Jul

2022

Has the comeback begun?

DIY Investor

28 July 2022

Analysts David Johnson and Tom McMahon debate whether the market has fully priced in the current inflation and looming recession…

Markets have staged a recovery over the past month, with the S&P 500 up 10% from its lows as of 25/07/2022. According to the poll we have been running on our site for the past week, 65% of our readers think equity markets will do better in H2 than they did in H1. Yet the economic news remains poor, with persistent high inflation and fears of a recession growing. Our analysts debate whether the recent bounce is the beginning of a recovery or a bear market rally.

Bull | David Johnson

The market falls this year are the second bloodbath in less than three years, with COVID-19 having brought about the sharpest market crash since the great recession. 2022 has already marked one of the longest bear markets in recent memory (the S&P 500 officially entered bear market territory on 13 June), with there having only been three other technical bear markets in the S&P 500 since the start of 2000. I cannot argue against the reasonableness of the market’s reaction to the sudden sharp rise in inflation, the outbreak of the war in the Ukraine, and the resurgence of COVID-19 in China. But bear markets mean bleeding equities, and as Nathan Rothschild famously said, “buy when there is blood in the streets”.

The bear-market selloff has been almost entirely indiscriminate, with only a handful of stocks being seen as beneficiaries of today’s environment. This indiscriminate selling has created phenomenal opportunities. I believe there are two clear opportunities in particular that justify a bullish sentiment: buying the next winners in the market cycle, or those whose growth potential has been hugely underestimated. In both cases there are opportunities to buy trusts at seldom found discounts.

Markets are inherently cyclical beasts, reflecting the behavioral biases all humans have, becoming overconfident during times of growth, and overly fearful during downturns. Given the repeating nature of markets, I believe one should be wary of becoming overly fearful during downturns. Today’s downturn is simply one of many, and it is unlikely to be the last. And while each bear market is different, there are clear trends in how the market behaves over their course.

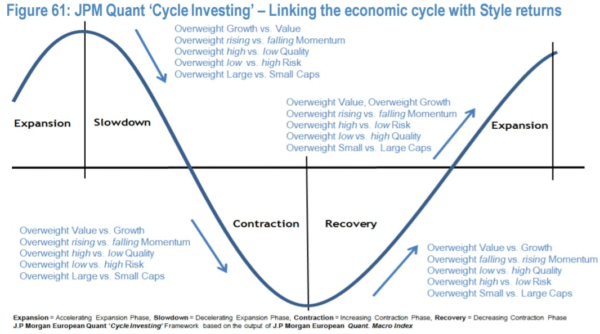

As can be seen by the below chart from JPM, there are clear patterns in the styles of investing which profit during a recovery, which I think is the next step in the current cycle, and where savvy investors may want to think about positioning themselves, given the forward-looking nature of markets. We note value strategies are an overweight in both contraction and recovery scenarios, according to JPM. Usefully, we can find value strategies across multiple sectors trading on historically wide discounts.

I think there are a couple of strategies in the North America sector which look good in terms of JPM’s cycle. Blackrock Sustainable American Income (BRSA) and Middlefield Canadian Income (MCT) both have strong value biases, thanks in part to their income objectives. In the case of MCT, its portfolio reflects the large value bias the Canadian market has. BRSA’s tilt to value reflects its manager’s belief that US value stocks had become irrationally cheap relative to the multiples their growth peers traded at. While both BRSA and MCT have generated returns which are multiples of the S&P 500 over the past 12 months, they have seen their discounts widen, and are trading on attractive discounts of 8.0% and 14.6% at the time of writing.

Given the steepness of the downturn in markets, bullish investors may prefer the strategy of buying the dip in those strategies that have sold off the most. This might be justified if the market has been mis-pricing the potential for high-quality companies in sectoral growth opportunities to grow unabated by inflation or supply chain issues. There are a number of ‘quality growth’ managers across different regions who feel that the secular growth stories of their companies are largely unaffected by the economic downturn, and even rising input costs are not a major inhibitor to their growth. Secular growth opportunities are those which are uncorrelated to macro-economic factors, be it reflecting unavoidable advancements in demographics, or the new opportunities arising from more sophisticated technologies. I think times like this are often the best entry points for what can be decade long growth trajectories, as the usual ‘premium’ applied to quality growth dissipates, as markets sell off together.

