Dec

2021

Investment Outlook 2022: ESG – Forks in the Road

DIY Investor

31 December 2021

Paul LaCoursiere, Global Head of ESG Investments, explores four themes for 2022 that he considers pivotal to the direction of travel for environmental, social and governance (ESG) investing.

Paul LaCoursiere, Global Head of ESG Investments, explores four themes for 2022 that he considers pivotal to the direction of travel for environmental, social and governance (ESG) investing.

KEY TAKEAWAYS

- ESG investing continues to gather momentum and we are hugely supportive. We believe open and meaningful debate on the opportunities and the limitations is key to realising potential.

- Challenges for the financial industry and investors include relying on corporate governance and capital markets to enforce intended change – key questions remain on how boardrooms strike the right balance.

- For investors to identify and invest in products that align with their values and objectives, we believe that global coordination of regulation and product labelling is a critical next step.

ESG investing is evolving at an unprecedented pace and we see no reason to expect this to slow in the year ahead.

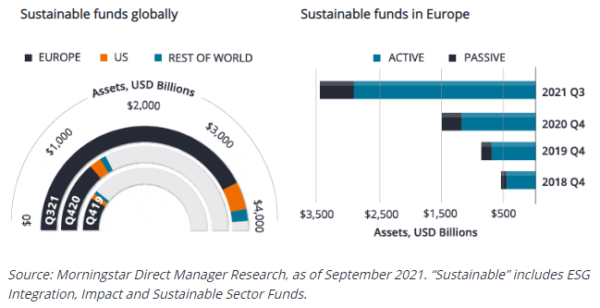

The direction of travel in terms of investor demand (Figure 1) is clear, in our view. As an asset manager committed to ESG, we welcome this building momentum. But we also believe there are meaningful obstacles to our industry achieving the outcomes that many hope ESG considerations and capital markets will deliver. International policy, regional considerations and investor preferences will all shape how ESG considerations, and our industry, develop.

Figure 1: Momentum continues to build

Investor demand for sustainable funds is rising globally, with Europe – considered to be the most advanced market for ESG investing – seeing a clear preference for active management.

Here we highlight four pivotal areas that we expect to evolve in 2022 and ultimately shape the future of ESG investing.

1. It’s showtime – asset management expectations

Actions rather than words will likely be in sharper focus for clients and regulators going forward. Attractive imagery and narrative may have helped some asset managers get this far, but it will need to be backed by proof points and actions in 2022. We view this as a positive development.

We also anticipate it will lead to bifurcation of the market. The market players with embedded, rigorous processes should start to stand apart from those that, to date, have been able to exist behind window dressing. We expect to see increasing examples of asset managers retreating where they cannot substantiate their commitments. And those that can, will likely prove ever more popular with investors.

Attractive imagery and narrative may have helped some asset managers get this far, but it will need to be backed by proof points and actions in 2022

Few groups can claim they have no work to do in this area. Evidence of progress, resource additions, long-term engagement and meaningful debate at an investment and corporate level will all be important in demonstrating genuine commitment. At Janus Henderson, we have made significant progress through 2021 but recognise that evolution across the industry needs to quicken pace to meet many ESG targets.

Assessing an asset manager’s credentials in this space is difficult. Ratings agencies produce reports, but the output and recommendations vary significantly depending on assessment criteria. Given the shifting environment, the reports can also fast become outdated. It will therefore be prudent for investors to set their own ESG and sustainable values and objectives in 2022 – and use these as the basis to challenge and select asset managers to partner with.

How asset managers evolve their approaches to ESG will drive the evidence clients should expect. The historical precedent, in many cases set by firms managing a significant portion of assets for an affiliate, has been to make ESG judgements centrally and then apply a one-size-fits-all approach to ESG integration and sustainability across products. While intuitive, this fails to address the varying nature of client preferences in terms of sensitivity to sustainability topics or prioritisation of ESG versus financial goals. As practices and theories mature and the path of ESG investing evolves, it would not surprise us to see customisation and bespoke solutions for specific portfolios gain more prominence.

2. Financial results, sustainability or both? – the boardroom dilemma

2021 saw sharply contrasting examples of the impact of ESG strategy at a boardroom level. At Danone, a leading multinational food and drink company, chief executive Emmanuel Faber was sacked in March for prioritising sustainability while failing to deliver satisfactory financial results. Faber, an advocate for environmental matters and a more sustainable way of doing business, had come under pressure as sales and margin growth underperformed some rivals in recent years.1

In contrast, a small activist investor firm won three of 12 ExxonMobil board seats2 after the company’s shareholder meeting in May. This was because of the activist’s claim that Exxon had not developed an adequate strategy around climate change – a view that subsequently received strong support from investors with large holdings in the company.

