Aug

2020

Income Investors Battered as Dividends Dry Up; how have Equity Income Funds and Trusts performed?

DIY Investor

30 August 2020

The second quarter of 2020 saw a massive outflow from markets in response to the pandemic and dividends disappeared as companies rushed to shore up their balance sheet in the face of the most dramatic event in generations – ‘Why are Companies Cutting Dividends?’ – writes Christian Leeming

Analysts have described events as ‘unprecedented outside of wartime’ creating a turbulent time for dividends as companies slashed or cancelled payouts in response to Covid-19; according to Janus Henderson’s Global Dividend Index, the UK was the worst-hit region by far for dividend cuts , with payouts falling 54.2% in Q2.

Inevitably this fed through to income-focused funds and investment trusts, with every single fund in both the Association of Investment Companies (AIC) and Investment Association (IA) UK Equity Income sectors turning negative for the year to date.

Company dividends are key revenue streams which enable funds to pay income away to their investors; because they are structured differently, investment trusts are able to use their ‘rainy day’ capital reserves to maintain payouts even when dividends dry up, which gives them an advantage over open-ended funds facing similar circumstances.

What’s the Damage?

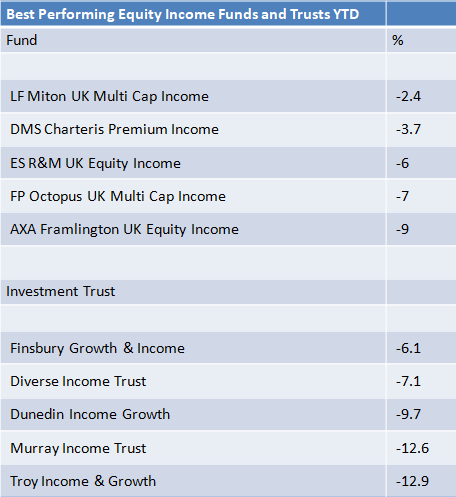

In the year to 18th August, the average investment trust in the AIC Equity Income sector fell 23.4%, with the worst performer, the British & American Trust down 52.8%; in open-ended funds, the average return from the IA peer group is -19.3%, with UBS UK Equity Income the worst, down 32%.

The best performer in the AIC sector over the period is Finsbury Growth & Income Trust which was down 6%, with the second-best is Premier Miton’s Diverse Income Trust, down 7%, which managed to keep a lid on year-to-date losses by using a form of portfolio insurance, using a long-held FTSE put option which insulated the portfolio against the market sell-off.

The best performer in the IA UK Equity Income sector is LF Miton UK Multi Cap Income, down 2.4%; even though the figure is still negative, those that held on to it will be feeling a lot better than most.

The difference between funds that hold up well and those that struggle will likely be how much exposure to the UK and cyclical sectors they have; those posting 30% falls are likely to be the ones holding financial stocks, travel and oil and gas, which were hit especially hard by economic disruption and the plunging oil price

Investors should be disappointed by funds showing a 30% decline over the year, but those ‘only’ showing single-figure drawdowns could be considered pretty respectable given the scale of the disruption.

By way of an example, BlackRock UK Income has proven defensive (-11.7% YTD) by virtue of it being underweight to the UK, with higher US exposure; it has also been underweight financials and energy, which were responsible for the majority of dividend cuts

Source: FE Analytics. Figures from 1 January 2020 to 18 August 2020.

Any cause for optimism?

As reported recently, there are causes for cautious optimism – ‘A Glimmer of Hope for UK Income Investors as Some Dividends Return’

There is a reasonable expectation that some companies may pay special dividends later in the year to make up for missed payments.

Overall, fund managers anticipate 20%-50% dividend cuts on the FTSE All-Share this year, while expecting dividends to return to 90% of normal levels by 2022, and completely back to normal by 2024.

There is a feeling that companies being prudent with cash, cutting dividends in order to get through the crisis, represent a good long-term bet; the message from fund managers appears to be, yes, it will be a bad year for income but it will recover, and most are reportedly sticking with their pre-Covid strategy rather than trying to deliver a short-term dividend fix.

Whilst of little comfort to investors that need cash in the short-term, there is a hope that the equity income space can build back stronger because it will make yields more sustainable in the long run; if dividend growth can come year in, year out, but from a more sustainable level, the current reset could actually be good thing for the longer-term health of the market.

Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.