Apr

2024

Heroes: The Two I’s; Inequality and Immigration

DIY Investor

12 April 2024

‘Everyone around, love them, love them

‘Everyone around, love them, love them

Put it in your hands, take it, take it

There’s no time to cry, happy, happy’

If there are only two subjects that dominate this election it will be immigration and inequality. N.B. with inequality I include the cost-of-living crisis as it mainly impacts those on the wrong side of inequality.

The UK population is C. 68m; according to the Financial Conduct Authority (‘FCA’) > 7.4 million, 11% of people, in the UK struggled to pay a bill or a credit repayment in January.

The figure is less than last year but is still significantly higher than before the cost of living crisis began, E.G. 5.8 million people reported that they were struggling to pay a large bill in February 2020.

The data, which gives an insight into the UK’s personal finances, showed that by January 2023, after the Russian invasion of Ukraine and the subsequent cost of living crisis, the number of people in financial difficulties almost doubled to 10.9m.

‘7.4 million, 11% of people, in the UK struggled to pay a bill or a credit repayment in January’

The FCA said 2.7m people sought help from a lender, a debt adviser or other financial support charity in the year up to this January, 47% of those who sought help said they were in a better position as a result.

Alongside struggling to keep up with bills, there has been a surge in unregulated ‘buy now, pay later‘ credit after the amount UK consumers spend online using such deals rose up to £1.7bn a month. The volume of this market has increased over 4x since 2020 and is expected to reach a record total of £30bn this year. Campaign groups are demanding urgent action to regulate the sector.

Morgan Wild, interim director of policy at Citizens Advice, said: ‘Three years on from the government promising to regulate ‘buy now, pay later’ as a ‘matter of urgency’, this much-needed regulation has ended up in the long grass.

Clearly, a large percentage of the UK population are struggling with the basic necessities of living. This is not a surprise as we have a very high level of income inequality compared to other developed countries.

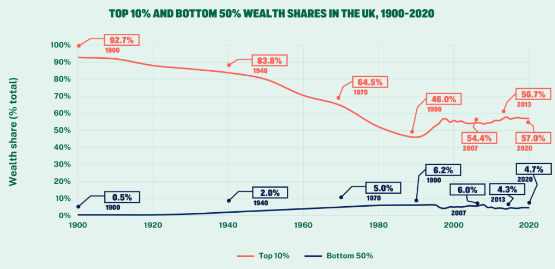

The Equality Trust calculates that the UK has the 9th most unequal incomes of 38 OECD countries (OECD, 2022) but is about average in terms of wealth inequality (Global Wealth Databook 2022). The top fifth have 36% of the country’s income and 63% of the country’s wealth, the bottom fifth have only 8% of the income and only 0.5% of the wealth.

The following data is sourced from: https://equalitytrust.org.uk/scale-economic-inequality-uk

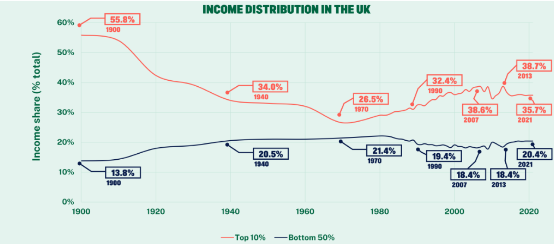

The top 1% have incomes substantially higher than the rest of those in the top 10%. Since 1980, the share of income earned by the top 1% in the UK has generally been rising, peaking at 14.7% in 2007 before the financial crisis. This is almost double the corresponding figure for Belgium (7%) and still higher than Australia (9%), Sweden (8%) and Norway (8%), to name a few.

The redistributive effect of taxes and benefits is felt most significantly in retired households, where disposable income inequality is lower than non-retired households. Retired households’ Gini(1) for disposable income is 28.5%, whereas for non-retired households this figure is 32.8%. Most of the increase in retired households’ income since end-1970s has to do with the seven-fold rise in private pension income in this period.

Wealth in the UK is even more unequally divided than income. In 2020, the ONS calculated that the richest 10% of households hold 43% of all wealth. The poorest 50%, by contrast, own just 9%. More than that, for the UK as a whole, the WID found that the top 0.1% had share of total wealth double between 1984 and 2013, reaching 9%.

