Apr

2024

Investing Basics: Investing in commodities with ETFs

DIY Investor

1 April 2024

The main attraction of commodities is in their potential to diversify your portfolio beyond the staple asset classes of equities, bonds, property and cash – by Dominique Riedl

Commodities have shown a very low correlation to equities and bonds in the past and strongly outperformed them both during the high-inflation of the 1970s.

That promise of performance in conditions that hit equities and bonds hard makes commodities worthy of serious consideration in an all-weather portfolio.

Commodities, of course, are the raw materials of global production. The main commodity categories cover:

- Agriculture – example commodities include wheat and coffee.

- Energy – think oil and gas.

- Precious metals – gold and platinum are your poster boys.

- Industrial metals – zinc and copper, for instance.

- Livestock – hello lean hogs and cows.

Naturally you can gain exposure to the diverse trade in commodities through commodity ETFs.

Commodity ETFs seek to capture the return on the major global commodities by tracking a commodity index and trading on the stock exchange. You can also track single commodities – for example gold – using another investment vehicle called an Exchange Traded Commodity (ETC).

Whereas an ETF is a fund, ETCs are debt instruments. That enables them to circumvent European rules that prevent funds from concentrating their assets in a single holding but it also exposes ETC investors to credit risk.

How commodity ETFs work

The unexpected thing about commodity ETFs is that they don’t track the current price of commodities, instead they respond to the futures price. This is not as daft as it sounds…

The current price for a commodity is known as the spot price. When you hear about the price of oil shooting up in the news, the reporter will normally be talking about the spot price.

‘exposure to the commodity without fretting about the noise, smell and ablutions of 10,000 lean hogs’

This is the price you’d pay right now to take delivery of a barrel of oil immediately. Or it might be a ton of sugar or a wagonload of cows.

But we don’t want a wagonload of cows on our hands, or a shipment of oil. Unlike with holding millions in equity securities, our ETF manager would be forced to charge us horrendous storage costs to stash away all those cows until we needed them.

So commodity ETFs deal with that problem by trading in commodities futures and tracking the future’s price instead.

Futures are financial contracts that, for example, commit you to taking delivery of 10,000 lean hogs in three months time at a set price. This contract provides exposure to the commodity without fretting about the noise, smell and ablutions of 10,000 lean hogs.

As delivery day approaches, our ETF manager deftly sells the contract on to someone who actually wants the beasts.

Scale that process up across the world’s major commodities and you have a working knowledge of how a commodity ETF operates. It’s a continual process of buying long-dated futures contracts with comfortably far-off due dates while selling short-dated ones to ensure you need never worry about where you’re going to park all those hogs.

Through this mechanism a commodity ETF provides practical exposure to indexes that track commodity futures.

Roll returns matter

The outcome of all that futures trading is that commodity ETFs aren’t designed to track spot prices.

Returns are instead a blend of spot price fluctuations, interest earned on collateral held by the fund, and the roll return.

‘protect yourself from long periods of under performance in any one commodity by spreading your bets across a broad range’

The roll return is the profit or loss the fund makes through its regular futures trading i.e. rolling out of short-term contracts and replacing them with long-term ones.

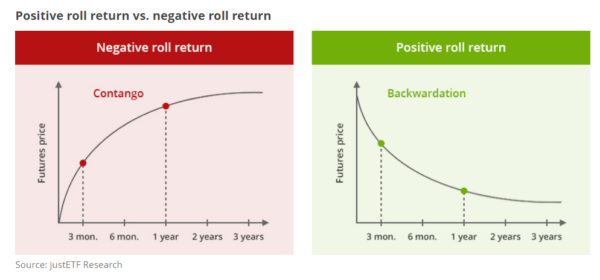

The ETF makes a positive roll return when it can buy long-dated futures in a commodity for less than it sells its expiring short-dated contracts. This is a market condition known as backwardation.

But the ETF earns a negative roll yield when it must buy long-term futures at a higher price than the short-term ones. This is called contango.

Think of backwardation as a tailwind that boosts your ETF and contango as a headwind that makes the going harder. These forces can cause the performance of a commodity ETF to differ markedly from spot price trends and are a good reason to choose a broad-basket commodity ETF over a single commodity ETC.

Individual commodity markets are highly volatile and will often switch between periods of backwardation and contango.

But as ever, you can protect yourself from long periods of underperformance in any one commodity by spreading your bets across a broad range. You may even pick up a rebalancing bonus as commodities tend to have low correlations with one another.

Commodity indexes

Before you choose a commodity ETF, make sure you fully understand its index. Commodity indexes are more diverse than their equity cousins because there’s no commonly used weighting mechanism like market cap.

Some indexes weigh their components according to world production e.g. The S&P GSCI Index.

Others will rank commodities according to economic importance, liquidity and their diversification potential e.g. The Bloomberg Commodities index.

Most indexes will set a minimum and maximum weight for commodity categories, otherwise energy tends to dominate at the expense of all the others.

You can even choose indexes that exclude particular categories like agriculture or energy.

Some indexes will try to more closely approximate spot prices by favouring short-dated futures while others will focus on optimising roll returns by favouring commodities that exhibit backwardation.

Take your time to understand the various index methodologies and remember that even strong commodities advocates generally stick to an allocation of between 5 and 10% of their portfolio.

In the ETF search you find a range of broad-basket commodity ETFs.

![]()

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest

Leave a Reply

You must be logged in to post a comment.