Feb

2023

Investing Basics: How to Easily Decipher ETF Names

DIY Investor

28 February 2023

ETF names can look complicated, but you’ll soon decode them with our handy guide – this article first appeared on justETF – by Dominique Riedl

One of the longest ETF names in the justETF database is the UBS ETF (LU) Barclays MSCI US Liquid Corporates Sustainable UCITS ETF (hedged to EUR) A-acc; nearly a tweet’s worth of terms and abbreviations!

Cryptic names can be off-putting, but they are usually based on a simple logic that can help you understand whether an ETF is right for you; once you know how to read ETF names you’ll be able to target your searches more quickly.

ETF names consist of five components

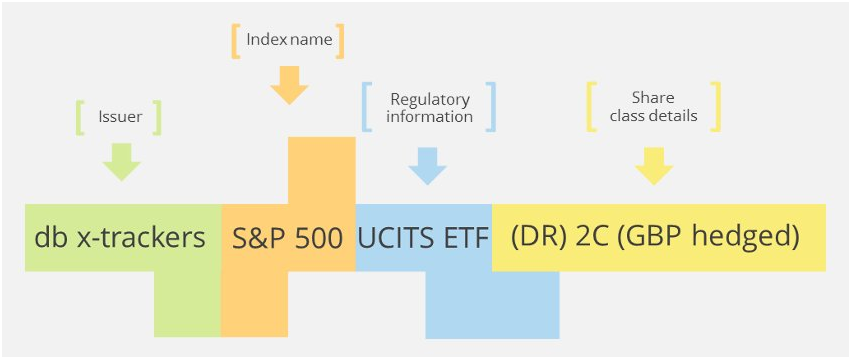

An ETF name is built from keywords that reveal the product’s most important features. The basic structure usually looks like this:

Provider: Who issued the ETF?

The ETF provider’s brand name usually comes first – e.g. iShares Core FTSE 100 UCITS ETF (Dist).

ETF providers are commonly subsidiaries of large banks or asset managers – iShares is part of the world’s largest asset manager, BlackRock, while db X-trackers is the ETF brand of Deutsche Bank.

A sub-brand, like Core in the example above, shows that the ETF is part of a sub-group in the provider’s product range; terms like Core are worth looking out for because these products are usually very cost-effective and generally based around key portfolio building blocks like the FTSE 100 or MSCI World index.

Index: Where do you invest?

The second component is the index that the ETF tracks – iShares Core FTSE 100 UCITS ETF (Dist).

Index vendors such as MSCI, FTSE and S&P provide independent verification of the indexes and licence them to the ETF providers.

Often the index name reflects the region as well as the number of stocks tracked and it pays to be aware; the EURO STOXX 50 tracks the 50 largest companies traded within the Eurozone, whereas the STOXX Europe 600 is broader and includes Switzerland and the UK.

You may also see an index with a suffix such as NR (Net Return), TR (Total Return) or TRN (Total Return Net); this tells you whether the index performance is calculated before or after withholding taxes on dividends, but it has no direct impact on the performance of the ETF itself which will distribute any dividends you are entitled to.

Regulatory information: Important for consumer protection

Always look for the words UCITS in your ETF name – iShares Core FTSE 100 UCITS ETF (Dist). This means the ETF is subject to European regulations specifically designed to protect private investors.

UCITS ETFs must meet certain standards such as not holding more than 20% of fund assets in any single security – which helps diversify the product.

‘ETF’ is also a regulatory classification, distinguishing ETFs from other exchange-traded products such as ETCs (Exchange Traded Commodities) or ETNs (Exchange Traded Notes) which are not UCITS compliant and are subject to additional risks.

Share class: characteristics of the ETF

Towards the end of the ETF name you will usually abbreviations which provide information on the share class, such as: db x-trackers S&P 500 UCITS ETF 1C.

ETFs often issue several share classes, which are variants of the fund that may differ by fees, trading currency or income distribution method; you can identify the variant you want by its unique 12-figure ISIN number, ensuring that you are investing in the Sterling rather than Euro version of an ETF, for example.

Unfortunately, each provider uses a bespoke set of abbreviations so there’s no quick hack for deciphering them.

Extra information

Income

Income paid as dividends or interest is either sent directly to your brokerage account or automatically reinvested back into the ETF to grow your holdings at a faster pace.

ETFs that pay out are ‘distributing’ – iShares Core FTSE 100 UCITS ETF (Dist); those that reinvest are ‘capitalising’ or ‘accumulating’ – iShares FTSE 100 UCITS ETF (Acc).

Distributing ETFs are abbreviated as ‘D’, ‘Dis’ or ‘Dist’; accumulating ETFs usually contain one of either ‘C’ or ‘Acc’

Currency

ETFs that invest in non-UK securities carry foreign currency risk; if the ETF’s name indicates its GBP hedged then it is protected against currency fluctuations by the use of forward contracts or options.

E.g. with the db X-trackers S&P 500 UCITS ETF (DR) 2C (GBP hedged), a UK resident will earn the return of the US index because the hedge cancels out the effect of the pound’s performance against the dollar.

If a currency is noted but without the term ‘hedged’, then this is usually a reference to the ETF’s trading currency; products are often offered in different currencies (GBP, EUR, USD) on the London Stock Exchange.

Domicile

Some ETF providers like to highlight the fact that their ETF is based in Ireland, because an Irish domicile can offer a tax advantage for some investors; e.g. the ‘(IE)’ abbreviation in UBS ETF names.

Replication type

An ETF’s replication method may be in its name if a provider wants to emphasise it. This is a particular feature of db X-tracker products where DR stands for Direct Replication where the issuer wants to stress the fact that they offer physical ETFs after years as a renowned synthetic ETF provider.

iShares are reputed for their physical ETFs already, so they don’t mention replication in their product names.

Be careful when you see: Short, 2x, 3x

Leveraged ETFs carry a leveraged, double, 2x or 3x in their name. These risky ETFs enable investors to multiply the movements of indices by a factor of two or three.

ETFs that benefit from declining prices are usually marked with the term short; short and leveraged products are high risk and specialised investments that should only be used by very experienced investors who thoroughly understand their workings.

However, ‘short’ in the name of a bond ETF, means something altogether less risky – the short maturity dates of the bonds held in the fund.

Conclusion

ETF names can appear confusing at first glance but we’ve outlined the most important things to look out for and you’ll notice that the same sets of terms and abbreviations keep cropping up.

The best tactic is to use the information contained in the name to guide you to a shortlist of suitable ETFs and then dig deeper into their profiles to choose the right ones for you.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest » Uncategorized

Leave a Reply

You must be logged in to post a comment.