Aug

2020

Has the time come for Europe?

DIY Investor

27 August 2020

Disclosure – Independent Investment Research. This is independent research issued by Kepler Partners LLP. The analyst who has prepared this research is not aware of Kepler Partners LLP having a relationship with the company covered in this research report and/or a conflict of interest which is likely to impair the objectivity of the research and this report should accordingly be viewed as independent.

With mutual eurozone debt established all eyes are on the continent once more; but what will drive relative returns?

With mutual eurozone debt established all eyes are on the continent once more; but what will drive relative returns?

Indeed, sometimes whether a risk pays off is dependent on your approach to it (just ask Icarus and Daedalus), as opposed to being dependent on the risk itself.

In this vein, we think it is sometimes important to understand the investment risks you are taking. Not in terms of volatility; however, we think there may be one obvious macroeconomic risk (or opportunity, depending on your viewpoint) that needs to be considered when constructing portfolios and selecting strategies at this time.

That is the current confluence of two core investment decisions and one macroeconomic variable.

These are:

- A decision to be overweight to European equities, or equities significantly allocated to this region

- A decision to tilt in favour of value-style investment strategies

- Global reflationary trends and macroeconomic recovery

We would contend that the former two are essentially variants of the same investment theme at this time, but not for the commonly assumed ‘valuation discount’ often cited as existing in European equities relative to their US peers.

Instead we would argue that both factors are, for this time, dependent on the content of the last bullet point – a global reflationary recovery and sustained upticks in global inflation – and that this is the investment theme that will likely impact relative performance for the near-term future.

Below, we set out why we think this. Our rationale includes trade balances, capital flows and relative equity opportunities.

And we think that understanding the interplay of these assets is essential for understanding true portfolio risk, which, in this most macro of market environments, we believe is reflective of strategy alignment across multiple portfolio holdings. You may wish to embrace risk, and have your cards aligned; we can sympathise with such a desire, given the potential upside if you are correct. But if you are doing so, we contend that you must understand the risks running through your portfolio.

Some background

The world, as an aggregate, operates a neutral trade and current-account balance. Countries and would-be countries do not. In a conventional calculation of GDP, net exports count as a positive towards the final calculation. GDP is, of course, an imperfect representation of domestic economic activity, but for the purposes of the impact upon the corporate sector, this is a useful fact to remember.

This is because in a very broad-brush sense a nation’s corporate profits can be boiled down to: government deficit − household savings + (exports − imports).

Corporate revenues are a reflection of sales achieved from the economy, and of external net demand. When governments borrow money, it is understood as essentially borrowing future demand. When economies run trade surpluses, they are importing additional demand to that they are able to create.

Typically trade surpluses are treated as an example of superior competitive inputs and productive capacity, but it should also be remembered that our economic system is predicated ultimately upon the desire to consume and improve standards of living. If a trade surplus derives from deficient domestic demand, this is not necessarily a healthy sign.

The eurozone runs a large trade surplus. Some of this is a result of genuine global demand for high-quality goods from global leaders in their industries.

Indeed, some managers, such as the manager of European Opportunities Trust (JEO), are often explicit in their separation of domestic eurozone demand from the growth prospects for their companies.

Over the long term, we agree. Operational realities and cash flows will nearly always, ultimately, dictate the direction of a stock price of a global company to a greater degree than the performance of the domestic economy in which it is listed.

However, these are not, we think it is fair to say, ordinary times.

May you live in interesting times

In the short term we face a perfect storm of macroeconomic factors which will likely drive global flows on a broad-brush asset-allocation basis to a far greater degree than reported earnings or stock-specific characteristics will.

Market perceptions are relatively binary at this moment; is the world facing insolvency risks, or a liquidity opportunity? This, in alignment with the extreme valuation dispersions being seen within different stock markets, is a reflection of the market-level acknowledgement of the recent conclusions of the Bank for International Settlements (BIS) that “inflation risks – downside, upside, or both – have increased almost everywhere”1.

