Apr

2024

Investing Basics: Investing in commodities with investment trusts

DIY Investor

10 April 2024

How investment trusts can provide investors with access to the high-growth commodities sector…by Jo Groves

Put simply, commodities make the world go round. The first commodities were traded as far back as 4500 B.C. and continue to underpin global trade today, with Statista forecasting that more than $130 trillion of commodities will change hands this year. From the gas that heats our homes, the agricultural products that feed us and the 60-odd minerals that power our computers, commodities are indispensable in everyday life.

In addition, commodities will be critical to the decarbonisation needed to meet ambitious net zero commitments. Electricity grids forming the backbone of the clean energy transition will require vast quantities of copper and aluminium, batteries play a key role in the storage of renewable energy and, on average, electric vehicles require six times the minerals of a conventional petrol car. As a result, the International Energy Agency (IEA) forecasts that demand for critical minerals could increase by 350% by 2030.

Commodities have also made headline news over the last few years, with oil and gas prices soaring after the invasion of Ukraine, which prompted national concerns over energy security. Against a backdrop of elevated global geopolitical tension, western economies are also trying to reduce their strategic dependence on raw materials from China by friend-shoring, as well as introducing legislation to secure the supply of critical minerals.

What drives the price of commodities?

The sector encompasses a wide range of commodities, which are divided into two main categories:

- ‘Hard’ commodities: these are mined or extracted, encompassing energy products (crude oil, natural gas and coal), precious metals (such as gold, silver and platinum) and industrial metals (such as copper, lithium and silicon).

- ‘Soft’ commodities: these are grown or reared, including agricultural products such as meat, soybeans, cotton, corn, coffee and wheat.

Rakesh Jhunjhunwala, often hailed as the Warren Buffett of India, is quoted as saying: “In commodities, when prices go up, demand goes down. In stocks, when prices go up, demand goes up.” It’s true that commodity prices are largely a function of demand and supply but the underlying factors can vary by commodity.

Demand for energy products (such as crude oil and natural gas) is highly correlated to the economic cycle. In terms of supply, OPEC seeks to manage production among its 12 member countries to support the price of oil, although demand is expected to peak in the next decade as countries reduce their dependence on fossil fuels. Oil and gas also have the highest price volatility amongst the commodities.

Precious metals have a limited supply and, as such, tend to command a higher price. Gold is one of the most expensive metals, thanks to strong demand (for jewellery, industrial applications and investment purposes) and limited supply (with the total volume of gold mined globally to date being only 22 cubic metres). Supply can be also influenced by other factors, including production rates, mining technology, availability of capital expenditure and geopolitical issues.

Industrial metals are naturally more cyclical as manufacturing demand will fall in an economic downturn, although the transition to clean energy should support long-term demand for metals such as copper, nickel, lithium and aluminium. Copper, in particular, is used in a broad range of industrial products from electronics to power generation and is often referred to as ‘Dr Copper’ due to its ability to signal turning points in the economic cycle. As with precious metals, geopolitical factors, the availability of capital investment and ESG considerations can constrain the supply side.

Turning to agricultural products, demand can vary according to population and economic growth, consumer taste and price relative to other products. A wide range of factors underpin supply including the likely yields from different crop types, adverse weather such as floods or drought, technological advances and government support.

Why invest in commodities?

There are a number of reasons to invest in the commodities sector, which we explore in more detail below.

1. Strong performance

Commodities have historically delivered strong returns over the long-term, although they can be volatile over shorter time periods.

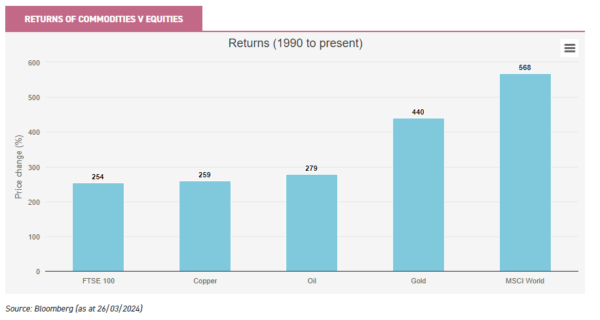

The chart below shows the price returns from a selection of commodities, all of which have outperformed the FTSE 100. Gold was the highest-performing of the selected commodities, with a price increase of 440% since 1990.

2. Long-term growth drivers

As mentioned above, commodities demand is expected to show long-term secular growth due to its critical role in the transition to clean energy. Electric vehicles and battery storage systems are the main growth drivers, with the IEA forecasting a five to sevenfold increase in demand for lithium by 2030, in addition to other related minerals.

