Oct

2023

Investment trusts: 6% returns on cash – too good to resist?

DIY Investor

29 October 2023

Savings rates have rocketed and UK savers can earn more than 6% on deposits. Should higher interest rates change what matters to investors?

Cash savers are benefiting from the highest returns in almost two decades, with one-year fixed-rate accounts currently paying over 6%. The rise in returns has been rapid, with the Bank of England increasing rates 13 times since the start of 2022.

After such a long spell in which returns on cash were negligible, there are signs that investors are now rethinking the role deposits can play in wider portfolios. Schroders’ May 2023 survey of financial advisers found nine in ten advisers were “having conversations with clients about long-term investing versus cash deposits”.

All savers’ circumstances are different, and some may have excellent reasons to be holding cash. But just because savings rates are rising does not mean cash is keeping pace with inflation.

Popular cash ISA rates vs inflation

|

Jan-2022 |

Jan-2023 |

Sep-2023 |

Best buy*** |

|

|

Variable ISA rate* |

0.3% |

1.7% |

2.8% |

5.0% |

|

2-year fixed ISA rate* |

0.5% |

3.9% |

5.4% |

5.7% |

|

Inflation** |

5.5% |

10.1% |

6.7% |

Sources: * average rates, Bank of England as at 30 September 2023; ** inflation, ONS as at 20 September 2023;

*** best buy rates, Moneyfacts as at 10 October 2023.

As shown, cash returns after inflation – or “real” returns – remain negative, even though rates have risen strongly. And, as the figures show, inflation rose faster and earlier than interest rates, so the value of cash has been eroding at a faster pace than for most of the previous decade, despite the better rates available to cash savers.

So, for many investors, the key question of how much risk to take with their investments remains as relevant as ever. In fact, it is arguably even more important now that the return on cash has improved.

Cash or equities: which has the best chance of beating inflation?

The attraction of cash lies almost entirely in the certainty of the return on offer. But that certainty lies only in its “nominal” value, not in its “real” value which can be eroded over time by inflation.

And cash rates are notoriously subject to change. In late August, NS&I offered its highest-ever rate of 6.2% on its one-year Guaranteed Growth Bonds. Just weeks later, that rate was withdrawn.

Meanwhile, the attraction of equities lies in the prospect of higher longer-term returns for those investors that are willing to tolerate the risk of shorter-term volatility. Equities are known as “real assets” because their value has historically demonstrated an ability to keep pace with, if not exceed, the rate inflation over time.

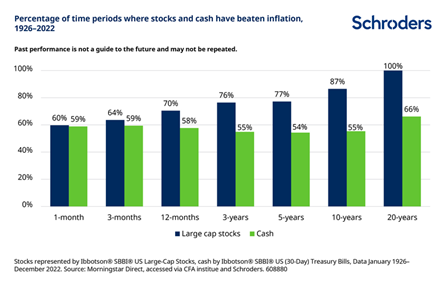

The chart below demonstrates this by looking at the historic returns delivered by cash and stock market investments over a range of timeframes extracted from 96 years of data. It then sets these against inflation over the same timeframes.

Time is the critical factor here. Over very short periods – three months or less – there has not been much difference in the likelihood of cash or shares beating inflation. But for longer periods the gap widens conclusively. Over every 20-year timeframe in the past 96 years, equities have delivered inflation-beating returns.

Higher returns on cash may well make the balance of options more finely poised, particularly for investors with shorter time horizons. But history suggests equities could continue to deliver better outcomes over the longer-term, both in nominal and real terms.

Many other factors matter to investors

Clearly the returns on offer from different asset classes will play a major role in determining the investment decisions that investors make. And as that risk-reward dynamic evolves, what matters to investors may change.

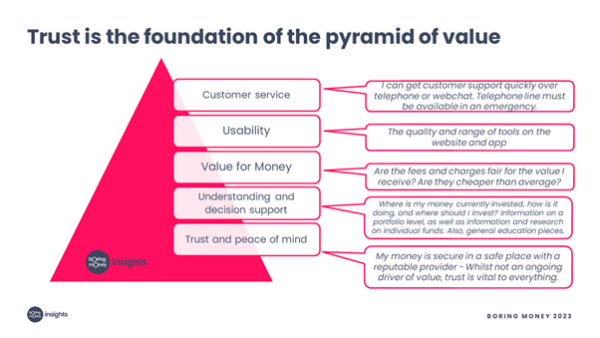

But in other respects, the things that matter to investors are relatively static. Boring Money is an independent research business whose mission is to help demystify the world of investment. Earlier this year, among the many useful insights in its latest Online Investing Report was an exploration of the various wants and needs of the modern investor. It found that trust and peace of mind were the foundations upon which many investment decisions were built, with other factors such as the quality of communications, value for money and customer service also ranking highly among investor priorities.

Peace of mind may come in many forms, however. For some, the certainty of the return offered by a savings account is more likely to result in a good night’s sleep than seeing the value of their investments swing up and down on a daily basis. For many other investors, that short-term volatility is merely a means to an end – they understand that this volatility must be tolerated if inflation is to be beaten in the long run.

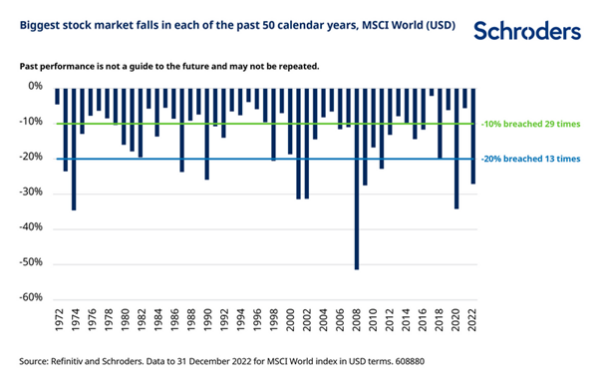

As the chart below illustrates, global equities fell by at least 10% in more than half of the last 50 years. They usually – but certainly not always – recovered to post a positive return for the year as a whole, but the prospect of loss is an ever present risk for equity investors in the short term. So, investors who opt for stock markets over cash need to be prepared for a bumpy ride.

In conclusion, the risks attached to cash and equities are different. And the returns attached to them can also change, as the experience of the last eighteen months clearly demonstrates. As these risk-return dynamics evolve, the priorities of investors are also bound to change and the arguments for cash over equities may become more finely nuanced.

Nevertheless, it is important to remember that cash is far from a risk-free asset. Even at today’s best available savings rates, deposits are unlikely to maintain their value when inflation is taken into account. Meanwhile, shares also carry risk, especially when held for shorter periods. But over longer periods, history suggests that equities offer investors a better chance of beating inflation.

For those investors looking towards the equity market in pursuit of inflation-beating returns, UK investment trusts represent a potentially appealing route to market. Schroders has a range of investment trusts that focus on specific opportunities, from UK or Asian equities through to European real estate, and from global innovation to social impact. Benefiting from Schroders’ breadth of experience and depth of expertise in these areas, the investment trust range can deliver long-term results. We’re confident we have an investment solution that will resonate with you.

Click here to find out more about our investment trust range >

Disclaimer:

Third party data including MSCI data is owned by the applicable third party identified in the material and is provided for your internal use only. Such data may not be reproduced or re-disseminated and may not be used to create any financial instruments or products or any indices. Such data is provided without any warranties of any kind. Neither the third party data owner nor any other party involved in the publication of this document can be held liable for any error. The terms of the third party’s specific disclaimers, if any, are set forth in the Important Information section at www.schroders.com.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Commentary » Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.