Jan

2020

DIY investing: How do tipsters react to share consolidations?

DIY Investor

26 January 2020

Stockomendation is pleased to introduce ‘Stocko Says’, a concise round-up of broker and professional tipster activity across the UK financial markets.

Using our unique dataset of almost 75,000 stock tips tracked on the Stockomendation platform, we provide insightful commentary on any company, sector and broader market trends that we identify, and make it easier for retail investors to distinguish the signal from the noise in the financial media.

Share consolidations – a process in which a company’s existing shares are combined into a proportionally smaller number of new shares – shouldn’t impact on the value of a firm.

If a company trading has 10,000 shares in issue trading at £1 per share, after a 1-for-10 consolidation it would have 1,000 shares issued worth £10 each. The value of the company is still £10,000.

That being said, consolidations can often be perceived by investors as a sign of weakness (some reasons are provided in this Nasdaq article) and so the announcement of this type of corporate action may affect an investors outlook on the future of the company.

Looking in more detail at this, we took a look at a sample of share consolidations that took place for London Stock Exchange-listed firms since early 2016, and measured average tipster and broker sentiment in the four weeks before and after the effective date of the consolidation.

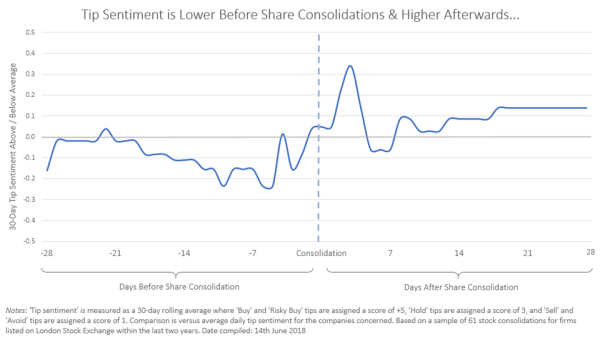

Although by this time investors will in most cases be informed of the company’s intention to consolidate its shares – which may have impacted both sentiment and share price – we also noticed some interesting activity in the days around the consolidation date itself, which is reflected in the chart below:

This chart shows the level of broker and tipster sentiment around share consolidations, compared to the average level.

There is a higher proportion of buy ratings than average when the line is above zero, and an increase in sell ratings when below zero. It is apparent that, on most days leading up to the consolidation, tipster sentiment is lower than the average level.

This could be a lingering effect of the negative outlook that the initial share consolidation announcement generated. Given that consolidations can be seen as bad news, this is no real surprise.

However, on the day that the consolidation takes place, and for most of the four weeks following, tipster sentiment increases above the average level for the period – especially in the immediate aftermath.

This could be, to some extent, because tipsters and brokers consider the worst to be over, and for the consolidation to be considered a ‘fresh start’.

Also, considering that share prices tend to increase upon split announcements, and decrease upon consolidation announcements – perhaps the shares are seen at this point to be ‘cheap’ and worthy of a ‘buy’ rating? It is difficult to say – the reasons may be different in each case – but with Stockomendation you can see what the tipsters and brokers justification is by viewing the source article of the tip (where available).

There are now 74,085 active UK share tips on Stockomendation. View the tips, tipster performance, data and links to original articles all in one place!

The information in this article is provided by Stockomendation, a multi-award winning Fintech50 platform allowing members access to over performance-tracked stock tips. Sign up for FREE at www.stockomendation.com

Leave a Reply

You must be logged in to post a comment.