In other words, risks are elevated for both uncontrolled higher inflation and deflation. To take one step further in this logical chain: do normal trade conditions resume soon enough that the mass of companies across the globe which are on life support can recover?

To briefly explain, a global edifice of $22 trillion of debt rests on a resumption of global trade or, at minimum, further policy support. The use of USD here is deliberate – the USD has been the de facto reserve currency of the world in the post-Bretton Woods environment.

When trade dried up as economies shut in the face of the COVID-19 pandemic, supplies of dollars both to meet debt obligations and to settle contracts for supply dried up.

Huge support measures have been put in place. Supplies of USD have been extended across the world by an accommodative Federal Reserve.

If trade resumes quickly, the huge liquidity-support measures in place could mean velocity of money does not drop off sufficiently to counteract the expansion of monetary supply, and inflation will ensue.

Suddenly, the easing of economic conditions, ready flow of dollars across the world and resumption of ‘business as normal’ suggests to the market that insolvency risks are overpriced.

If a ‘V-shaped’ economic recovery does not materialise, insolvency risks are probably rationally priced. Therefore, barring intervention, the USD squeeze will likely resume as buyers grasp for dollars to meet obligations that they no longer anticipate being able to access.

Global trade has collapsed this year, and extreme policy measures have been rolled out to support companies.

There are certainly suggestions and signs that governments may be tempted to dabble in monetary financing of spending (having their central bank purchase bonds at issuance or in the secondary market in sufficient volume to suppress yields at a level well below the market rate).

However, from valuations and market movements the market appears to be inferring two things: 1) given a choice, governments will direct this capital towards households (aka voters); and 2) learning from Japan’s experience, companies kept afloat by government largesse alone will make poor equity investments. Neither of these assumptions seem irrational to this analyst.

Europe’s trade surplus is thus a reflection of the need of the European corporate sector for foreign demand to underpin and justify current scales of operations, and leaves European equities operationally more vulnerable to many global peers from disruptions to economic growth or further slowdowns.

Redemption in the north?

Much fanfare has accompanied the recent eurozone recovery-fund agreement. Long-term European bulls have in many cases been tempted to argue this is the EU’s ‘Hamiltonian’ moment, and that this ultimately removes all but the most remote of concerns over potential reversion to national currencies and monetary dissolution, clearing the way for an investment glut creating additional productive capacity and injecting demand into the domestic economy.

Furthermore, the assumption is that the sins of the flawed eurozone structure will now be redeemed in the fiscally robust northern states, and that in underwriting the debts of the perceived functionally insolvent ‘south’ and offering sustained fiscal transfers to the ‘north’, the northern states themselves stands to benefit from a more stable economic environment and resumed demand in the south.

Ultimately this is often then further extrapolated to assume increased investment in the southern economies, improving their competitiveness and boosting the bloc’s economic position.

This is likely, this analyst would contend, to prove illusory. Thousands of words can (and have) been expended on the sustainability or otherwise of the eurozone, the efficacy of fiscal transfers and the political outlook.

Let us, instead, touch briefly on Wicksell’s concept of the natural rate of interest (where savings and investment are in equilibrium). Clearly the natural rate of interest remains distinct and separate at this time between Italy, Spain, France and Germany (as the most obvious examples).

Actions speak louder than words; no matter how much policymakers in the eurozone push, credit uptake in the southern states remains weak. If this persists, then capital transferred to the states in straits will simply leak back.

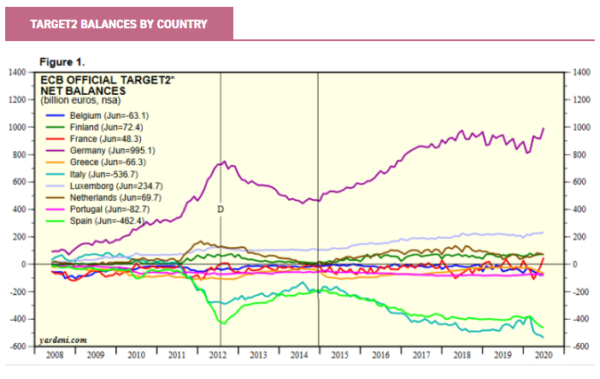

We would contend that this can be seen in TARGET2 balances. TARGET2 is the ECB’s payment-settlement system across internal borders, and is essentially the inverse of capital flows between domestic banks.

