Apr

2020

Hold Fast for Income

DIY Investor

25 April 2020

A long, long time ago, I can still remember how, that election had us all talking about sterling (well, some of us). Instead now we are hard put not to talk about mass dividend cuts, with Link Group estimating dividend cuts of 47% or more in the UK equity market.

Way back in those distant epochs of early December 2019, we appeared to be approaching a greater degree of certainty about the shape of the future in the UK: an election was in the offing which promised to help resolve the outlook for our relationship with the EU and the rest of the world, and to clarify what kind of environment businesses would face going forward.

At the time, GBP looked undervalued on the basis of the Economist’s ‘Big Mac’ index (a way of looking at the relative valuations of various currencies based upon the relative cost of a McDonald’s Big Mac in different countries).

‘GBP looked undervalued on the basis of the Economist’s ‘Big Mac’ index’

With signs that global investors’ positions in UK assets were starting to move towards normality from their previous large underweights, it seemed prudent to highlight that a rising currency could prove a headwind for dividend streams.

With UK payout ratios (the proportion of earnings paid out as dividends) very elevated, and in general terms a roughly inverse relationship between UK corporate earnings and the strength of the currency, dividends funded by overseas earnings logically seemed somewhat vulnerable.

Sure enough, following the general election we saw the GBPUSD rate move up to c. 1.35 in fairly rapid fashion (having traded below 1.30 since May 2019).

Even so GBPUSD remained short of the ‘fair value’ level of c. 1.42 suggested by the ‘Big Mac’ index at the time, but there were certainly positive signals in sentiment surveys that suggested sterling was setting up for a more durable rally.

Duct tape for Icarus

Against this possible headwind to index-level dividends, in December we highlighted the benefits of investment trusts having revenue reserves to fall back on.

Trusts are required to pay out a minimum of 85% of distributable income generated from their holdings, unlike their open-ended counterparts who are required to distribute all income.

This allows investment trusts the option of using strong years to build a ‘revenue reserve’, giving boards the option in leaner years of paying income from balance sheet reserves.

‘the option in leaner years of paying income from balance sheet reserves’

Investors evidently remain cognisant of this distinction, with UK Equity Income sector discounts proving resilient in the difficult market conditions (as we recently discussed here).

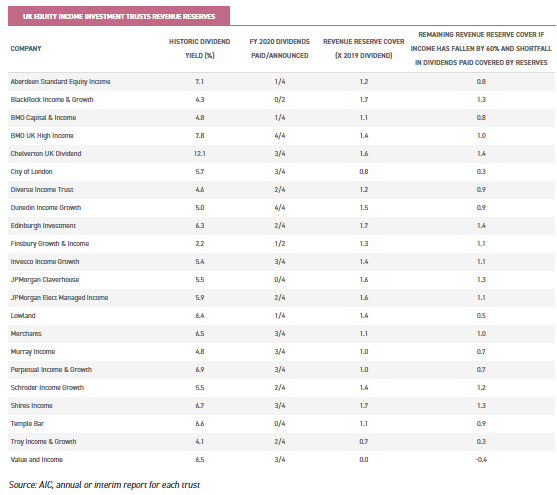

Below we look at how trusts’ revenue reserves compare to their 2019 full year dividend (based on the most recent annual or interim report for each trust).

We would caveat that some of these reserves will have been reduced in the intervening period, in order to pay subsequent dividends; as such the data in the table below is a guide and not a hard data point.

However, whilst reserves may be slightly lower than reported here, most distributions in this period will have come against a backdrop of robust dividend distributions, with UK company aggregate dividends reaching record levels in 2019.

Thus, we would expect most dividends paid so far to have been covered by income, and we do not anticipate that any serious deterioration in revenue reserves will have occurred since the last publicly available accounts.

Still, FTSE 100 Dividend futures currently suggest a likely fall in dividends of c. 59%. For context, this is worse than that seen in the Great Depression.

For an extreme stress-test, we have attempted to look at what revenue reserves would be for each trust if they had seen income subsequent to the reporting period fall by 60% and they paid the shortfall in their dividends from revenue reserves. [Note: this is an extremely unlikely scenario, with many companies having reported prior to H2 2019.]