These two examples illustrate the conundrum for businesses and asset managers. Will we see a broader shift in one direction or the other in 2022? Will shareholders apply pressure on a case-by-case basis? How should investors weigh the risks of a pro- or anti-corporate ESG stance?

The situation may require asset managers to rethink their approach to engagement. While some investors may wish to see their capital allocated to backing a company’s sustainability initiatives above financial return and would have been happy for Faber to remain at the helm of Danone, others may not. For the financial industry, this poses an interesting question: should asset managers aim to reflect individual preferences in execution of proxy votes and corporate engagement instead of following a central policy or unified approach?

Some investors may wish to see their capital allocated to backing a company’s sustainability initiatives above financial return. But others may not.

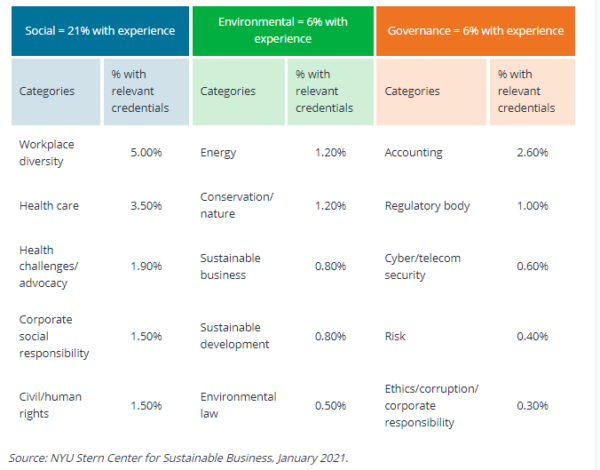

With such a range of approaches already applied by asset owners, board directors need to ever more accurately communicate the issues being focused on and why those may have a material impact on the business. Identifying and prioritising these issues correctly is complex, particularly for directors with little experience in dealing with the intricacies of ESG. The New York University Stern Center for Sustainable Business sought to assess ESG expertise in board directors of Fortune 100 companies. Based on biographies in 2019, the study found that of 1,188 directors, 29% had relevant ESG credentials. Going deeper, however, most of the experience was under the Social category (21%) – mainly around health and diversity issues, while far fewer had experience in Environmental (6%) or Governance (6%) matters (Figure 2). This expertise gap could result in additional board room shake-ups as ESG-aware investors set higher expectations. Or when CEOs misjudge sentiment and are considered to have prioritised ESG factors above financial returns.

Figure 2: Board directors – ESG expertise gap

Analysis of board directors of Fortune 100 companies shows a worrying lack of credentials in ESG matters.

This raises a deeper question as to how credible corporate governance is as a mechanism to solve societal problems like climate change. We believe the scale of the challenge requires a coordinated response incorporating both capital markets and political policy. Politicians and regulators, in our view, have a responsibility for enforcing change and altering public behaviour. Capital markets, including asset managers, can then play their part as an enabler of change.

So, we watch with interest to see if 2022 will see a further divide in boardroom attitudes toward ESG. Or if there will be a shift to a commonly held view on whether a focus on ESG is synergistic with financial performance or something to be considered on a case-by-case basis. How an entity assesses its ESG-related risks will also come under scrutiny: should they be considered independent to more traditional financial measures or integral to all aspects of company management? This is a difficult but critical debate for corporate leadership to have.

3. Coordination conundrum – regulation and labelling

While ESG is already reshaping the business landscape, and we expect this to continue in the year ahead, we have no official, globally accepted accounting or regulatory standard around ESG or sustainability metrics for an investor to track. Rather than a coherent framework forming, dangers are emerging as regulation and guidance in different markets leads in different directions.

Categorising ESG investment strategies, for one, is becoming increasingly challenging. A strategy or investment process that qualifies as sustainable in one market can be labelled differently in another due to diverging guidelines. These labels are beginning to act in competition rather than moving towards the hoped-for consistency in the main investment product categories within the ESG ecosystem.

Lost in translation

ESG terminology has different applications globally and can make it difficult in terms of labelling and objectives.

This is to the detriment of end investors. The first rule of good categorisation and regulatory design is that the result is clear and easy to understand. Currently, it is difficult for a global asset manager to design an ESG investment strategy and then label and market it in a consistent way across regions or countries.

