Dec

2023

In-come all ye faithful

DIY Investor

15 December 2023

Equity income could be a beneficiary of the higher interest environment, with trusts a good way to capture it…by Ryan Lightfoot-Aminoff

And for our next act

A change in the macro landscape could herald a new era for equity income investing, as higher interest rates imply a totally different environment to the past decade. High interest rates are creating a more difficult funding environment for growth companies, whilst bringing the benefits of cash generation within a business into greater focus. Additionally, valuations in equity income sectors are often undemanding, to say the least, which we think creates an attractive setup for the years ahead. In a recent strategy note, we flagged the disappointing returns to cash after inflation over the past two years, and here we dig into the potential in equity income as an alternative.

Returned, with interest

Interest rates are back. Having spent over a decade at record lows, the base rate in the UK has shot up to over 5%. This has had significant implications for personal finances, investments, and beyond. One area where this has completely changed the landscape is in equity income investing, which we believe could be due a new golden age after a decade in the wilderness.

In recent years, from at least 2016 to 2020, growth stocks drove the market due to the near-zero interest rates. These firms had little to no capital discipline as debt cost them very little but were offering future growth potential which investors clamoured for as returns from other asset classes, such as cash in the bank and government debt, were incredibly low. However, thinking back further, following the financial crisis of 2008 / 2009, equity income was in favour. The comparatively high yields attracted investors, which led to price rises and yield compression. However, their lower levels of growth meant these companies were eventually squeezed out, with the market focussing on an ever-narrowing band of tech-focussed growth stocks. These income-paying firms were exhibiting capital discipline, including paying a dividend, but as they were not offering the exponential growth potential investor appetites were seeking, they were overlooked by the market. However, we think this could change again, as meaningfully high interest rates look likely to be a feature for the foreseeable future, slashing the appeal of the debt-fuelled future growth markets of the previous decade. Going forward, we believe those firms paying dividends from genuine free cash flow are likely to appeal to investors again, as not only will this dividend be seen as an attractive element of total returns, but the companies’ capital discipline will be valuable in a high interest rate world.

One example of this is the energy sector. In the past decade, the push for renewable energy has led to questions over the future of traditional energy companies, and whether their existing oil wells and gas fields would become ‘stranded assets’. Instead, investors poured money into solar and wind assets instead which proliferated. As interest rates have gone up, the cost of financing these renewable energy projects has increased materially which has led to a number of high-profile issues for companies such as Orsted. Meanwhile, fossil fuel energy companies, which restrained a lot of their capital expenditure in the 2010s , are now benefitting from strong free cash flow generation, as not only has their revenue increased as demand and supply dynamics have moved back in their favour, but their costs are now under control. This has led equity income investors to take larger positions in them to capitalise on the well-supported dividends.

One trust taking advantage of this is JPMorgan Claverhouse (JCH), in which co-managers William Meadon and Callum Abbot hold both Shell and BP, believing them to have the potential to return a significant amount of cash to shareholders. They are JCH’s largest and fourth largest holdings respectively totalling over 15% of the portfolio. The managers are also balancing these attractive income streams with a holding in SSE which is a likely beneficiary of the secular tailwinds from renewable energy. We believe this barbell approach offers the trust a nice blend of a high but sustainable income—the current yield is about 5.1%—alongside future capital growth.

JCH is not alone in its attractive income though. Its yield is in line with the average of the AIC UK equity income sector which compares to the current yield on the FTSE All Share Index of 3.96%. There are higher yielders. Abrdn Equity Income (AEI), for example, currently yields 7.4% and has increased its dividend for 23 years. Such attractive figures are often met with scepticism by investors. However, we believe these levels are sustainable due to low valuations as well as the resilience the sector has shown in the past few years. In the early days of the covid pandemic in 2020, large numbers of firms suspended or cut their dividends as fears climbed over their earnings. In the period since, many of these companies have reinstated, but have done so at sustainable levels, supported by stronger balance sheets and covered by revenue. Yet despite this headwind, the equity income trusts were able to maintain or grow their dividends through the pandemic, making use of revenue reserves built up in the good times.

Working capital

Whilst the income element is an undoubted positive, investing in equities offers investors upside potential that is not a feature of cash. We would argue that this potential is particularly high at the moment due to both valuations, especially in the UK, and market dynamics. We have mentioned above and highlighted in a number of recent articles, that UK valuations are particularly cheap at the moment. Several factors have led to this, ranging from political, technical, and economic concerns. These have put the UK stock market under considerable pressure which has pushed valuations down significantly and affected small- and medium-sized companies in particular, due to their perceived exposure to the domestic economy. In a recent note, the seven-strong management team of Aberforth Smaller Companies (ASL) summed this up neatly by stating the UK small caps remain cheap versus large caps, and the UK remains cheap versus global equity markets. Furthermore, a value portfolio, which is typically a bias for equity income trusts, is naturally at a discount to the market, and most trusts are trading at a discount to their NAVs, there is in effect a quadruple discount on the trust at the moment.

