Jan

2023

Inflation is back and so is momentum investing

DIY Investor

18 January 2023

Summary

After decades of slow price growth across developed markets, inflation has now reached its highest levels in more than 40 years. Investors worry about how to preserve their wealth and generate real returns in this inflationary environment. One proven option is the exploitation of momentum investing across asset classes – by Dr Michael Stamos and Nicolas Hengstebeck

Key takeaways

|

Even before the invasion of Ukraine by Russian armed forces in February 2022, inflation was a topic of public concern and discussion. Indeed, inflationary pressures started building in the summer of 2021, when global supply chains were interrupted because of measures triggered by the global pandemic. At the onset of rising inflation, authorities were convinced of its transitory nature, and expected a fairly quick return to target levels of about 2%. However, inflation today is much higher than expected, and is forecasted to remain above the levels of recent decades for the foreseeable future.

Given the challenges investors face to achieve real returns with reasonable risk appetites in an inflationary environment, we conducted an analysis of which factors and strategies are likely to enable investors to preserve their wealth, and generate satisfactory real returns, during such periods. Our analysis shows that a sophisticated momentum strategy across asset classes and geographies is a good approach to consider, particularly if one expects inflationary pressures to persist over the medium term.

Inflation Continues to Surprise on the Upside

After decades of low inflation across developed markets, recent inflationary pressures have reached levels unheard of for generations. While these observations are worrying, and pose challenges for investors looking for real returns it is important to differentiate within the analysis between headline inflation and core inflation rates. Core inflation rates usually exclude more volatile components of the inflation basket, such as food and energy prices, which in the context of the Russian invasion of Ukraine are the main drivers of current headline inflation rates. However, even looking at only core inflation rates, we currently observe these at over 6% in the US, and above 3% in the euro area. Current forecasts by central banks expect inflation to stay elevated at least during 2022, and anticipate – compared to what we have become used to in recent years and decades – a somewhat higher inflationary environment in the medium term. Conscious of the fact that previous inflation forecasts have grossly underestimated the current inflationary environment, investors should think about strategies to preserve wealth, and generate real returns. One proven option is the exploitation of momentum investing across asset classes.

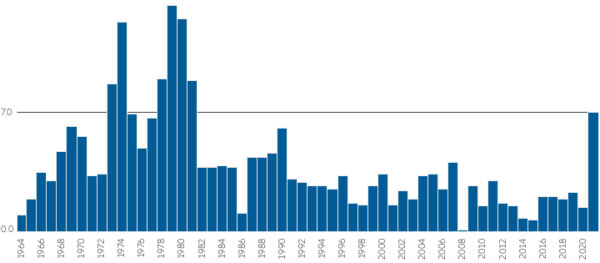

Chart 1: Recent acceleration of inflation in the USA (Annual US Consumer Price Index Growth)

Momentum-driven Investing with Strong Tailwinds

Momentum or trend investing1 is based on a simple idea: the performance of an asset will continue in the same direction. An asset’s price that has increased will continue to increase. An asset’s price that has decreased will continue to decrease. Momentum, defined as the performance of an individual stock over the past 12 months, was first studied in detail for individual equity market securities. Carhart (1997)2 expanded Fama-French’s pioneering Three-Factor Model (market, size, value) (1992)3 to include momentum. These and other researchers identified positive- and negative-trend continuation that, on average, lasts around three to 12 months. Since then, this definition of momentum has been adopted as the standard, with one variation – the 12 months excludes the most recent month, in order to appropriately reflect short-term reversal effects, or delayed implementation of the momentum signal in the portfolio.

Momentum investing can yield considerable returns by exploiting trend-following patterns in capital markets.

Using this definition of momentum, Asness et al. (2013)4 also examined stock market indices, bond market indices, commodities and currencies, and found evidence of trend continuation patterns. Our analysis of historic data supports the claim that momentum investing can yield considerable returns, by exploiting trend-following patterns in capital markets. Only periods where we see strong trend-reversal patterns pose challenges to momentum investing. Nevertheless, on a medium-term and particularly on a long-term horizon, momentum investing usually generates strong performance patterns.