When money flows from an Italian bank to a German bank, for example, this is matched by a reduction in the Italian bank’s deposits at the Italian central bank, whilst the German bank’s account with the Bundesbank is credited.

The Bundesbank makes good this difference, in essence, at the ECB, creating credit which is a liability for the Italian central bank. Mario Draghi and the ECB’s “whatever it takes” gambit eased incipient internal capital flight for a time, as we can see below.

However, remember that it was 22/01/2015 (please note that the 2012 announcement and the start of 2015 are marked on the chart below) when the ECB initiated a systematic quantitative-easing bond-buying programme across the block. Suddenly capital flight from Spanish and Italian (and Greek) banks to German and Dutch banks accelerated.

Source: Haver Analytics via Yardeni Research2

Equity investors in the round are fairly aware of this problem. This is why eurozone bank equities have been a truly catastrophic investment, and remain seemingly recalcitrant even to the sentiment bounce from the recent mutualisation package.

We would argue then that fiscal transfers therefore seem unlikely to address these flaws.

Italian banks will still struggle to identify attractive lending opportunities, a vicious cycle will remain in place, and capital will flow back to Germany, the Netherlands and select other northern member states. In turn, corporate reliance on cash flow remains stunted by inefficient capital flows in this regard.

The ultimate dependence on foreign demand to sustain and maintain aggregated debt loads, let alone create sufficient free cash flow for reinvestment and operational expansion, therefore deepens.

Finding ‘value’ has never been so easy. Realising ‘value’ has never been so hard

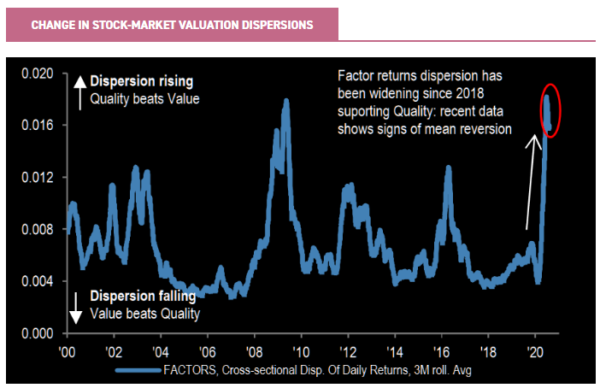

As noted above, the BIS sees elevated risks of both inflation and deflation at this time. This helps explain why stock-valuation dispersions between the cheapest and most expensive stocks have been rising. This is partially a result of the outperformance of ‘quality’ and ‘growth’ stocks.

Quality stocks on a quantitative level will screen positively for wide economic moats, dominant market positions and strong balance sheets with resilient cash flows.

In the market environment of 2020 thus far, the outperformance of quality can be understood as the perception of relative operational resilience to a cataclysmic collapse in economic activity.

The understanding that some companies might not be able to survive the COVID-19-related economic shutdown has led some of these to be aggressively sold in the market drawdown, but the lack of certainty that remains around their operational future means these have not yet been re-bid by the market.

Perceptions of risk are understandably elevated just now, and the collective wisdom of the market is, in line with the view expressed by the BIS, that economic risks are tilted to deflation.

In such an environment, there is a logical sense to paying a sizeable premium for companies that can not only survive, but which are likely to emerge with a stronger market position (and thus where stronger future profitability and cash-flow generation can be inferred).

Source: JPMorgan via The Market Ear3

The relative case for value as a broad basket, by contrast, is likely to revolve on a case for economic normalisation occurring more rapidly than general perceptions, and insolvencies thus averted, in our opinion.

Value also has linkage to inflation and interest-rate expectations, which are assumed to be likely to move in response to one another, an increase in which raises the present value of cash flows and reduces the value of future cash flows.

