May

2022

Investing Basics: A simple guide to risk profiled funds

DIY Investor

10 May 2022

Investors have a huge choice when it comes to deciding where to place their money they must consider what their attitude to risk is and how they might want to diversify their investments. Risk profiled funds allow investors match their individual attitudes to risk to investment goals – writes Christian Leeming.

Risk versus reward

Before devising an investment strategy in order to reach your end

investment goal, you must first establish how much risk you are willing

to take. This can depend on:

- Your capacity to recover from losses should the markets fall during your investment period

- The length of time you wish to be invested

- Which investment products you should be invested in

- Whether cash is more suitable for you

- What other dependents you have relying on your investment goals

i.e. family

Some investment products are more ‘risky’ or volatile but can offer greater returns over time, but the reverse is also true: you could potentially suffer greater losses.

For example, shares are usually considered to be more risky compared to bonds; for the most part, the more risk you are prepared to take the greater the potential reward, but you must be aware

of that before you select your investments.

How can my attitude to risk be assessed?

A financial adviser or online tool can assist you in arriving at your

‘attitude to risk’ and then recommend the most appropriate investments

to match your circumstances and needs.

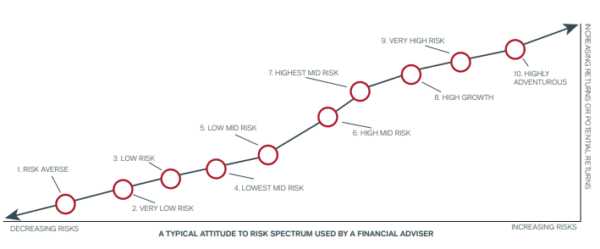

Typically categories of attitudes to risk can range from (1.) being risk averse to (10.) being highly adventurous (see below).

Normally your attitude to risk will be assessed via a detailed questionnaire.

Don’t forget that taking on more risk can potentially lead to higher rewards but also potentially higher losses.

How can investments be matched to my own

attitude to risk?

A risk profiled fund can potentially be matched to an investor’s attitude to risk; using this illustration of different attitudes to risk, there are risk profiled funds on the market to match each category.

Risk profiled funds are independently assessed according to a number of

factors including what investments they hold, the investment team behind

them and how they have performed to determine their risk profile.

Risk profiles are indicative, based on historic data and should not be solely relied upon when making an investment decision.

One widely used measurement for risk is volatility – i.e. how sharply and

frequently an investment price moves up or down over a certain period.

Someone who is risk averse or who has a low risk score for example, will

be matched with an investment with a low expected volatility.

What are the different types of risk profiled funds?

Risk profiled funds fall into two categories; risk rated or risk targeted.

Risk targeted funds are designed to not deviate from specific risk parameters, usually measured by volatility*, and to keep the same risk profile. As such these funds are investor goal driven, which means they can be more closely aligned with an individual investor’s financial plan.

Risk rated funds typically have growth or income objectives rather than being specifically investor goal driven. Their risk profile is assessed at one point in time and may change.

Top tips:

- Measuring your attitude to risk can help you match with the right investment strategy

- By speaking to a financial adviser or using an online tool, you can discover your ‘attitude to risk’

- Risk profiled funds help match the right fund to your ‘attitude to risk’

*The rate and extent at which the price of a portfolio, security or index, moves up and down. If the price swings up and down with large movements, it has high volatility. If the price moves more slowly and to a lesser extent, it has lower volatility. It is used as a measure of the riskiness of an investment.

Commentary » Equities Commentary » Financial Education » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.