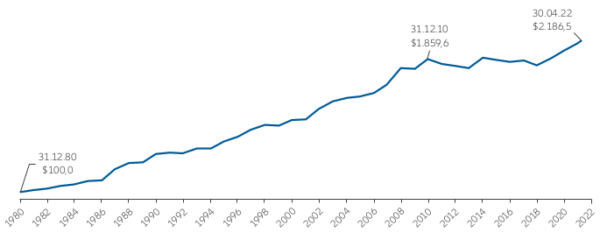

Today it is interesting to observe that trend-following strategies did very well in the recent period. For instance this can be seen in the performance shown in Chart 2. The depicted BarclayHedge CTA Index tracks the performance of so-called CTA funds since 1981 and recently made new all-time highs. CTA funds are a category of funds that are able to go long and short different asset classes. We believe what helped them was the ability to capture the down-trend in bond markets and the up-trend of commodities markets.

Chart 2: Momentum Investing with strong track record recently after a flat stretch: Performance of CTAs over time

Long-Term Analysis: Asset Class and Factor Returns in Inflationary Periods

Based on our observations that inflation rates in developed markets are likely to stay elevated for the foreseeable future, we asked ourselves how asset classes and factor strategies have performed during previous periods of high inflation. In our analysis, we reviewed the past 58 years of available data in the US. We began with 1964 due to the availability of asset class and factor returns data since then, and because it seems reasonable to omit the post-war period. For asset classes, we use Ibbotson database returns, except for commodities where we use the Bloomberg Commodity Total Return Index; for equity risk premia we use the data from Prof. Ken French’s website (Kenneth R. French – Data Library (dartmouth.edu)).

As for Cross-Asset trend-following, we compute our own index based on our proprietary trend-following model that is applied to eight major asset classes: Ibbotson US Large Cap Index, Ibbotson US Small Cap Index, Ibbotson US High Yield Index, Ibbotson US Corporates Index, Ibbotson US Government Bonds Index, Oil Futures Index, Gold Futures Index, US Dollar Index. We use our own proprietary model as there is no CTA index that stretches back to before 1981.

However, the period before 1981 had the highest inflation readings in modern history; we are thus particularly interested in these years. To make the performance of all investment options comparable, we scale all asset class returns to have a volatility of 10 percent.

We focus on high-inflation years, defined as years with a consumer inflation of above 5%. Such years have been relatively rare as can be seen in Chart 1; overall, we counted 12, which amounts to roughly one-fifth of the entire dataset. 2021 was obviously one such year, with 7.0 percent inflation; before that, we have to go back to 1990 with 6.1 percent, and then 1981 with 8.9 percent inflation. 1981 was the last of a string of high-inflation years, beginning with 1969.

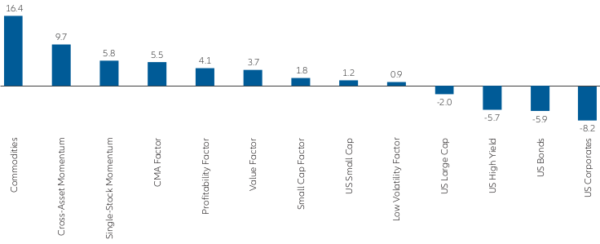

We find that commodities delivered the best excess returns above cash, with 16.4 percent on average during high-inflation years. This tallies somewhat with the common wisdom that commodities are in fact part of consumer price indices and production price indices. The second-best result is generated by the simulated Cross-Asset Momentum strategy, that has produced an excess return (above cash) of 9.7 percent.

On the other end of the spectrum are traditional asset classes such as bonds and equities, which delivered negative excess returns in the range of -2 to -8 percent. The fact that momentum investing can deliver in years when major asset classes have a negative return makes it more valuable during these periods. Also noteworthy is that other equity risk premia have a positive return in inflationary times, and that single-stock momentum delivered the second-best return.

While these results may be surprising to some, particularly when incorporating the magnitude of outperformance of Cross-Asset Momentum vs. other factors, such as value, profitability, small cap or even single-stock momentum, we believe that these observations can be intuitively explained. The most straightforward explanation relates to fixed income markets.

In an environment of high and rising inflation, central banks are usually required to increase interest rates, thereby triggering a trend of declining prices for fixed income instruments, and therefore forming a strong negative trend across fixed income markets. When thinking about commodity markets and the role that input prices for commodities play in the context of headline inflation, we also usually observe a correlation between high and rising inflation rates and rising commodity prices in a positive trend pattern. For equity and currency markets the situation can be more varied and depend to some extent on factors other than inflation, such as geopolitics or economic issues.