One of the standout facts from all of this is that, post 1980, inequality, which had been falling , starts to increase. The importance of this is simple, this is the beginning of Thatcherism.

I looked at this some week ago in, ‘The End of an Era‘, when I wrote; ‘There is the myth that she injected a new entrepreneurial dynamism into the British economy. Whereas, in reality whole sections of manufacturing industry were damaged or even destroyed by her early flirtation with monetarism. In the end, Thatcher resorted to membership of the European single market in 1986 as a means of attracting crucial overseas investment from countries such as Japan, who valued their access to the wider European market from a safe base in the UK.’

‘We now don’t make anything’

We now don’t make anything. If we do, then often those companies are overseas owned, E.G., Rolls Royce Motors are part of BMW, Bentley are part of VW Audi.

As manufacturing died under Thatcher services industries, especially the City thrived. Certainly up until the GFC it was fair to say that we were dependent on financial services for our income. Even post the GFC finance dominated, until Brexit!

In 1986, the country exported £2bn of financial services. By 2006, this had risen to £23bn. Added to the UK’s net surplus on investment income, this paid for the most of the national deficit on trade in goods. At this point the City was arguably the world’s most important financial services provider.

One of the key points that is often overlooked is the fact that, post Big Bang in 1986, a host of City institutions were sold. Whilst some such as de Zoete Wedd, Hill Samuel and Samuel Montagu were bought by UK retail banks, other brokers such as Phillips & Drew, Warburg’s and Smith New Court were bought by large investment banks from overseas.

Today the City is a very cosmopolitan place:

- In 2017, 40% of the workforce was born abroad

- International workers in the City make-up 43% of smaller firms headcount

- International workers in the City make-up 36% of medium/large firms headcount

Source: https://democracy.cityoflondon.gov.uk/documents/s116151/international-workers.pdf

Today, post-Brexit the City’s importance is in decline.

Shell appears to be considering moving its stock market listing to the US. If so, BP is likely to follow. HSBC is an Asian bank that just happens to have its HQ in London. Other UK miners, pharma firms and other companies will likely consider similar moves, as they have a fiduciary duty to shareholders to maximise their valuation if they did not.

‘Today, post-Brexit the City’s importance is in decline’

Fortune 500 is a list of the world’s largest companies by revenue, only 15 UK firms are represented, and not all of those can be counted as ‘British’ in the conventional sense. Measured by market capitalisation only Shell, AstraZeneca, HSBC, Unilever, Rio Tinto and BP beat $100bln – and only Shell and Astrazeneca make the top 100. The market cap of Apple and Microsoft each exceed the total market cap of the entire UK market.

Turning to the second ‘I’, immigration the picture is very different; the numbers are going up!

Historically, immigration has been good for the UK. However, post the GFC it has become more of an issue. Today, it is foremost in many people minds, or is?. The following data was sourced from:

https://d3nkl3psvxxpe9.cloudfront.net/documents/WPI_Results_230904_W.pdf

- Immigration / Asylum by age groups:

18-24: 24% were concerned by it

25-49: 24% were concerned by it

50-64; 37% were concerned by it

65+: 51% were concerned by it

- Voted in 2019 GE:

Con: 57% were concerned by it

Lab; 12% were concerned by it

LibDem; 15% were concerned by it

- Voted Leave / Remain in 2016

14% of Remain voters were concerned

54% of Leave voters were concerned

In truth, the data holds little in the way of surprises. Immigration only becomes a majority issue, for Leave voters, Tories, and those over 65.

Within this group are my new national socialists. For them, immigration will always be a problem. Why? Because they are basically racists.

The question then is why has immigration become such an issue?

‘Immigration only becomes a majority issue, for Leave voters, Tories, and those over 65’

Firstly, the Tories are clinging onto this as something they can challenge Labour on; ‘labour are soft on immigration’. They can paint pictures of a country swamped by migrants, also it plays on Islamophobia. In this they are supported by their adoring media, including their own TV channel GB News.

Then there is Brexit; immigration was typically avoided per se but there was always an undercurrent of it. ‘Taking Back Control’ can equally be viewed as stopping immigration as an alternative to parliamentary sovereignty over Brussels. Seriously, how many Brexit voters care about the latter over curbing immigration?