In the case of Henderson EuroTrust (HNE), its manager, Jamie Ross, has doubled down on the quality growth factor in today’s markets, using this as an opportunity to increase the overall quality of his portfolio, tapping into the highest-quality companies which were previously too expensive. While HNE’s fortunes are not directly linked to the health of Europe’s economy, it has nonetheless been caught up in the wider sell off of European equities, and trades on a 15.3% discount. This is two standard deviations wider than its one-year average, an attractive level by any measure.

While Europe has been one of the most bloodied sectors, technology is not far behind, and may be at equally as attractive an entry point. Allianz Technology Trust (ATT), for example, was for a few months in 2021 the best performing investment trust in any sector over five years. Yet, thanks to the pullback in the tech sector this year, ATT trades on a 12.0% discount, the widest it has been in five years. The managers point out its holdings in household technology names, security software, and more moderately valued semiconductor companies continue to see strong tailwinds supporting their growth. Even the team’s holding in Tesla, arguably the poster child of growth stocks, was able to report 57% earnings growth in its recent results.

Bear | Thomas McMahon

It took about two years for the consequences of the sub-prime crisis to work its way through markets in the Great Financial Crisis of 2007/2008. Stresses became apparent in the sub-prime market in Q1 of 2007, but it was later that year when events sped up: in August BNP Paribas froze three funds investing in CDOs and German bank Sachsen Landesbank was rescued by a competitor after losses in the sub-prime market. In September LIBOR spiked to its highest levels in over a decade, the Fed started cutting rates and Northern Rock suffered a bank run. The crisis in the financial sector was apparent. Yet the FTSE All Share finished 2007 up 5.3% for the year, and the S&P 500 4.9% (both in local currency). It was only in 2008 that markets cratered as the ramifications of what was happening in the financial system flowed through the rest of the economy. My point is that stock markets are known for anticipating news, but they don’t have perfect foresight, to say the least. In my view we are likely to be in a similar lull today, with the shape of the basic crisis clear but the impact on the real economy not yet apparent.

It is the US that has led markets in recent years. While we all know US large cap tech has driven markets, the scale of this is shocking. The chart below shows the returns of the FTSE All World vs the FTSE All World ex US over five years. Returns in dollars to the latter are 12.4%, or 2.3% a year.

Source: FE Analytics

Past performance is not a reliable indicator of future results

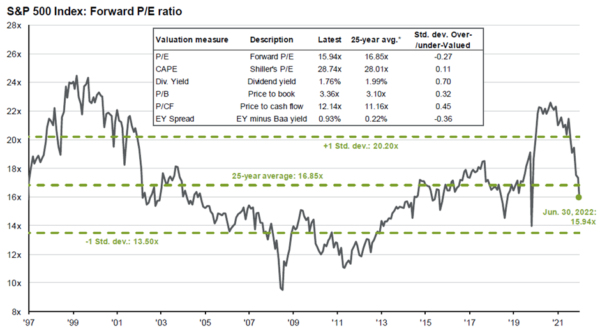

Much of this return has come from multiple expansion. Even after the losses in the S&P 500 over the past year, the forward P/E has only fallen to the middle of its historic range (JPM data below).

Source: JPMorgan

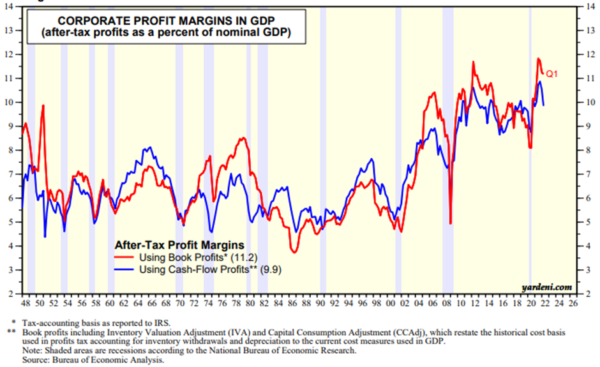

Profit margins remain extreme by historical standards. While this may imply some leeway to handle rising input prices and falling sales in any recession, it also implies margins will fall, and so multiples will rise unless share prices fall. To some extent the forward P/E will be already incorporating an expected fall in earnings which would include any fall in margins but, as the above chart shows, it is only placing an average rating on whatever earnings it is forecasting, perhaps implying sensitivity to any negative earnings surprises.

