Nov

2022

Iceland: the land of fire, ice … and digital infrastructure?

DIY Investor

29 November 2022

Sparsely populated Iceland may seem an unlikely tech hub, but my visit there showed why the country is so important for digital infrastructure, by Ben Foster

Five years ago I wouldn’t have pictured myself sitting on a plane to Iceland in the name of equity research. What changed over that period was a dramatic evolution in how we use the internet. Businesses embraced cloud data storage, artificial intelligence “AI” rapidly caught up with humans and Netflix enabled us to impatiently binge-watch video on-demand.

As a thematic equity investor focused on global cities, I witnessed these trends creating massive demand for digital infrastructure: the data centres, mobile phone towers and fibre optic cables that form the plumbing of the internet.

Initially this infrastructure was built around leading global cities such as London, Washington DC and Singapore. Pioneering tech firms like Amazon and Google naturally gravitated to where their customers lived and worked.

Five years later, however, resources have become scarcer, land prices have soared and data connectivity has improved. The tech giants are shifting their attention to where their services are now growing most rapidly. These include the next tier of developed European cities – Madrid, Vienna and Berlin – as well as key cities in emerging markets that we consider ‘the digital frontier’. (Read more about the digital frontier here).

Critically, sustainability has leapt to the top of the corporate agenda, at the same time as Europe experiences an energy crisis.

At first glance, the sparsely developed volcanic island of Iceland, with a population 376,000, is an unlikely nexus for these trends. In fact, it’s about as far from a global city as my market research has taken me.

As my taxi makes the 40-minute journey from the airport to its capital Reykjavik, where 60% of the population lives, we pass through expansive lava fields. I can see snow-capped mountains in the distance and motionless lakes accompanied by the odd brightly coloured house.

Source: Ben Forster, November 2022.

But approaching the city fringes I am surprised to see a kilometre-long smelting plant, which produces over 200,000 tonnes of aluminium every year for its owner, Rio Tinto Alcan. The smelters arrived in the 1970s to take advantage of Iceland’s unique access to reliable hydro and geothermal power, overtaking fishing as the dominant industry in 2008.

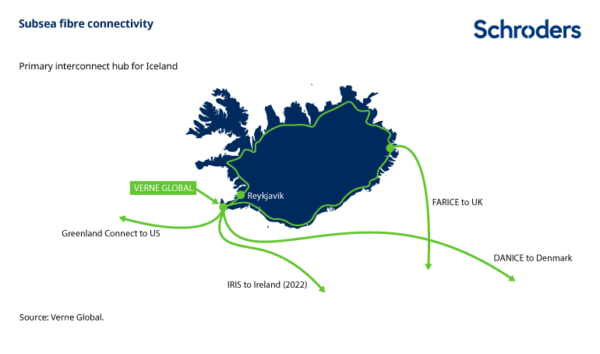

The digital infrastructure industry joined them around a decade ago, benefitting from the industrial power infrastructure operated by national supplier, Landsvirkjun. Other attractions included a proliferation of sub-sea fibre cables connecting the small island to North America, the UK and continental Europe. As I arrive at my hotel, I am sharply reminded that the climate is also predictably cold – perfect for naturally ventilating power hungry computer servers.

I am in Iceland to visit Verne Global, the leading data centre operator on the island, which is celebrating its 10 year operating anniversary. Spending time with management teams, seeing assets and meeting underlying customers are great ways to ‘kick the tyres’ when considering the potential of a business.

Verne is situated on an ex-US Naval base adjacent to Keflavik airport, meaning physical security remains unsurprisingly tight on arrival. After a rigorous check-in we visit the control centre, before walking the vast data halls and seeing the unique cooling infrastructure, all of which helps to contextualise the sheer scale of the operation. In 2021, customers based at the facility used the equivalent of 10,000 homes worth of power, while leaving a carbon footprint equivalent to just 70.