Other growth drivers include the substantial upgrade of transmission infrastructure to support greater electrification. Copper is used extensively in transmission networks, as well as solar PV (photovoltaic) modules, wind turbines and batteries, with the IEA forecasting a doubling in current demand by 2030. Silicon is used in the manufacture of solar panels and rare earth elements are needed for the powerful magnets used in wind turbines.

Given the importance of critical minerals, governments have also earmarked substantial investment in low-carbon technologies. The recent US Inflation Reduction Act (IRA) committed $400 billion of public spending in clean energy, while the EU’s Green Deal Industrial Plan includes a €270 billion investment in the European production of clean technologies and critical raw materials.

3. Portfolio diversification

Commodities provide the opportunity to diversify into a different asset class to equities, bonds and property. Historically, commodities have had a low correlation to equities, meaning that commodities have generally outperformed when equities have underperformed. Commodity equities will often display the same low correlation, but can be highly correlated to broader equity indices at other times.

This low correlation has been particularly valuable in recent years. In 2022, investors in BlackRock World Mining (BRWM) would have enjoyed a net asset total return of 18%, compared to negative returns of 35% and 18% in the UK index-linked gilt and S&P 500 indices respectively (using iShares ETFs as proxies).

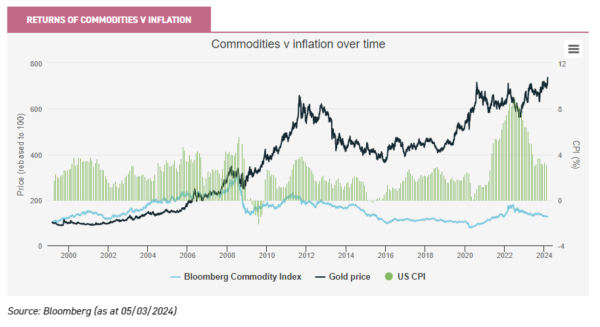

Commodities can also act as a hedge against inflation as prices generally rise during times of inflation, and, indeed, commodity prices are often included in inflation calculations.

The chart below shows that the broad-based Bloomberg Commodity Index has largely tracked US inflation, with gold showing an even stronger correlation. Equity investors will look to anticipate these moves in commodity prices. As a result, commodities equities may often show a correlation to inflation, but at other times this is not the case: for example, commodity equities underperformed the broader market in 2023, even though inflation remained high

As mentioned earlier, there is a diverse range of hard and soft commodities, with precious metals typically performing better during times of economic and geopolitical uncertainty, while industrial metals tend to outperform during an economic upturn.

Why invest in commodities via investment trusts?

It’s worth saying at the outset that it is difficult to invest directly in physical commodities, other than precious metals. However, owning precious metals incurs a cost in terms of secure storage and insurance, and jewellery typically has a high mark-up on the underlying value of the metal itself. Another option is futures contracts, but these are highly volatile and only suitable for professional traders.

By buying shares in an investment trust, investors have exposure to the portfolio of assets held by the trust, rather than having to buy shares in individual companies. Investment trusts also tend to invest in mining companies, rather than directly in commodities. The share prices of these companies are highly correlated to commodity prices but are not as volatile as the underlying commodities themselves, and there are occasions where commodities equities will diverge from the underlying commodity prices. An active approach enables trusts to research the best companies in this space rather than investing indiscriminately across the sector.

Many mining companies are highly cash-generative with low debt, and disciplined spending on capital investment has freed up cash for share buybacks and dividends. Mining companies were the top three dividend-payers by value in the UK in 2022, according to AJ Bell, and, despite a fall in payouts in 2023, continue to dominate global dividend league tables.

There are currently seven trusts specialising in the commodities and natural resources sector on the London Stock Exchange. The scope varies by trust, with some trusts investing in a more concentrated portfolio of companies, while others take a broader approach.

Investment trusts v open-ended funds

Investment trusts have some clear advantages over their open-ended counterparts in the commodities sector. The closed-ended structure allows trusts to invest in less liquid and private investments, including pre-IPO companies and private market royalty investments. Trusts also have the ability to deploy gearing, which can enable broader exposure and enhance returns (although it can also augment losses on the downside).

Open-ended funds are also not publicly-traded (unlike investment trusts), meaning that the size of the investable fund will rise and shrink with the purchase and sale of units in the fund. This means that open-ended funds typically hold a significant proportion of cash in reserve to meet redemption requests, which can create a drag on returns. Investment trusts can also use capital reserves to pay dividends (if needed).

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Financial Education » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.