growth, return expectations over the next decade will be lower than they have been historically.

BlackRock, for instance, expects US and global large-cap equities to return between 5.2% and 5.8% p.a. for the next decade (see this link). If they are right, it makes sense to look around for other opportunities.

The longer-term statistics show that by far the greatest proportion of stock market total returns comes from dividends.

‘by far the greatest proportion of stock market total returns comes from dividends’

An article in the Financial Analysts Journal examines US stock market returns over the very long term (200 years).

This analysis determined that of the 7.9% total return from US equities over the period 1802-2002, a full five percentage points p.a. of these returns came from dividends.

Interestingly, much smaller proportions of returns came from revaluation (0.6%) and real growth in dividends (0.8%). The rest came from inflation (1.4%) (‘Dividends and the Three Dwarfs’, Robert Arnott in the Financial Analysts Journal).

In fact, in the US, the study showed that dividends’ contribution to total returns has dwarfed the combined effect of inflation, dividend growth and changing valuation levels.

Certainly the past ten years hasn’t reflected the long-term pattern. But in a lower growth environment it is possible that the long-term trend will reassert itself, meaning that dividends’ contribution to total returns will again be much more significant in the future.

Dividend paying stocks outperform

As a generalisation, stocks with the highest growth potential are perceived as likely to not be paying a dividend.

Instead they will typically need to continue to reinvest excess cash in expanding products, intellectual property and capacity to deliver the expected growth.

At the other end of the spectrum, value stocks typically pay high dividends. There are plenty of arguments, both ways, as to whether growth or value will be a better investment strategy over the next decade.

However, one recent study did attempt to disentangle the truth about the importance of dividends from the traditional ‘growth vs value’ argument. In ‘What Difference do Dividends Make’ (2016) Conover, Jensen, and Simpson sought to determine whether a dividend yield is a differentiator of performance, independent of whether you are a growth or value investor.

Their conclusions backed up the longer-term statistics, finding that companies that pay a dividend have conclusively outperformed those that do not.

‘companies that pay a dividend have conclusively outperformed those that do not’

In fact, the research found that over 51 years (from July 1963 to December 2014) high-dividend payers had the least risk, yet returned over 1.5% p.a. more than non-dividend payers.

They observed that dividend paying stocks reduced portfolio risk significantly, and that the reduction in risk was achieved without a corresponding reduction in returns.

The ‘no dividend’ cohort of stocks in their analysis had the highest volatility, even greater than that of their ‘extreme- dividend’ cohort.

This outcome is odd, given that the highest dividend yielding stocks might be presumed to be composed largely of financially distressed companies, or companies unable to find growth opportunities to reinvest income into.

Another finding, again perhaps contrary to expectation, was that the benefit of targeting dividend paying stocks was greatest for growth and small-cap investors.

Why do dividend payers outperform?

One reason could be age. In the traditional model of company development, younger companies need to fund their growth; whereas mature and established companies require less investment (with the implication that they will have more longevity), and pay dividends with surplus cashflows.

This model suggests that incumbents have, on average, more reliable prospects than new disruptors, many of whom will fail.

While this hypothesis is probably true on average, the lesson of the past decade has been that it only takes one disruptor to change an industry for ever.

A more plausible, and perhaps enduring, reason why we believe that dividends have contributed to the majority of long-term returns is that they tend to be significantly less variable than capital returns.

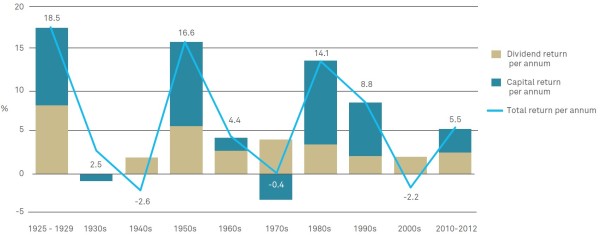

The graph below from Newton is a little out of date, but illustrates the point. It splits world equity returns over the decades (from 1925 to 2012) by capital and income.

Income variability was relatively low over the years examined, while capital returns were significant in some years but negative in others.

WORLD EQUITY RETURNS (INFLATION ADJUSTED), SPLIT BETWEEN INCOME AND CAPITAL

Source: Newton

Over short races, sprinters have the edge. But over longer distances, it is those who are able to keep the steadiest pace who are likely to feature in the medals.

