Feb

2020

Investing in Britain: Beyond the FTSE 100

DIY Investor

17 February 2020

Guy Anderson, lead investment  manager for The Mercantile Investment Trust, explains the benefits of investing in mid and small cap UK companies, and explains the thinking behind some of the Trust’s more interesting holdings.

manager for The Mercantile Investment Trust, explains the benefits of investing in mid and small cap UK companies, and explains the thinking behind some of the Trust’s more interesting holdings.

As the British body politic continues to suffer from the fevers and convulsions brought on by Brexit, you might think me a brave soul to beat the drum for investing in UK businesses. If so, smaller, less-established firms outside the FTSE 100 may seem a particularly hard sell.

However, for investors focused on the long term there has arguably rarely been a better time to invest in UK mid and small cap companies. Allow me to explain why.

The case for UK mid and small caps

While the uncertain state of British politics may affect UK share valuations, the intrinsic value of the best stocks remains strong.

‘Quality companies with strong fundamentals will be resilient enough to survive the current climate and will be well-positioned to thrive once the political landscape settles down.’

Quality companies with strong fundamentals will be resilient enough to survive the current climate and will be well-positioned to thrive once the political landscape settles down. In the meantime the general headwinds caused by Brexit are making the valuations of some UK equities extremely attractive.

Mid and small cap UK equities in particular offer two key strengths. Firstly, they provide the opportunity to diversify beyond the typical holdings in a FTSE 100-focused fund. Secondly, they provide access to the stronger growth potential of firms who are at an earlier stage of their development trajectory.

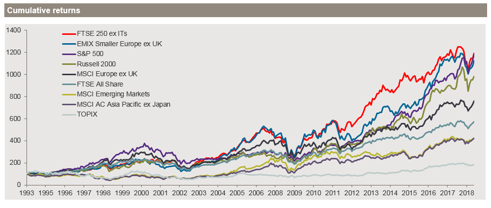

Over the last 60 years, mid and small cap stocks in aggregate have outperformed the overall market in two years out of three. Not only that but cumulative performance of mid and small caps has historically been strong, even when holding through bumpy periods.

For the longer-term investor, the potential benefits are clear with returns among the best in the world.

Long-term outperformance of UK mid and small caps

Source: J.P. Morgan Asset Management, Reuters Datastream. All series are rebased to 100 as at 31 December 1993 to 30 April 2019. All indices in GBP and include reinvested dividends. Indices do not include fees or operating expenses and are not available for actual investment.

Sectors and companies to watch

So, while ongoing uncertainty around Brexit has continued to impact valuations of UK equities, the strongest firms across a range of sectors could be set to benefit as soon as the fog has lifted. As our choice of sectors and stocks determines the relative performance we are able to deliver, it’s worth taking a closer look at some of our holdings.

Software and computing

IT comprises the strongest sub-sector position within the Trust’s holdings, a situation which is likely to continue since the best firms offer huge potential over the long term.

‘IT comprises the strongest sub-sector position within the trust’s holdings.’

Specialised software firm AVEVA Group plc is a global leader in its field and stands ready to benefit strongly from the so-called Fourth Industrial Revolution. Working across industries as diverse as mining, utilities and biotechnology, AVEVA provides solutions to optimise business efficiency, from planning and procurement to operations.

Another business in which the trust has an overweight position, Softcat provides infrastructure, digital workspace, cybersecurity and IT efficiency solutions to well-known names like Virgin Money and Nuffield Health. A FTSE 250 company, the firm has enjoyed strong ongoing growth and hit the £1billion revenue milestone in 2018.

Property and construction

Despite a prolonged downturn in the volume of UK housing sales, outside the traditionally overheated London market prices and demand remain relatively healthy in regions including Yorkshire, the Humber and Scotland.

The trust continues to be substantially overweight in Bellway, a FTSE250 company with a 70-year trajectory from family business to becoming one of the UK’s biggest house builders. The firm sold more than 10,000 homes in 2018 in hotpots from Bristol to Scotland, with a return on capital employed of 27.2%[1]

Meanwhile, as time-poor consumers increasingly turn to ‘do it for me’ as opposed to DIY, building materials distributor Grafton Group PLC is well positioned to profit from Selco, its trade-only warehouse format for which it has ambitious growth plans.

Finally, finding potential in another thriving sub-sector, we have a strong holding in Derwent London, a real estate investment trust (REIT) focused on the healthy London creative industries sector, with a portfolio worth £5.2billion.

[1] Source: Bellway Annual Report 2018 P2

Retail

In the current UK political climate consumer confidence lags behind the increase in disposable income.

However, while the media may be focused on struggling traditional high street retailers, behind the headlines there are businesses exploiting sub-sectors with plenty of room for growth.

These include discount store owners B&M European Value Retail, who with minimal advertising spend and an aggressive pricing policy have grown to a chain of nearly 600 shops in the UK.

Already owners of German chain J. A. Woll, B&M purchased French retailer Babou in October 2018 to position themselves in the three strongest European markets.

Fantasy game business Games Workshop Group PLC may seem like a left-field choice, but its suitability as an investment is firmly based in reality. Both a manufacturer and a retailer, the company is a global leader in its (admittedly niche) market.

Finally, also worth mentioning are SSP Group plc. Billing themselves as the Food Travel Experts, the firm specialises in running food outlets in travel locations like airports and major stations. Well placed to continue to benefit from the ongoing growth of international travel, SSP are already a truly global concern, operating more than 2,600 outlets in 33 countries worldwide.

Why Mercantile?

The Mercantile Investment Trust plc is built around a rigorous research process aimed at discovering tomorrow’s market leaders. The Trust looks for firms with a nimble business model who are either disruptors within their sector or first movers in a new market. Our specialist investment team then focuses on three key areas:

- Quality: Profitability, sustainability of earnings and capital allocation discipline

- Outlook: Is the operational momentum of the business improving?

- Value: Have its future prospects been correctly estimated by the market?

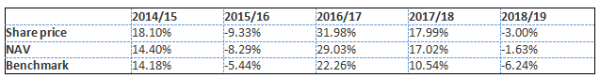

Our careful active selection of sectors and stocks within them has allowed The Mercantile Investment Trust plc to outperform its Benchmark over 3, 5, 10 and 25 years.

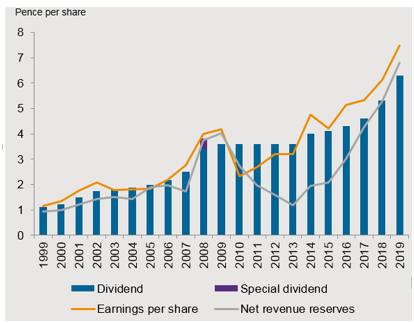

While income is not a primary focus, a strong secondary objective is to grow dividends at least in line with inflation: dividends have increased six-fold since the turn of the millennium and have never been cut.

Dividend policy smoothing income return

Source: J.P. Morgan Asset Management. All figures based on the current trust total shares, after the 10 for 1 stock split in mid 2018

Important information

The Mercantile Investment Trust plc Quarterly rolling 12 months – as at end of June 2019

Past performance is not a guide to current and future performance. Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Investor Disclosure Document, Key Features and Terms and Conditions and Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. 0903c02a826a0d50

Leave a Reply

You must be logged in to post a comment.