ASL: EQUITY VALUATIONS

| P/E (X) | |

| Global equities | 15.1 |

| UK equities | 10.7 |

| UK small caps | 10.2 |

| ASL (Assuming share price discount to NAV of 8%) | 6.9 |

Source: Aberforth, Panmure Gordon, London Business School

This value is beginning to be recognised by private equity. There has been a spate of takeovers in the past year, most notably by Mars of Hotel Chocolat at a premium of over 130%. We believe this demonstrates the upside potential in cheap UK equities. Capturing these moments can be difficult to time though and missing the best period of a recovery whilst sitting in cash can have a significant impact on total returns. According to figures from Aberforth, missing a month of the rally from their inception in 1990 would reduce an investor’s returns from 2,966% to 2,158%. The equivalent of missing out on over £8k on a £1,000 investment. Had the investor missed out on the best six months, they would be over £21k worse off. We believe this demonstrates the value of spending time in the market, rather than timing the market.

On a more esoteric level, we theorise that equity income could become an increasingly attractive M&A target for private equity (PE) in the next market cycle. PE relies on ‘financial engineering’ to improve its returns. This involves buying a company, taking on cheap debt to grow the firm, and selling it on. As interest rates have moved considerably higher, we think there will be challenges to this approach in the foreseeable future. However, firms generating free cash flow through prudent management, and using it to pay a dividend could be a better PE target. We could envisage a strategy where PE could seek firms paying modest but growing dividends, indicative of strong cash flow, buying them out and cancelling the dividend in lieu of interest payments to sustain a debt-fuelled growth plan instead. Again, this is more conjecture than evidence, but it could make for an interesting dynamic.

Trust in me

Not only do we believe that the timing for equity income looks compelling at current valuations, but we believe the investment trust structure offers a particularly advantageous way of accessing the asset class. This is due primarily to their ability to use revenue reserves. This is where a trust can hold back some income in more bountiful years in order to cover the dividend in leaner periods. This has enabled many trusts to pay a continually growing dividend amount every year which has been particularly attractive amongst retail investors. Many trusts have a track record of increasing their dividends for over 20 years, with City of London (CTY) leading the way on this with a record 57 consecutive years. For context, the last time CTY didn’t increase its dividend, Harold Wilson was prime minister.

DIVIDEND GROWTH TRACK RECORD

| TRUST | CONSECUTIVE YEARS | YIELD (%) |

| City of London | 57 | 5.1 |

| JPMorgan Claverhouse | 50 | 5.2 |

| Schroder Income Growth | 28 | 5.0 |

| abrdn Equity Income | 23 | 7.6 |

| Dunedin Income Growth | 12 | 4.8 |

Source: Association of Investment Companies, as of 08/12/2023

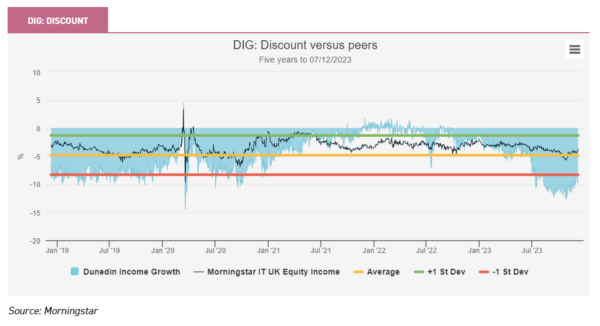

Dunedin Income Growth (DIG) is one trust building up its dividend growth track record, currently at 12 years, though the trust has a history well beyond this. The trust turns 150 years old this year. It originally invested in the United States which was considered an emerging market at the time but has evolved considerably since, like the USA! Nowadays, managers Ben Ritchie and Rebecca Maclean primarily focus on the UK and aim to generate a combination of capital returns and growing income, all within a sustainable framework. They have a highly concentrated portfolio in which they look to blend income and growth opportunities to create an attractive total return. The dividend growth is also supported by an option-writing strategy. Performance has also benefited from a number of takeover bids in the past year, and the trust has outperformed its peer group as a result. Despite this, the trust has slipped to a wide discount, even against the peer group, which offers a compelling yield and capital opportunity in our opinion.

Equity encore

In conclusion, we believe the current macro environment is very supportive of equity income due to the dividend-paying nature of the companies that populate portfolios. These companies typically have higher, resilient cash generation and exhibit lower duration as an investment, both of which are attractive characteristics in a higher interest rate environment. Additionally, equities offer upside potential due to low valuations, especially so due to the value style these companies are typically categorised as. Furthermore, the UK is also trading at historically low valuations making for a particularly attractive opportunity at the moment. The market is also home to a number of investment trusts which are trading on wide discounts and attractive yields, supported by plentiful reserves which combine to offer a compelling entry point to an asset class with long-term potential. In this season of goodwill, UK equity income trusts may be a true festive gift, even if they are difficult to get into a stocking.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.