Reinvesting dividends means that investors are less likely to experience extreme highs and lows in terms of total returns, given the lower variability. Dividends buffer capital losses and through reinvestment they enable an investor to consistently pound cost average.

Other reasons why dividend paying stocks have outperformed could be that – at an underlying company level – management may run their businesses in a more disciplined way when they are paying dividends.

It is argued that this discipline reduces the possibility of them squandering funds on ‘moon-shot’ projects (such as Alphabet?), which in some cases are likely to never make an acceptable return on capital employed.

At an investment level, a flow of dividends is significantly easier to value than projecting a capital value in a number of years’ time and discounting back.

‘strategies that don’t produce a natural income, yet where the structure allows investors to receive a steady stream of dividends’

As a result there is arguably less risk of overpaying for a dividend paying stock, which could be a reason why such stocks outperform over the long term.

This may be one reason why, according to another study, dividend paying stocks have been found to outperform non-dividend paying stocks by 1 to 2% more per month in declining markets than in advancing markets (as set out by Fuller and Goldstein in their 2011 paper, ‘Do dividends matter in a declining market?’).

One of the classic arguments against dividend investing is that it reduces your investment opportunity set, in that you have to rely on a narrower investment universe. We would argue that the ‘reduction in choice’ argument doesn’t hold water in the investment trust sector.

Here we see several notable examples of strategies that don’t produce a natural income, yet where the structure allows investors to receive a steady stream of dividends as part of their total return – see the Enhanced Income set of companies we expand on below.

The trust structure therefore allows investors to benefit from the stability that income producing investments can give, without sacrificing diversification, or chasing investments that – with hindsight – turn out to be yield traps.

This allows investors far more flexibility when drawing up their investment strategy; enabling them to consider a significantly wider set of asset classes and investment approaches (for diversification) rather than just those that produce income.

Dividend paying strategies in the investment trust sector

In targeting dividend paying trusts and reinvesting those dividends over time, we believe that investors will be diversifying their growth exposure, but not necessarily giving up long-term returns.

The investment trust sector provides an incredible array of income producing investment strategies; many of which use the unique advantages of the structure to provide a much more attractive income stream than open-ended funds are capable of, for example the ability to hold less liquid assets, gearing, and smoothing of dividends.

We divide the dividend payers into four categories which we think will both prompt thoughts from investors and – as a result of selecting different categories of dividend payers when constructing a portfolio – might help generate ideas for portfolio diversification.

Traditional equity income

This category of trusts typically has a strong focus on dividends and dividend growth built into their mandates.

The investment trust sector as a whole has a strong reputation of providing rising dividends over extremely long timeframes, as witnessed by the AIC’s list of ‘dividend heroes’ who have increased dividends for more than 20 consecutive years.

‘AIC’s list of ‘dividend heroes’ who have increased dividends for more than 20 consecutive years’

City of London and JPMorgan Claverhouse, for example, have exceptional track records of providing an increased dividend every year for the past 53 and 47 years respectively. At as close of trading on 10 March, they offer dividend yields of 5.4% and 4.6%.

Other dividend hero constituents with decent dividend yields include Schroder Income Growth and Invesco Income Growth which yield 5.1% and 4.6%. We note that Aberdeen Standard Equity Income will achieve hero status next year, having raised its dividend every year since launch 19 years ago.

The board has undertaken to pay a minimum of 21.4p per share for 2020, which represents a prospective dividend yield of c. 6.5%.

Many of these trusts have substantial revenue reserves to help the board continue to grow dividends, even in lean years for the market. We highlighted the level of cover here.

Troy Income & Growth has been successful at increasing the dividend every financial year since 2010, the managers having taken over in August 2009.

When we met up with the managers recently, they noted that often those companies with lower yields exhibit superior dividend growth; often reinvesting in their businesses to drive growth in the business.

By contrast companies exhibiting higher headline yields often show less ability to grow these dividends, and show poorer dividend cover.

We noted a slight move by the managers towards lower yielding but more resilient stocks within the portfolio, thereby reducing the headline yield slightly.

The UK has more of a dividend paying culture when compared to developed market peers, which partially explains the higher dividend yields available.

Outside the UK, however, there are plenty of options for investors to access international sources of equity income. Many of these, as we discuss below, have adopted an ‘enhanced income’ strategy, where dividends are boosted by capital distributions or gearing.