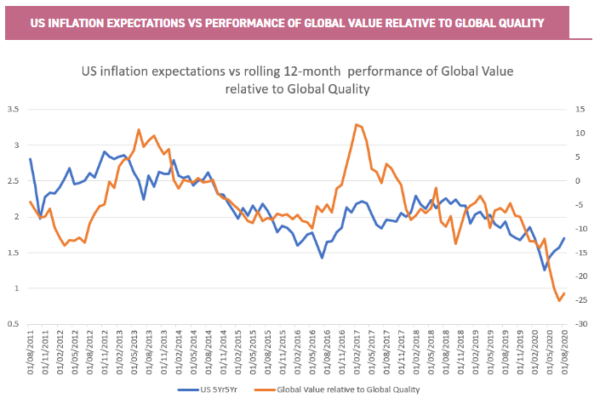

Thus, increases in inflationary expectations have tended to be associated with stronger value relative performance in the past ten years, as we can see in the chart below.

Whilst there seems to have been a notable divergence from this pattern in recent months, this is because increased inflation assumptions are being driven by anticipation of disruption of supply chains, and from extraordinary policy stimulus, as opposed to increasing demand.

Source: Morningstar, St. Louis Federal Reserve

If global macroeconomic performance remains weak and economic recovery is slow or illusory, then solvency risks increase. As Europe has highly indebted economies and imports corporate demand through a trade surplus, it has a corporate sector where solvency risks are more exposed to global trade volumes.

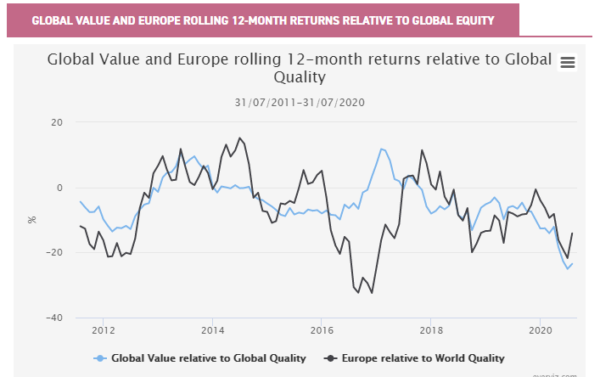

This is why the relative fortunes of European stocks have, like inflation expectations, tended to roughly correlate to the relative fortunes of global value indices (with an R² correlation measure in the relative returns of Europe and global value to global quality of c. 0.67 over the past 12 months).

Source: Morningstar

Putting theory into practice

So, what relevance does all of this have to investors?

For many of our readers who are professional investors, you will doubtless operate asset-allocation models of varying degrees of strictness of compliance.

These will assess a confluence of factors to try to best match asset allocations, including European-equities allocations, and to risk and volatility tolerances. Strategy selection should be in alignment with your expression of conviction and risk through any tactical under- or overweight positions.

For private investors, you may also look to balance your portfolio across the globe, and systematically allocate a proportion to European equities. Or you may not, but seek the opportunities globally that you feel best align with your outlook.

Our observations here are not in the spirit of a commentary on likely market direction (which we discussed here), or a forecast of the likely macroeconomic outcome (discussed here). They are about understanding what drives your European-equity exposure relative to global markets, and what drives your strategy selection relative to European equities, and also about potentially using this to evaluate how and to what degree you wish to take exposure going forward.

In either instance, we reiterate the following, based on the observations above:

- Value is, at this time, a play on global reflation and rapid recovery.

- European-equity markets relative to global markets are, at this time, a play on the same considerations.

Accordingly, investors overweight to European equities (whether to a model allocation, or mere greater exposure than a global passive equity exposure) who are holding their exposure through a value-focussed investment vehicle are essentially incurring the same macroeconomic risk twice through different mediums.

This potentially increases the upside if the base case, higher inflation, materialises. And this does not seem, to us, an irrational assumption. After all, as investment strategist Russell Napier has noted, at this point you either believe the ECB will hit or exceed its inflation target for the eurozone in the not-too-distant future, or you have to assume this spells the end of the eurozone.