Even in this scenario, many trusts would retain revenue reserves in excess of their 2019 dividend, whilst others would retain ample reserves to cover a shortfall from income. We discuss this further below.

When we last highlighted revenue reserves in December 2019, we had highlighted how the managers and boards of trusts such as Aberdeen Standard Equity Income (ASEI) had been able to grow their dividend at significant rates whilst still increasing their revenue reserve against a sudden stop; indeed, ASEI has, since this time, been able to maintain its level of revenue reserve relative to a growing dividend.

‘managed to expand its revenue reserve, with the board keen to ensure that the trust’s track record of 47 consecutive years of dividend increases’

JPMorgan Claverhouse (JCH) has even managed to expand its revenue reserve, with the board keen to ensure that the trust’s track record of 47 consecutive years of dividend increases remains intact.

Headline revenue reserve figures are only a guide, of course. As we have noted above, there will be some variability in these figures depending on reporting periods and dividends in the intervening period. Similarly, some trusts, such as Troy Income & Growth (TIGT) will deliberately target within their portfolio companies which pay ‘safer’ dividends.

In essence, the board of TIGT will be comfortable operating with a lower level of revenue reserve cover in the expectation that the underlying companies should offer resilient dividend streams which are unlikely to require much support.

So, on the basis of the above data we can estimate that the UK Equity Income sector had a weighted average revenue reserve of c. 1.1x their 2019 dividend, and a median revenue reserve of c. 1.4x.

Coming into 2020, UK equities looked well set and the AIC UK Equity Income sector well placed to deal with any potential currency headwinds to income streams.

Legend of the Wu-Han Clan

Unfortunately, somebody persuaded an adventurous epicurean in Wuhan to eat a bat.

‘Unfortunately, somebody persuaded an adventurous epicurean in Wuhan to eat a bat’

After some bureaucratic buck-passing, officialdom denial, and the passage of several weeks, financial markets started to wake up to the potential of a global pandemic, a fear that only accelerated as the rest of the world started to realise the Covid-19 virus could not be easily contained, nor its economic impact easily constrained.

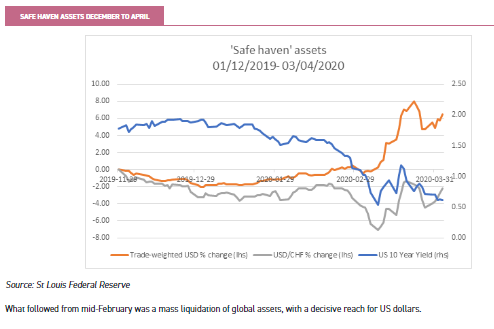

Financial markets are forward looking and discounting. As news started to leak out of Wuhan province about the intractable nature of the virus, many ‘risk-off’ moves to ‘safe haven’ assets started to occur in FX and bond markets, even as equities in general ground higher.

The US dollar started to appreciate against other major currencies (such as GBP) with the exception of the Swiss franc, as buyers across the world tried to ensure they had a ready supply of USD for any eventuality.

What followed from mid-February was a mass liquidation of global assets, with a decisive reach for US dollars.

A fistful of dollars

The US dollar has remained the global reserve currency. Essentially, companies and countries need ready supplies of US dollars to function.

And when there was a sudden communalistic (but not communal or coordinated) reach for US dollars, the global financial system started to creak.

‘the global financial system started to creak’

Bond yields and yield curves collapsed: bad news for banks (a significant dividend constituent in the UK, contributing around 14% of the FTSE All-Share dividend).

Even worse for UK equity income investors, we also saw a sudden, fairly calamitous crash in the spot price of oil, throwing in doubt the ongoing commitment of oil majors to their dividends.

For now, the US Federal Reserve appears to have essentially accepted its role as the globe’s central banker with the mass extension of US dollar liquidity (whether the methods used ultimately prove ephemeral or otherwise remains to be seen).

And the US, Russian and Saudi governments appear to be edging towards some sort of concord on oil production levels; devil may cry indeed.