‘an ‘enhanced income’ strategy, where dividends are boosted by capital distributions or gearing’

On the other hand, Securities Trust of Scotland has a global mandate and a progressive dividend policy.

It aims to offer investors inflation-beating dividend growth alongside capital appreciation.

In 2016 the board changed the dividend policy, repositioning the portfolio towards stocks with stronger cashflow and growth characteristics.

This transition saw revenue reserves being dipped into during the interim period. But the shift has paid off and the trust has seen its revenues and dividends (now fully covered) increase dramatically in recent times.

As we highlighted last week, Asia has a number of uniquely attractive characteristics for long-term investors, including those investing for income.

Schroder Oriental Income, which we hope to publish an updated profile on soon, provides an attractive natural yield of 4.8%, which compares to 4.7% for the average UK equity income trust. We note that it has a significantly more diverse sector exposure than UK equity income funds, meaning it offers strong diversification properties for income investors.

Enhanced income

Recognising the attraction of income, trusts are increasingly taking advantage of the opportunities and flexibility that their structure affords to enhance the dividends that they can pay.

But they want to do so without changing an existing investment strategy that might otherwise deliver a lower ‘natural’ dividend. In many cases discounts have narrowed and discount volatility has reduced as a result of these measures.

‘trusts are increasingly taking advantage of the opportunities and flexibility that their structure affords to enhance dividends’

Trusts which have implemented this strategy include JPMorgan Global Growth & Income, which pays an annual 4% of NAV as a dividend each year, based on the NAV at the start of the year and paid in quarterly installments.

The managers have not had to change their high conviction, valuation-sensitive approach to stock-picking, yet shareholders benefit from the chunky dividend payment.

Returning capital to shareholders (based on a percentage of NAV) also helps to reduce concerns about potentially becoming stuck with an entrenched discount.

The portfolio is therefore considerably different to those of most peers in the AIC Global Equity Income sector, because the investment managers can hold companies in high growth sectors which don’t typically pay high dividends.

BlackRock North American Income, as the name suggests, has always had a focus on income paying stocks.

The managers believe that companies that pay dividends have stronger management teams, and that those trusts which can grow their dividends offer attractive long-term returns at lower levels of volatility.

‘those trusts which can grow their dividends offer attractive long-term returns at lower levels of volatility’

Historically, reflecting the US equity market, the dividend yield on the trust was relatively low by international standards; so in 2018 the board announced a shift in strategy, increasing the dividend by 62% and allowing a proportion to be funded from capital.

Since the current managers took over in 2014, there has been a marked improvement in the trust’s performance: it has now outperformed the benchmark Russell 1000 Value index in four of the past five calendar years, and this has been achieved at low levels of beta.

JPMorgan Asia Growth & Income’s managers aim to generate alpha from stock-picking. They believe that it is earnings growth and dividends which determine returns in the long run.

The process has been proven to work in recent years, with the trust outperforming the benchmark in each calendar year since 2015 – in both up and down markets.

The trust pays a dividend equivalent to 1% of NAV each quarter, out of capital if necessary. As a result, the managers have greater exposure to growth sectors than an income fund, yet the trust pays an attractive yield of 4.4% at the current share price.

Baring Emerging Europe could perhaps straddle two of our categories – with the underlying companies in the portfolio showing an increasing propensity to reward shareholders through dividend payments.

Notwithstanding the significantly rising dividends, the board took the step to boost dividends in 2017, with a payment of up to 1% of NAV from capital to support the dividend, which yields 5.6% at the current price.

This strategy should provide some reassurance to investors that the dividend might be at least maintained in coming years, even in poorer periods for EPS growth.

Aberforth Split Level Income Trust uses structural gearing through zero dividend preference shares to materially enhance the dividend payable to ordinary shareholders.

‘aiming to identify undervalued companies with attractive dividend yields’

The managers are experienced value investors, targeting UK smaller companies and aiming to identify undervalued companies with attractive dividend yields.

The ordinary shares currently yield 6.3%, significantly higher than sister trust Aberforth Smaller Companies Trust (which has a dividend yield of 2.8%).

NB Private Equity Partners offers exposure to a diversified portfolio of private companies, accessed through co-investments with private equity managers – often made on a no fee basis.

