Dec

2018

Hunting for income in the recession that supposedly never happened

DIY Investor

31 December 2018

‘Feeling browbeaten, day after day, I think it’s over, but I just can’t get away’*

Retail Bond Expert’s Mr Bond looks at the factors that suggest we may have been in recession since the Global Financial Crisis and the contrasting fortunes of two recent retail bond issues trying to lure income investors on ORB; as only he can, he also manages to squeeze in a Hermes Birkin bag and Pussy Galore – shhhocking!

Retail Bond Expert’s Mr Bond looks at the factors that suggest we may have been in recession since the Global Financial Crisis and the contrasting fortunes of two recent retail bond issues trying to lure income investors on ORB; as only he can, he also manages to squeeze in a Hermes Birkin bag and Pussy Galore – shhhocking!

The Global Financial Crisis was the worst economic catastrophe since the Wall Street Crash 1929, unlike the latter the world didn’t go into recession, or did it? Maybe we just didn’t notice

10-years ago, in 2008, the world was seeing unprecedented economic turmoil, for example:

- Banks such as Northern Rock, IKB, Bear Stearns had already failed

- Waiting in the wings was Lehman; Merrill was kept alive by BoA

- Fannie Mae and Freddie Mac were just part of 2008 Bonfire of the Vanities

- The world’s biggest insurer, AIG, along with RBS and Lloyds (weighed down by the time-bomb that was HBoS) were all subject to government bail-outs.

Central banks reacted decisively cutting interest rates to record lows, and undertaking eye-watering amounts of quantitative easing, the net effects of these action included

EQUITIES; as the graph below shows since a low-point of below 3700 in March 2009 the FTSE 100 index has over-doubled, a remarkable bull run. During this time, we have had a sovereign debt crisis in Europe, and Brexit to contend with.

GLOBAL EQUITIES RISE, YIELDS PLUMMET; MSCI’s main world equity index has recovered to hit new record highs and is on course for its longest monthly winning streak since 2003 but is only 22 percent above levels 10 years ago. Yields on 10-year government debt benchmarks have more than halved as central banks actively stockpiled bonds.

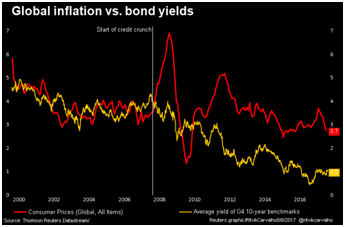

LOW INFLATION, LOW YIELDS; Despite a return of world growth back close to historical norms, global inflation failed to pick up sustainably as developed country wage growth remains subdued.

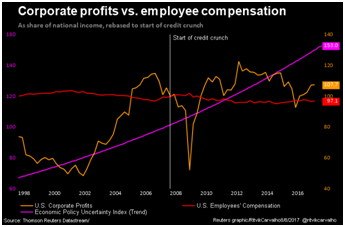

LABOUR SHARE OF GDP FALLS VS CAPITAL, POLITICAL ANGST RISES: As real wage growth has flatlined since the crisis, corporate profits as a share of the overall economy has rebounded sharply. The combination has contributed to voter disaffection and surprising electoral results that have added to economic and political policy uncertainty.

So, was there a recession? If we accept that stock markets are not an actual measure of wealth, then it appears that the rich have got richer whilst the poor have got poorer!(1) For example;

- few have seen any wage growth over the last 10-years, unless you happen to be CEO of a listed company or a professional footballer

- Inflation has risen, though not by historic levels, making people worse off

- Even if you have funds to invest yields, by historic levels, are still low

If anyone doubts statement (1) above, look at the high street, even Oxford St is seeing store closures, whilst over in Bond St rents are reaching record highs and brands such as Chanel, Hermes, et al fight over prime retail space.

If anyone doubts the rich are doing well, try buying your wife a Hermes Birkin bag! You will need C.£7,000 (that’s entry level) and if you are a mere mortal you will have plenty of time to save-up, that’s if they let you on the waiting list.

Actually, investing in a Birkin is the way to go, on eBay the cheapest, ‘new with tags’ is £8,500. Puuurfect for Pussy Galore.

Then there is art; pre-2008 the record was US$78.1m set in 1990 for van Gogh ‘Portrait of Dr. Gachet’, the current record is US$450m set in 2017 for da Vinci’s ‘Salvator Mundi’. N.B these are the actual prices paid not inflation adjusted. Source:

https://en.wikipedia.org/wiki/List_of_most_expensive_paintings

Now, most of us don’t have US$450m knocking around, but, at a more modest level, a friend bought a ‘sculpture’ by Ai WeiWei less than a year ago for £500, today they are now changing hands for £4,000

Now, most of us don’t have US$450m knocking around, but, at a more modest level, a friend bought a ‘sculpture’ by Ai WeiWei less than a year ago for £500, today they are now changing hands for £4,000

Now, hopefully Mr Bond has proved the point there are a few people doing shockingly well.