Possibly, then, this will prove to be no more than a passing liquidity crisis, with the Fed pouring sufficient dollars into the world to sate the globe’s demand; in this instance, a USD devaluation would seem likely, and sterling may well strengthen once more (having fallen to 22% undervalued on the ‘Big Mac’ index in January 2020).

In these circumstances, our original point remains. Conversely, if the Fed’s actions prove insufficient, we could see credit pressures building, and some of the worst-case dividend scenarios may come to pass.

There’s something about dividends

Governments across the developed world are stepping in with gargantuan stimulus packages (many are still to be agreed, but the one thing all agree on is they will be huge.

Some estimates of Japan’s stimulus, for example, suggest it will amount to c. 20% of GDP). Much of this spending will be used to provide lifelines to businesses, and some of it no doubt will represent essentially unnecessary corporate giveaways courtesy of the taxpayer.

However, what we are already seeing is that governments will not be amused if their largesse is used to fund dividends: UK banks have already abandoned dividends in the face of political pressure and stern warnings from the Bank of England.

‘Governments across the developed world are stepping in with gargantuan stimulus packages’

This also has implications going forward, of course, with HSBC already threatening to move their primary listing to Hong Kong in protest. [We’re sure they will find the Communist Party of China, which requires party interests to be written into every company’s articles of association, much more respectful of corporate autonomy….]

According to Link Group, 45% of the largest UK public companies have now either cancelled or are due to cancel their scheduled dividends.

Furthermore, as at 6 April 2020, 15% of the FTSE All-Share by weight (24% by number) had already confirmed their intention to cut their dividends.

According to Link, more than £52bn of dividends are now allegedly at risk under worst-case scenarios; with c. £110bn of dividends having been paid out in 2019, this would represent a fall in dividends of c. 47% (by way of comparison, during the Great Depression dividend payments fell by c. 55%, whilst during World War I and the Spanish flu they fell by c. 33%).

Yet some companies such as Tesco remain committed to paying out dividends, and Shell seems likely to do so: understandably, Shell is reluctant to forfeit its track record of not having cut its dividend since World War II.

Still, if you are an investor reliant on income and are invested through an open-ended UK passive product, we’re afraid we must warn you that you are most likely – in the short-term – scunnered (to use a technical term).

For closed-ended investors, research from JPMorgan Cazenove suggests that UK Equity Income trusts have exposure to dividend suspensions declared to date ranging from 1% to 47%.

A cement mixer for the little Dutch boy with his finger in the dam

Still, it’s not all bad; not all dividends will be cancelled, Eurovision has been cancelled, and UK Equity Income trusts retain healthy reserves on the whole.

Investment trusts are companies, and as such follow a corporate financial year particular to themselves.

Thus, many have already paid out some or most of their financial year (FY) 2020 dividends. In the case of BMO High Income and Dunedin Income Growth (DIG), both have in fact paid all four of their FY 2020 dividends already.

Many of these trusts have exemplary records of growing dividends consistently over many years, such as City of London (CTY) (53 years going on 54), JPMorgan Claverhouse (JCH) (47 years), Schroder Income Growth (SCF) (23 years), and Invesco Income Growth (IVI) (23 years).

IVI will, in any event, be benefiting from a cautious approach and from its overweight exposure to sectors such as utilities; whilst SCF has large positions in stocks that should prove resilient, such as GSK and L&G (which announced it would proceed with its dividend despite pressure in some quarters).

‘the expectation that income streams will be expected to improve once again in the not-too-distant future’

Trusts such as these will not lightly sacrifice their track records, while many others will be continuing to work hard to establish a track record of exactly this kind.

The crisis in dividends will likely prove ephemeral; much of the impairment of corporate operations, cashflows and incomes is a political decision that the scale of the economic drawdown that a lockdown entails will be justified on medical grounds.

Economic costs ultimately have medical costs too, though, and the more protracted the lockdown the greater these will become; and the more the calculus will change.

In our view, revenue reserves will be justifiably drawn upon at this time, in the expectation that income streams will be expected to improve once again in the not-too-distant future.