Although not an avowedly ‘value’ strategy, the manager of Henderson European Focus Trust, John Bennett, has explicitly moved towards value stocks on the expectation that inflation will materialise as policymakers maintain and expand policy support.

This has included adding European banks, and exposure to Volkswagen; this latter holding, in particular, clearly has exposure to global economic dynamics.

Holding no or low exposure to European equities or value stocks globally, but instead preferring to continue to allocate to quality-focussed investment strategies, technology and/or the US is taking the other side of this trade.

It is implicitly expressing an expectation, in line with the BIS forecast, that the risks to inflation are skewed to the downside. Again, this is not irrational: huge demand destruction has occurred globally from the COVID-19-related economic shutdowns, huge surges in unemployment have occurred (dampening the potential for wage inflation), and debt piles have risen hugely.

It is certainly still possible, however, to allocate to European equities with this outlook. The manager of European Opportunities Trust (JEO), for example, has an explicit preference for what might be considered global companies that just happen to be listed on European markets.

These companies tend to be market leaders in their sectors, and in a disinflationary or even deflationary outcome, they stand to expand their global market share.

A more gentle view on the relative prospects of inflation, expressed through investment value styles and geographic allocations, can perhaps be undertaken by either market-weighting allocations, with a style tilt to reflect a macro outlook, or by an active geographical allocation split across strategies.

For example, a lower-conviction outlook for higher inflation could potentially be expressed either through a neutral weighting to Europe, but with a value tilt, or through an overweight exposure with a balanced style exposure.

For a Few Dollars More

However, a good general rule for any macroeconomic-driven investment decisions, we would contend, also remains to look to maximise your upside for any conviction call. It is also to look for where fundamental asymmetry may exist.

In this spirit, we suggest there is a non-geographic way of playing any outlook regarding inflationary pressures increasing and global economic recovery, which nonetheless over the long term retains core quality characteristics: to allocate to commodities.

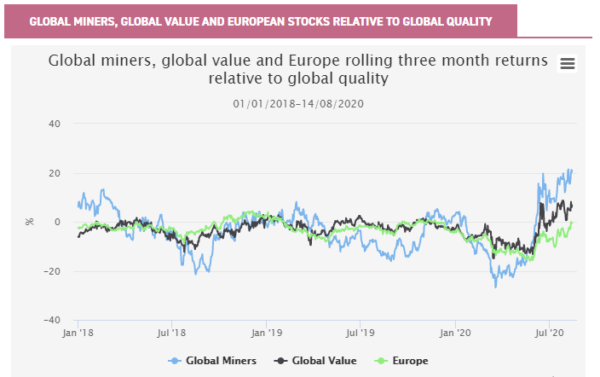

Consider the chart below, where we show the cumulative relative performance of global mining stocks, global value and European equities to global quality stocks.

Obviously these do not move in perfect sync with one another, but the market clearly imputes similar macro characteristics as varyingly favourable and unfavourable to these assets.

Source: Morningstar

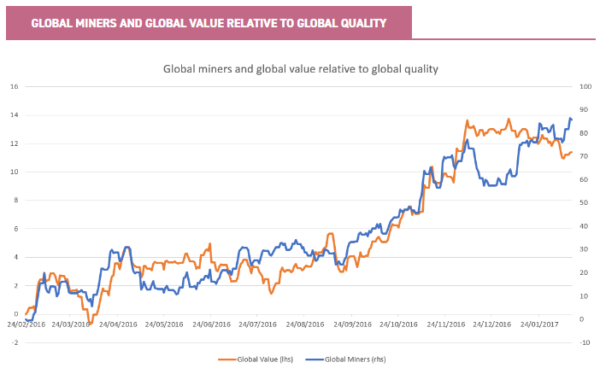

Now let us look at the same performance of these assets in the last period where we saw value outperformance driven by global expectations of a broad-based global reflationary recovery. This was in February 2016–February 2017.