We believe increased standardisation of terminology and better coordinated regulatory guidance are a necessity in 2022 in order to maintain momentum in the positive impact ESG investing can have. The optimum outcome would be the formation of globally accepted product categories that make it easy for end investors to understand and compare strategies with ESG-related objectives.

4. What could possibly go wrong? – open debate matters

Ahead of any committee meeting, pitch, or negotiation, I take time to reflect on how the situation could go sideways. Consistent with this practice, I dedicate time to considering how the evolution of ESG might not live up to expectations. One particular thing concerns me about the direction things have taken in recent times: there is a notable absence of debate. Open debate and the consideration of opposing views are a healthy part of progress, but I’d argue it is also critical for ESG at the current stage of development.

The underlying science of sustainability brings together research across multiple fields at various stages of development, previously framed in a 2007 National Academy of Sciences editorial3 as ‘a field defined by the problems it addresses rather than by the disciplines it employs’. While the related disciplines develop over time, as with any field related to social systems, active debate is necessary to minimise and manage unintended consequences. In our view, it is imperative that the months ahead bring a shift towards acceptance that business leaders and analysts can – and should – put forward nonconsensus views without fear of reputational risk.

ESG reputational risks

ESG considerations have become mainstream news, increasing the reputational risk of getting it wrong.

Bringing the focus to asset management, it is important for people to question whether promises and expectations have gone too far in some areas, if altruistic efforts may be misplaced and whether customers are being given the right level of service and information from a fiduciary perspective. This may be as simple as ensuring shared levels of understanding on time horizons. We believe ESG integration will deliver superior value creation over the long term, but investors should be prepared for ups and downs along the way.

At a recent meeting I attended with a management consultancy, a partner put forward the notion that strict ESG integration into an investment process was a clear win-win-win – stating it would “save the planet, solve society’s ills, and systematically deliver attractive investment returns to clients”. Voices should rise to push back on such blatant over-selling, else we risk ESG taking on the status of theocratic dogma without genuine substance. A grounded counterview would reference that certain areas of the market appear fully valued and could face corrections, and that investors should be cognisant of this risk.

Voices should rise to push back on blatant over-selling, else we risk ESG taking on the status of theocratic dogma without genuine substance.

At all levels – in private meetings or public forums – there is a nervousness to put forward views that consider trade-offs of ESG. However, analysing worst-case scenarios and then shaping mitigation plans accordingly is good business management. If the discussions cannot take place given risk of being branded a non-ESG believer, planning and contingency management will be stymied. Authenticity and realism are key, and honest and open discussions are necessary.

At a research level, analysts need to be able to put forward recommendations when they believe prioritising sustainability comes at too great a cost to a business and could impact returns for investors. However, momentum is currently so strong in one direction that there can be a nervousness in some organisations to highlight any near-term trade-off of adopting sustainability practices.

The brand risk of being considered ‘non-ESG’ is ever present but could stifle valuable counterarguments. It is important to play devil’s advocate, and history illustrates the dangers of one-sided views going unchallenged. While we firmly include ourselves in the camp that ESG is critical for delivering the investment outcomes clients want, we would welcome more open debate on the associated limitations and trade-offs.

Our approach

At Janus Henderson, we are committed to ESG investing and are adapting our approach as client needs evolve. We seek to be transparent in our views and believe open and honest debate on the opportunities and challenges ahead is imperative to our ongoing progress. We believe ESG investing will help shape the future, and 2022 will bring pivotal decisions that set direction for our industry and the world more widely.

1 Reuters, ‘Danone board ousts boss Faber after activist pressure’, 14 March 2021.

2 Reuters, ‘A changing boardroom climate: insurance planning with ESG in mind’, 24 September 2021.

3 Proceedings of the National Academy of Sciences of the United States of America (PNAS), ‘Sustainability Science: A room of its own’, February 2007.

Activist investor: An individual or group that invests in a company and/or obtains seats on the board to effect a major change in the company.

Engagement/corporate engagement: The practice of asset managers interacting with company management teams to influence decisions or conduct due diligence on financials, business decisions or ESG behaviour.

ESG: Environmental, social and governance (ESG) are three key criteria used to evaluate a company’s ethical impact and sustainable practices.

Margin/profit margin: A measure that gauges the degree to which a company or a business activity makes money, typically calculated by dividing income by revenues.

Sustainable funds: Investment products considered to improve the environment and the life of a community. A common strategy would be to avoid investing in companies that are involved in tobacco, firearms and oil, while actively seeking out companies engaged with environmental or social sustainability.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.