Chart 3: Excess-Return p.a. (%) in years with high inflation (inflation > 5% during 1964–2021)

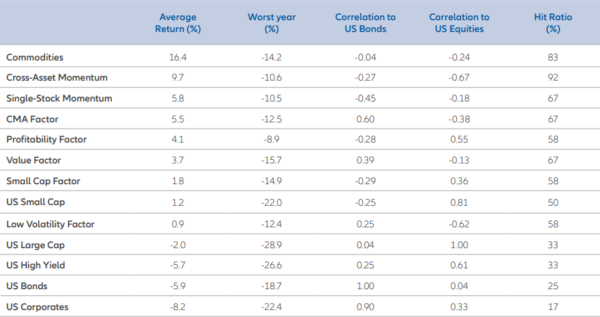

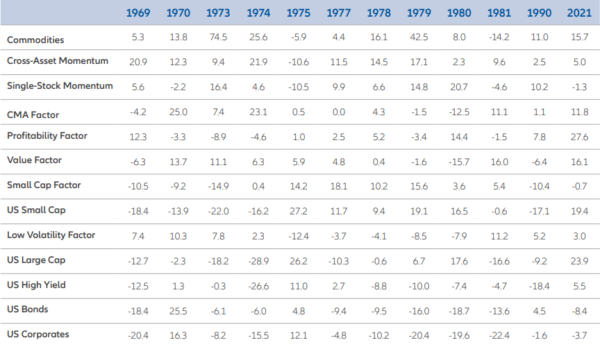

able 1 shows a deeper dive into performance patterns during high-inflation years. It is interesting to see the hit ratio on the high side for commodities and Cross-Asset Momentum. With respect to diversification benefits relative to bonds and equities, it is commodities, Cross-Asset Momentum and single-stock momentum that have the lowest and negative correlations. Table 2 presents annual returns for each individual high-inflation year. It can be seen that there is no absolute certainty and that, even if an inflation hedge performs well on average during these periods, the hedge may not work each and every year. Sometimes there are even sizeable drawdowns.

Table 1: Statistics of Excess Returns (above cash) in High-Inflation Years (Inflation > 5%) asset/strategy returns scaled to have 10% volatility

Table 2: Single-Year Excess Returns (above cash) in High-Inflation Years (Inflation > 5%)

Momentum-based Strategies can be Strong Return Contributors in all Market Phases

Inflation has continued to surprise on the upside for almost 12 months now, and inflation rates may stay elevated as long as inflationary pressure remains, especially if a wage-price spiral is set in motion. For investors to hedge portfolios against losses in real terms, we recommend considering asset classes and strategies that have a proven performance pattern in inflationary times. It is also important to scrutinize the overall portfolio allocation, and to have a risk-factor mix that allows performance in inflationary times, but also not to lose sight of non-inflationary times.

We believe that bespoke momentum-based strategies can be a strong return contributor in all market phases that exhibit strong trends when it comes to economic growth or inflation. This is because extended moves in the real economy are likely correlated with strong momentum in asset prices. Furthermore, Cross-Asset Momentum has the potential to perform independent of market direction, as these strategies are not bound to go long only but may also go short in markets with negative trends.

AllianzGI: Decades-long Expertise in Multi Asset Investing

We at Allianz Global Investors are pioneers in Multi Asset investing. Over the last decades we have evolved to become a globally recognized provider of multi-asset funds with sophisticated Multi Asset momentum strategies.

1 The terms momentum and trend are considered synonyms and are used interchangeably

2 Carhart, 1997, On Persistence in Mutual Fund Performance, The Journal of Finance. 52 (1): 57–82

3 Fama/French, 1992, The Cross-Section of Expected Stock Returns, Journal of Finance 47, 427–465

4 Asness/Moskowitz/Pedersen, 2013, Value and Momentum Everywhere, The Journal of Finance, Vol. LXVIII, No. 3, June 2013

Investing involves risk. The value of an investment and the income from it will fluctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an offer to sell or a solicitation of an offer to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its affiliated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Qualified Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public offer by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service offered by Allianz Global Investors. Via reception of his document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access specific information on the products and services of Allianz Global Investors. This communication is strictly private and confidential and may not be reproduced. This communication does not constitute a public offer of securities in Colombia pursuant to the public offer regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an offer by Allianz Global Investors or its affiliates to provide any financial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Pacific Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional/professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide financial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of financial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which differ from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors U.S. LLC, an investment adviser registered with the U.S. Securities and Exchange Commission; Allianz Global Investors Distributors LLC, distributor registered with FINRA, is affiliated with Allianz Global Investors U.S. LLC; Allianz Global Investors GmbH, an investment company in Germany, authorized by the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; in HK, by Allianz Global Investors Asia Pacific Ltd., licensed by the Hong Kong Securities and Futures Commission; ; in Singapore, by Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK).

2178048

Commentary » Investment trusts Commentary » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.