This was driven by an easing of Federal Reserve policies in response to global liquidity squeezes and acute concerns over credit tightness in the domestic Chinese economy spilling over into regional and ultimately economic global contagion.

It is worth noting that miners anticipated the easing, and started to outperform in August 2015, well before the broad market bottomed and before value started to stage its relative recovery.

We have used different axes for the two data series, to demonstrate the commonality in the driver. However, please pay close attention to these scales, as outperformance for the mining sector at this time was c. 86%, against c. 11% for value outperformance.

Source: Morningstar

It seems likely to us that the relative fortunes of miners and Europe remain linked to similar macro outcomes for the near term. Yet the broad mining sector remains cheaper than the European market (Source: iShares), and the sector as a whole has exercised strong capital and balance-sheet discipline.

Whilst you may experience greater downside beta in the short term from miners than from Europe, there are likely to be fewer systemic issues and risks with the sector in our view.

When we look at where forward revenue expectations had got to for the mining sector, these were at levels where previously serious risks of a global economic meltdown were being considered.

If there is fundamental downside to mining companies on a revenue basis, there is also downside to every risk asset (and indeed every non-physical asset).

The question therefore moves to management of the mining companies. As the manager of BlackRock World Mining Trust (BRWM), Evy Hambro, has pointed out, capital discipline remains very strong amongst these companies.

With commodity prices, particularly those of precious metals, moving sharply higher in recent months, there should be convexity to mining margins, yet leading companies are, Evy notes, already able to comfortably pay high yields out of free cash flow with commodities at current (and likely even lower) levels.

In many ways, this therefore looks a more attractive way to express a macro outlook that inflation is not adequately priced into equity markets, with likely greater asymmetries than conventional value or an overweight allocation to Europe.

What would Janus do?

As we have outlined above, this note is not intended to forecast broad market directionality or likely macroeconomic outcomes.

It is to consider the macroeconomic risk factors that may cut across different allocations without investors realising it, and to allow for potentially more efficient allocation, either from a raised conviction basis or from a risk mitigation (as suits the temperament of the reader).

What we will caution, however, is that a strong bet on the disinflationary/deflationary outcome is, as we have outlined above, a very negative bet on the global economy at this time due to potential solvency risks inherent in such a macro outcome and likely contagion effects.

The very high valuation premium attached to large-cap technology stocks at this time is not just a reflection of their considered growth prospects, but also of their financial solidity and perceived relative immunity to any such systemic risk.

This latter point may even be true in a financial sense (though it probably isn’t; Facebook and Alphabet, for example, rely on advertising revenues, which are obviously at risk when the advertising firms desperately need to source cash for core operations).

However, as we will look to discuss in a future note, this probably isn’t sustainable from a societal perspective, and any (reasonable and understandable) bias in this direction should be balanced by uncorrelated hedges.

We believe strategies such as BH Macro (BHMG) and BH Global (BHGG) offer potential hedges in this respect, and continue to serve as useful risk offsets for all portfolios.

Conclusion

Risk is inherent to allocation decisions. This is true of both preferred equity style, asset-class selection and geographic allocation decisions. There are times when these different contributors to portfolio-level risk can overlap and coincide with one another.

We would argue that for two fairly major investment-allocation decisions which investors face, in weightings to European equities and in weightings to value strategies relative to quality-focussed strategies, major macroeconomic risks currently coincide.

This is due to the status of the eurozone economy, eurozone corporate revenues and global economic-trade dynamics.

Whilst much heralded as a potential driver of European-equity outperformance, recent political developments do not address fundamental imbalances.

The relative fortunes of eurozone and value stocks are for the present time therefore likely to remain at the whim of global economic reopening, yet commodities may offer the same exposure with greater asymmetries and attractive dividends.

Click to visit:

Disclaimer

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that as a private investor independent financial advice should be taken before making any investment or financial decision.

Kepler Partners is not authorised to make recommendations to retail clients. This report has been issued by Kepler Partners LLP, is based on factual information only, is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.