Source: Yardeni Research

So which is more likely, rising multiples or falling share prices? Going back to my analogy, I don’t think the impact of the current inflation has come through into the real economy yet. Unemployment is low in the US (and the UK) and the housing market has remained pretty solid. Retail sales grew by 1% in June, following a brief dip in May. The problem is that, as we alluded to in a strategy article in February, having a healthy consumer just increases the pressure on inflation. If the consumer has lots of cash, and wants to spend it after two years living in a hole, they have the ability to chase prices higher even while surveys of their opinion tell us they expect their situation to decrease. Importantly, the political imperative has shifted in the US and getting inflation down is more important to the average voter than making them feel richer through their 401k, so if strong economic numbers and high inflation persist, the Fed will be emboldened to cut faster and further. For the same reason, when we do start to see retail sales, house prices and employment fall, the Fed will not rush to support the markets by rowing back on rate cuts – it is more important for them politically to tackle inflation. I think hopes of this are desperate and will be disappointed. So far we have seen a massive re-rating of US equites, but they are still trading on high multiples by historical standards, with profit margins that are about to be eroded by inflation, a consumer which is about to see its earning power massively reduced and the housing market come off. In my view the direction of travel for the US market is down.

Turning to Europe, Germany is deeply troubled. In the short term the country is rationing energy use in July, with the winter still to come. In the longer term the country’s economic model is in doubt. Trade disputes bring into question its export led model. Worryingly, over the past year imports from China grew by 52.8% and exports fell by 1.5%. The country reported its first trade deficit in May since reunification in 1991. Structurally higher energy prices look here to stay, with cheap gas from Russia unlikely to return whatever happens in Ukraine. The crisis in Germany puts it in a much weaker position than it was during the eurozone crisis when it was able to act as a backstop to more troubled southern European economies. This means the whole eurozone will face a much taller task generating stability in the current crisis, while its weaker employment market and general economic picture means the ECB faces the prospect of a declining euro as the interest rate differential with the US increases – sub-optimal in a high energy cost world.

For these reasons I think there is the likelihood of another leg down in global equity markets. I don’t think the ramifications of structurally higher energy prices and a 20-30% shift up in the price indices have really been felt yet thanks to the strength of the consumer and of balance sheets entering the crisis. I think holding on to Ruffer Investment Company (RICA) makes sense, even though the trust has been vastly popular this year, with its shares trading on a premium despite massive issuance. BH Macro (BHMG) will also likely have a good sandpit to play in, although the premium of 16% is pretty rich, and implies giving up almost one year of annual returns based on the past five years (in which the trust has made 19.6% p.a.). This might be too rich for some.

Another strategy would be to build a position in the equity markets which look cheapest and best-placed, taking advantage of discounts to build in a margin of safety. I think the little old UK is pretty interesting. A high weighting in energy and materials no longer looks so old-fashioned, and contributes to the UK market being expected to see significant growth in earnings this year. It still trades on a very low P/E – on a forward basis just 9.7x, back in the range it traded in the immediate aftermath of the 2008 crisis. By luck rather than foresight, the UK is less directly exposed to a Russian energy shutdown in the winter, while its relatively strong domestic economy means higher rates make more sense domestically than they do in the eurozone. The BofA Merrill Lynch fund managers survey shows investors are still significantly underweight the UK, so the technical position is supportive.

For large cap focus, City of London (CTY) could be an interesting equity trust to hang on to. Amazingly, Job Curtis has managed to deliver positive NAV returns this year of almost 2%. However, this success means the trust trades around par. More of a value play could come via Schroder UK Mid Cap (SCP, discount: 15%). The FTSE 250 has an excellent track record of generating outsized returns, but over recent years the growth mantle has passed to the S&P 500. With all the structural headwinds now facing large cap tech, UK mid-caps could do relatively well over the next five years, buoyed by the low valuations and sentiment noted above. A significant double-digit discount only offers greater potential returns and a margin of safety.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.