The strategy has delivered strong total returns over time, with a proportion paid out as a dividend from capital. The shares currently offer a yield of 4.3% according to JPMorgan statistics, and offer access to private market opportunities, yet receive a significant dividend over time.

Trusts exposed to high yielding asset classes

BlackRock World Mining (BRWM) is a specialist trust which offers exposure to metals and the mining sector.

The board announced the final dividend at the beginning of March, which will take the dividend to an all time high of 22p, representing a dividend yield of 7.1% at the current price.

Even though mining is a historically cash-intensive business, the managers’ central thesis is that mining companies’ management teams are set to exercise significantly better capital discipline than they have historically, and that the resulting free cash flow will enable a sustainably high dividend to continue to be paid.

In the past year, BRWM has seen strong revenue growth of 23.7%, driven by special dividends, strong royalty payments and option writing.

‘attractive to investors looking to diversify their sources of income’

It is worth noting that, in the context of recent market volatility, many major mining companies have made clear that dividend levels will be dependent on the spot price of the commodities they extract.

While the managers have worked hard to diversify BRWM’s revenue streams, the current dividend yield could be vulnerable if global growth stalls and commodity prices follow the same downward trajectory.

BlackRock Frontiers (BRFI) offers a considerable yield of 5.9%, despite income not featuring in its objectives. We note that there are no enhancements as such, but that this yield is available mainly due to the asset class being significantly out of favour, with extremely cheap P/Es.

The trust offers access to the fastest growing, least developed markets in the world, to which most investors have little or no exposure.

We therefore believe it could be attractive to investors looking to diversify their sources of income.

The trust is managed in US dollars, and declares its dividend in that currency. Dividend growth over the past five years has been 4.3% per annum in dollar terms.

Alternative income

Whilst alternative income funds (by definition) provide a very different investment return to equities, we believe they are worthy of consideration from a total return / long-term compounding perspective.

As we note above, many commentators warn that the next decade will deliver lower returns than were available historically.

In this context, the returns offered by many alternative income funds might look attractive – especially considering the significantly lower volatility and lack of correlation to equity markets that they tend to exhibit.

That said, there have been some hiccups in some areas of the alternative income fund space – peer-to-peer lending being a case in point, where the opacity of the underlying assets has often caused disillusionment for investors when they are faced with partial impairments.

Investors need to get a proper understanding of the drivers of returns before investing in this dividend category, which can be many-faceted in some cases.

The Renewables Infrastructure Group (TRIG) proves the fact that slow and steady often wins the race, with NAV and share price total returns from the diversified renewable energy infrastructure fund totalling 71.6% and 94.9% respectively since IPO, compared to the FTSE All Share total return of 30.4%.

TRIG invests in on an increasingly pan-European basis (with a focus on Northern Europe and the Nordics), and owns wind as well as solar assets. The shares yield 4.9%, providing a strong and uncorrelated income flow.

In the same way, Greencoat UK Wind (UKW) has also shown equity markets a clean pair of heels since launching in 2013, focussing solely on UK wind assets.

The managers invest to achieve a high single-digit total return, and employ low cost gearing to boost returns.

The trust does not amortise its debt, which ensures it has a high proportion of its cash flow to distribute as a dividend, and aims to reinvest one-third of cashflows to build up the asset base (and protect NAV in real terms). The shares yield 4.8%.

HICL Infrastructure (HICL) invests in institutional quality lower-risk infrastructure assets.

‘attractive for long-term investors, both in the consistency of returns and the lack of correlation to equity markets’

The trust’s 13-year history illustrates why infrastructure investing has proven so attractive for long-term investors, both in the consistency of returns and the lack of correlation to equity markets.

Despite the managers’ preference for investments at what they view as the lower end of the risk spectrum, the trust has handsomely outperformed the FTSE All Share Index since its IPO, on both a NAV and share price basis. The dividend target for 2021 (8.45p) is equivalent to a dividend yield of 4.7%.

Hipgnosis Songs Fund (SONG) is one of the newer alternative income funds, which aims to deliver a strong income stream and good total returns from investing in songwriters’ royalties.

The managers aim to invest on a gross yield of 8%, with tailwinds provided by the huge growth in streaming revenues seen worldwide, as well as active management by the portfolio management team.

The portfolio has been ramping up, and the company has recently been included in the FTSE 250 Index. The shares yield 4.8%

Click to visit:

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Isas commentary » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.