Mar

2022

How will the Ukraine crisis affect the energy transition?

DIY Investor

20 March 2022

We see three main financial market risks resulting from Russia’s illegal and shocking invasion of Ukraine. These will have important consequences for energy transition investors

We see three main financial market risks resulting from Russia’s illegal and shocking invasion of Ukraine. These will have important consequences for energy transition investors

The Russian invasion of Ukraine represents a devastating attack on Ukrainian and European democracy and our first thoughts are with the people of Ukraine, who are courageously fighting to defend their freedom and sovereignty.

As investors, we have to consider the implications of this crisis for our clients. We see three major risks affecting equity investments in the energy transition, as well as financial markets more broadly.

Risk 1: Inflation, especially prolonged higher prices for energy and raw materials

Inflation around the world was already at multi-decade highs before Russia invaded Ukraine. This was particularly the case for energy prices.

Given that Russia accounts for a significant part of the world’s oil (c.12%) and gas supplies (c.17%), the current situation creates clear risks around energy flows. This concern has caused oil, gas and power prices across Europe to continue their steep recent rise.

Russia is also a major supplier of platinum group metals (PGM) and agricultural commodities. It also has production capacity tied in to many industrial value chains. The inflationary impulse from the conflict – and associated ratcheting up of sanctions from the West – could be quite significant.

These further inflationary pressures and constraints in supply chains across Europe may continue to weigh on corporate earnings.

Risk 2: Economic outcomes of inflation

The second risk concerns the potential economic outcomes of inflation. These include tighter financial conditions, higher energy prices, and potential wage increases – and what they may mean for economic growth.

History has shown that energy shortages and conflicts resulting in higher energy prices can slow down economies significantly. The risk of such a slowdown was already there before the escalation in Ukraine, and it is certainly higher now.

Risk 3: Potential shift out of equities

The final risk is around a broader shift in investors’ attitude to risk and a resultant sell-off in the wider stock market.

This could result in equity outflows (after a period of enormously strong flows into equity funds around the world) and a return to bonds as investors look for perceived safe havens.

How will these risks affect energy transition equities?

We believe that all three of these risks could impact energy transition shares to some extent.

The sector has been more exposed than most to higher raw material prices and logistics bottlenecks. The current situation will not help these ease.

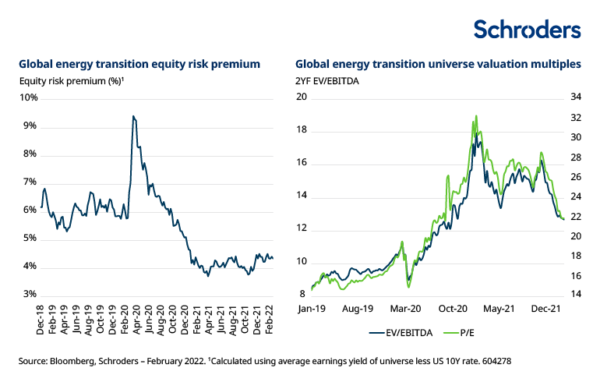

Valuations in the space have retraced from their 2021 highs. However, the equity risk premium (ERP) still remains lower than previous levels, creating a risk that valuations could fall further. (The ERP is the extra return, over the yield on government bonds, that equity investors expect to receive. The ERP shrinks when stock prices rise, because their future growth potential shrinks, and grows when stock prices fall).

The threat from a broader economic slowdown will likely be less impactful because of the structural nature of most energy transition markets. But those sectors that are more exposed to the economic cycle (autos, electrical equipment, etc.) will likely suffer. We should also not rule out the potential impact that shifting consumer demand could have on more customer-facing energy transition goods.

What could be the longer-term consequences of the crisis?

There may be some potentially interesting consequences of the higher conventional energy prices and the current conflict in Ukraine from an energy transition perspective.

Russia is a major supplier of the world’s oil and gas. It has the ability to use this natural capital to its advantage, particularly given Europe’s reliance on its fuels. One of the benefits of renewable power is that the resources that energise it are more equally spread and can help reduce dependence on key suppliers.

What’s more, as conventional energy prices spike higher, the relative economic attractiveness of renewables continues to grow. This is the case even after taking into account the higher costs of equipment from supply chain constraints.

The situation in Ukraine adds further credence to the argument for transitioning our energy system to one based on cheap, clean, reliable power.

However, we would stress that this does not change the near-term growth and earnings forecasts for companies. Indeed, they could potentially be outweighed by more prominent inflationary risks. Supply chains are still disrupted and it takes time for new demand and projects to come through.

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.