So, where is an investors Robin Hood when you need him? Anyone investing in equities post-2018 has done well, perhaps so well that we are due a correction? Mr Bond doesn’t care what anyone says, it isn’t going to be different this time; remember Goldilocks ‘not too hot, not too cold’ that was followed by 2008, then there was the late-90s new paradigm followed by the dot-com crash. History does repeat itself!

Could ORB be Robin Hood? A retail bond in green tights perhaps? However, the search for yield doesn’t come at any price, as evidenced by two recent issues:

- Regional REIT 4.5% 2024 bonds

- Monaco Resource Group 7% 2023 Issue

Now for yield hungry investors the choice looks simple, number 2. The term is a year less and the coupon over 50% higher, yet it didn’t raise sufficient investment and was withdrawn, whilst number 1 romped away. Why? When Mr Bond looked at number 2 his thoughts were:

- The 1st coupon will be paid after 12-months. Does this suggest that they are relying on generating income from bondholders’ funds to service the coupon?

- The terms and conditions of the Bonds contain certain covenants including: a minimum ratio of Equity to Total Assets and a Negative Pledge. Further details in relation to the covenants can be found in Part III ‘Information on the Programme – What financial covenants apply to the Group?’ of the Prospectus and in the ‘Negative Pledge and Financial Covenant’ section in the ‘Terms and Conditions of the Notes’ starting on page 87 of the Prospectus.

This all fine, but there is a lot of documents for an investor to read, maybe they just passed?

- Issue size; he couldn’t see a number which made him suspicious, maybe he missed it?

- The Lead Manager will receive a fee of 2.5% of the aggregate nominal amount of the Bonds issued of which up to 0.5% will constitute distribution fees available to Authorised Offerors as follows.

2.5% is the highest fee we have seen on ORB, perhaps reward for a hard sell?

- Issuing off a programme is often viewed as too complex for retail.

- The Guarantor is owned and controlled by Cycorp First Investment Ltd. as the majority shareholder holding 100% of the share capital of Monaco Resources Group S.A.M. Accordingly Cycorp First Investment Ltd. indirectly controls the Issuer and directly controls the Guarantor. To the extent known to the Issuer, the ultimate beneficial shareholder of Cycorp First Investment Ltd. with more than 25% is Mrs. Pascale Younes.

![]() As Mr Bond said surely the issuer knows who controls the guarantor? After all, it is the financial viability of the guarantor that you are relying on.

As Mr Bond said surely the issuer knows who controls the guarantor? After all, it is the financial viability of the guarantor that you are relying on.![]()

Now, Mr Bond has covered this point before, however he feels it bears repeating. One of the most important investment objectives is to achieve a ‘real’ rate of return, in yield terms this means that the interest you receive is greater than the rate of inflation.

In the UK we use the Consumer Price Index (CPI) to measure inflation; the current level is 2.4%. Therefore, if you buy, or already hold, bonds yielding 4% you are receiving a real level of return (income) of +1.6%.

Mr Bond used a table from Fixed income Investor as a research tool; https://www.fixedincomeinvestor.co.uk/x/bondtable.html?groupid=4

Whilst there are a number of issues in the secondary market yielding in excess of CPI, bonds to consider might include:

- Paragon 6.125% 2022

- Burford (BURLN) 6.5% 2022

- Intermediate Capital Group 5.00% Mar 2023

- RCB Greensleeves Homes Trust (GSHT)

- Italy (Republic of)

In summary:

10 years on from a catastrophe has the world recovered? Well, yes and no.

Yes, central banks saved the banking system, stock markets have recovered, unemployment is ‘low’ by many past measures, as is inflation.

No, because we have had a steady recession that we haven’t noticed, evidenced by the lack of wage growth for the majority of the population.

A final thought; if youth is our future we aren’t doing much to help them. In this example the percentages quoted for youth employment is based on those younger than 25:

- Greece 42.3%

- Spain 35%

- Italy 31.7%

- Great Britain 11.5%

Source: https://www.statista.com/statistics/266228/youth-unemployment-rate-in-eu-countries/

Recession what recession?

* full marks if you said ‘The Story of the Blues’ by The Mighty Wah! – enjoy!

Alternative investments Commentary » Commentary » Fixed income Commentary » Fixed income Latest » Latest

Leave a Reply

You must be logged in to post a comment.