Already the board of City of London (CTY) has made clear that intends to continue its track record of dividend growth for a 54th consecutive year.

The manager of CTY, Job Curtis, recently cautioned that the travel, retail and leisure sectors would be particularly hard hit by the lockdown, but said he was identifying resilience in other spaces such as consumer staples and utilities.

Even if the UK listed companies it held were to cut dividends by a weighted average of over 75% (a far worse outcome than that seen in the Great Depression, as noted above), CTY should remain in a position to maintain its own dividend.

‘identifying resilience in other spaces such as consumer staples and utilities’

As we have noted above, dividends will undoubtedly be under pressure. Governments may look to pressure companies to cut dividends, to better ensure that staff can be retained; and any company paying a dividend now will find future financial support subject to far more stringent conditions.

Even if the constraints prove more durable and lasting than expected, managers will have an opportunity to reposition.

In the table below, we can see:

- How many dividends each trust has paid or announced thus far in their financial year 2020

- The level of 2019 dividends per share (DPS)

- The level of DPS paid thus far in 2020

- The ratio of reported revenues per share (RRPS) to the remaining DPS still to be paid IF the trust were to leave dividends flat for the year (i.e. 0% dividend growth). If this metric is above 100, the trust in question will, if its board so chooses, be able to maintain its FY 2020 dividend solely through revenue reserves even if it receives no further dividend income.

This analysis is based off the numbers we have used above, where we have assumed that each trust’s revenue reserves have been depleted to meet a 60% shortfall in income from its underlying holdings. Again, it is worth stressing that this stress scenario is extremely unlikely.

As noted with regard to the table above, these figures are estimates. Accordingly, they should be considered a guide within reasonable parameters as opposed to ‘hard’ figures.

Two trusts have already announced their full FY 2020 dividends, BMO UK High Income and Dunedin Income Growth (DIG) (both are highlighted below). For these trusts, we have instead calculated RRPS relative to the full FY 2020 dividend.

We can see above, then, that most UK Equity Income trusts are well set to at the very least maintain their FY 2020 dividends, and should be able to do this even if we see unprecedented drops in incoming dividends.

BlackRock Income Growth (BRIG), as an example, has yet to distribute a FY 2020 dividend; however, even if it were to literally have received no income so far in FY 2020, and were to receive none for the rest of the year, it would be able to meet and indeed grow its dividend from reserves.

Conclusion

The future is, by definition, uncertain. We have some precedent for pandemics but none for the current governmental response; and the timeframe and shape of exit strategies from ongoing lockdowns remain, as yet, unknown to the public.

Whilst many companies have been able to continue to operate more or less normally, for many others the crisis represents an existential threat.

It is for precisely such a rainy day that investment trusts accrue revenue reserves. We have looked above at the worst possible income scenario for trusts (literally zero income over a reporting period, which for many includes the second half of 2019 when dividends were relatively plentiful), and still we find a strong degree of resilience.

‘many investment trust boards similarly place a great deal of importance on their ability to maintain and grow dividends consistently’

Income remains important for many investors, but it has also been made clear that many investment trust boards similarly place a great deal of importance on their ability to maintain and grow dividends consistently.

The accumulated reserves at many trusts should, even in implausibly extreme scenarios, mean they can cope with an unprecedented shortfall in income on a temporary basis.

This is true outside the UK Equity Income sector too. This note has focused primarily on trusts in the UK Equity Income sector, but these are by no means the only trusts to offer revenue reserve protection. Aberforth Smaller Companies (ASL), for example, retains revenue reserve cover of c. 2.8x on a historic dividend yield of c. 3.5%.

Revenue reserves are not a new or novel concept, and have received much coverage in recent weeks. However, an investor can know something while still not being in a position to do anything substantial about it.

This will likely represent the main difficulty for open-ended equity income funds under all but the most optimistic scenarios; they may know they face a Sisyphean task to match their previous year’s payout solely from dividend income received, but they have no reserve to call upon.

Like the Duke of Wellington at Waterloo, embattled investors in UK Equity Income trusts know reserves are out there, but they will truly appreciate them when they arrive to carry the day.

Visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.