These credentials helped to attract Verne’s new owners, investment trust Digital 9, who acquired the company in September 2021, unlocking the next era of their growth. After 10 years of bootstrapping as a fledgling business, the company appears to have reached escape velocity with customer demand now growing quickly.

While onsite I had the opportunity to hear from one of their first key customers in 2012, BMW, who described the attraction of the highly efficient, low-carbon computing capacity on offer.

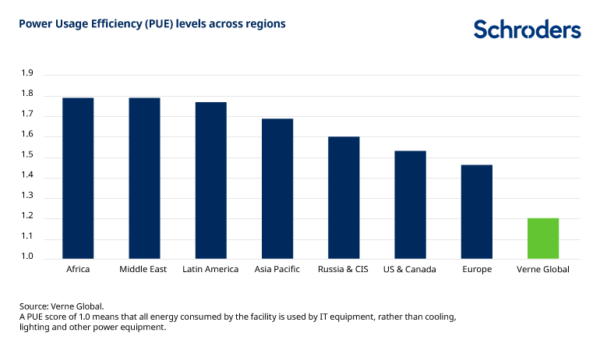

One way to illustrate efficiency is through delivering a Power Usage Efficiency (PUE) as close as possible to 1: see chart below.

Investment ideas are often hatched on the road as deeper and more varied conversations are possible. Over dinner I had the unexpected pleasure of hearing from experts in the metaverse, glacier science and global connectivity – all forces shaping the future of the data centre industry.

With oil and gas prices soaring across Europe due to disrupted supply, Verne estimates that it currently offers a 75% cheaper service than peers in major European cities. Verne has the space to expand and agreements with Landsvirkjun to access the renewable power capacity that is increasingly scarce elsewhere.

A new 1,700km sub-sea fibre cable connecting Iceland to Galway in Ireland has just been completed and will begin service in 2023. Such developments cost upwards of $100 million and should open up Iceland as a digital hub to more businesses across Europe.

Sifting through reams of hastily-typed notes and photos on the plane home, I found myself thinking about incentives and the efficient allocation of resources. Why not put all of our computer servers in Iceland? The simple answers are resilience and speed.

Just as we seek to build diversified investment portfolios to manage risk, infrastructure diversification creates a more resilient internet. This is paramount for high stakes applications such as financial exchanges where outages can result in large regulatory fines. If a sub-sea cable is snapped by a fishing trawler or a volcanic eruption grounds flights, the digital infrastructure industry is well prepared with back-up data cables, power storage and facilities in other locations.

For such users, every millisecond of delay (latency) or outage really counts, meaning that they will pay a premium to locate their servers in close proximity to the point of consumption and their engineers. Similarly, many of us will only wait a couple of seconds watching the spinning wheel telling us that our content is loading, before clicking away or refreshing.

These type of workloads still need to be stored close to large population hubs. Therefore data centre landlords with well-positioned facilities in locations like London should continue to enjoy strong demand. Combined with constrained supply, the conditions are in place for rents to rise.

This may cause the marginal customer to think twice about whether their less time-sensitive applications should occupy prime real estate.

Automotive engineers at BMW use their Icelandic servers to run extremely complex aerodynamic simulations overnight, reviewing the results in the morning. VW Group is also a tenant of Verne’s and reiterated its commitment to a carbon neutral IT strategy this month, shifting more of its computing resources to the Nordics over time. IT teams that require slightly less immediate access to their data can seek to optimise for performance, carbon footprint and cost.

We therefore think that ‘dollars per millisecond of latency’ and ‘per kg of CO2 equivalent emissions’ could become key metrics for data centre buyers, alongside ‘dollars per square foot’ and ‘per kilowatt of power’.

Sustainability should remain top of the agenda once high and volatile power prices stabilise. We expect greater industry transparency around standardised metrics like Carbon Usage Effectiveness and Water Usage Effectiveness, allowing customers, governments and investors to make more informed resource allocations.

As these trends play out, we see a bright future for digital infrastructure in the land of fire and ice.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Leave a Reply

You must be logged in to post a comment.