The real, unspoken issue is inequality. When you look back immigration started to become prevalent in the news post the GFC. Why? Because the GFC sparked the recession that never was. Yes, ostensibly central banks avoided a techical recession, but for many it was just that. Austerity left many struggling and worse off than before. ZIRP did nothing for anyone other than rentiers, asset owners.

The first time we saw a kickback was in the Brexit referendum.

All of a sudden, it 2016, 52% of people voted to leave the EU. There have been ‘true’ Brexiters since 1973, but never that many. For them sovereignty, supposed EU red-tape holding us back, were issues to fight for, and in fairness, they did.

‘What was different in 2016 was a mix of lies, snake oil salespeople, and propaganda’

What was different in 2016 was a mix of lies, snake oil salespeople, and propaganda. All of a sudden Brexit was the answer to all our problems. Even the NHS’s problems would be solved with a swish of the magic wand, or, more accurately £350m per week.

There would be no more ‘cheap Polish plumbers’ stealing our jobs, and for the ‘Little Englander’ it would make us great again.

Only it hasn’t. But, hey this is hard-right politics. What does the playbook say? It’s the stab-in-the-back theory, find a scapegoat. It can’t be the EU now we have left, but there is the establishment and ‘remoaners’ who ensured that Brexit wasn’t done properly, and immigrants. Taking our jobs, taking all the housing, having to be accommodated, scrounging off the NHS, etc., etc..

The easiest way to take immigration off the table is prosperity. If people feel well off, the vast majority will cease to care. In fact looking at the data they already don’t.

At the heart of this problem is Thatcherism’s free markets, which led to the closure of much of British industry, which was replaced by…….very little. If the proceeds from North Sea oil and privatisations had been invested perhaps we wouldn’t be in quite such a mess…..sigh!

‘And more, much more

I did it, I did it my way ‘

Notes:

- Gini / Gini Coefficient; The most widely used summary measure of inequality in the distribution of household income is the Gini coefficient. The lower its value, the more equally household income is distributed. The Gini coefficient is a measure of the way in which different groups of households receive differing shares of total household income.

‘Earlier this week in “Actions Speak Louder Than Words”, I touched on immigration and inequality, and made the statement that I believed it was inequality that led people to worry about immigration. Today, we look a bit more deeply.

For the first time in the forthcoming election, the majority of people will be poorer than they were at the last election.

It’s too easy to blame Covid, and inflation brought on by war in Ukraine. It’s also too easy to blame Brexit. Sure, none of these have helped but this is a longer malaise.

The GFC was the lightning rod, the recession that never was. Measured traditionally via GDP maybe we escaped technically, but practically it has been a long recession for many. Economists love using letters to describe recessions, U-shaped, V-shaped. To that we can now add L-shaped.

Inequality fell post-WW2 up until 1980. Neoliberalism, Monetarism, free market economics, call it what you will, was the reason for much of the UKs deindustrialisation.

In the editorial to “Actions Speak Louder Than Words”, I wrote, “If I had to summarise Thatcherism, I would say that she had some good ideas but the execution was poor”. In this article I conclude by saying, “If the proceeds from North Sea oil and privatisations had been invested perhaps we wouldn’t be in quite such a mess.”

Immigration, for the majority, isn’t an issue, data confirms that. It has been made an issue by populists who need someone / something to blame. For some of them it is the ticket to being Tory leader, for others it is something they feel can play to the electorate and might save their parliamentary seats.

This, unfortunately, is just another example of the politics of the 1930s….haven’t I said that before? Or, is it an echo?

Lyrically, we start with REM’s “Shiny Happy People” although you will be hard pushed to find many of those today. We finish with “My Way”. Of course, the classic version was by Frank, but Sid’s take on it was just so chaotic, it’s hard not to love it! Enjoy!

@coldwarsteve

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip Gilbert is a city-based corporate financier, and former investment banker.

Philip is a great believer in meritocracy, and in the belief that if you want something enough you can make it happen. These beliefs were formed in his formative years, of the late 1970s and 80s

Leave a Reply

You must be logged in to post a comment.