Nov

2022

Guns n’ roses

DIY Investor

24 November 2022

A sustainable future for the free world may depend on investments in weapons and oil as well as traditional ESG friendly investments …by Nicholas Todd

ESG was flying high in 2020 and 2021. As governments committed to net zero dates and the world was determined to ‘build back better’, companies with low carbon emissions performed well and won the favour of investors for multiple reasons.

However, the worm has turned, and energy has been one of the best places to invest in over the past year. Meanwhile, the Russian invasion of Ukraine has thrown into relief the importance of energy security and defence to stable and prosperous societies. Here we discuss how managers have responded and ask whether ESG is changing – or is it just over?

In the ‘bad old days’ it was popularly held that investors would have to sacrifice returns to ensure their capital was being allocated to those companies with strong ESG credentials.

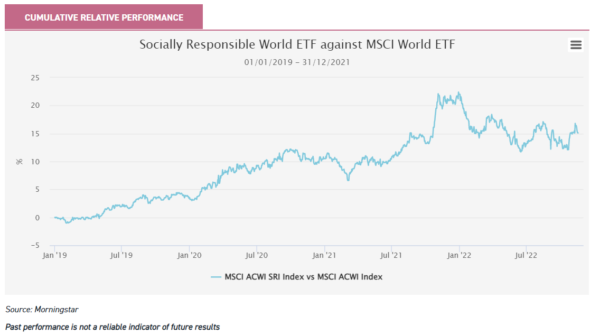

However, ESG strategies saw a strong period of outperformance from 2019 to early 2022, which gathered investor interest and assets. ESG questions focussed on climate change and reducing carbon emissions, resulting in the exclusion of companies associated with fossil fuels from many indices, whilst also impacting the industrials and materials sectors that require significant capital expenditure on infrastructure and energy in the production process.

Such criteria favoured companies operating in technology and software-related sectors. The chart below shows the cumulative relative performance of the iShares MSCI World Socially Responsible Index (SRI) ETF against the iShares MSCI World ETF from 2019 to the end of 2021, with a rising line indicating outperformance of the SRI Index and vice versa.

An increasing number of ESG investment strategies came to the market to take advantage in 2020 and 2021 and, according to Morningstar, during 2021 there were over 1200 global sustainable fund launches with over three quarters of these coming from Europe, matched by progressive sustainable asset flows.

However, the reflationary rally that followed the pandemic saw demand for commodities go through the roof. Industries which limited capex in recent years, partly due to ESG pressures, benefitted, chiefly fossil fuels and the energy-intensive miners. As polluting industries outperformed, there was a significant drop in ESG-focussed fund launches and asset flows, particularly compared to Q4 2021, as can be shown in the charts below.

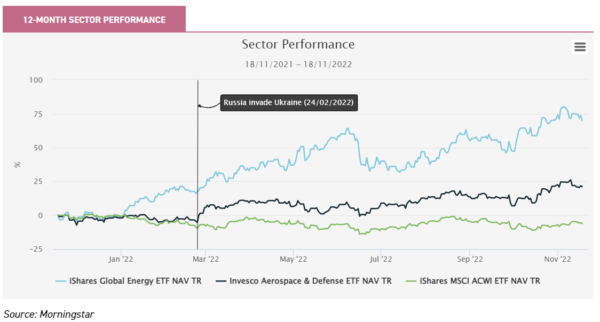

Then, Russia’s invasion of Ukraine, which began on 24/02/2022, boosted further energy prices’ pressures and highlighted the importance of defence and energy security. This has been reflected in the significant outperformance of the energy and defence sectors since the date of the invasion, as shown in the chart below.

Some managers have taken this to show how energy security, and the ‘S’ in ESG, needs to come to prominence. Several managers whom we speak to have been actively allocating to holdings in the defence sectors on ESG grounds.

For example, James de Uphaugh, manager of Edinburgh Investment Trust (EDIN), has highlighted the importance of the defence sector to preserve democracy against aggressors. He has a position in BAE Systems, which he notes benefits from the capital-intensive nature of the industry that leads to high barriers to entry and the focus on government contracts provides significant visibility on longer-term order books.

Peter Ewins, lead portfolio manager of the Global Smaller Companies Trust (GSCT), is another to see the opportunity in the sector and has been increasing positions in defence holdings, including North American component manufacturer Curtiss-Wright and UK-based multinational defence company QinetiQ. Meanwhile, City of London (CTY) portfolio manager Job Curtis also holds BAE systems within the top ten holdings, and it was the biggest contributor to returns for the 12 months to 30/06/2022. Co-portfolio manager David Smith cited longer-term fundamental improvements in the operations of the business which are related to the management team’s activities and improved Western defence spending, with the war in Ukraine being the stimulating factor for the company’s re-rating.

Another aspect of defence is cyber warfare. Not only is it important for companies, which are more vulnerable through the ever-increasing amount of investment in IT networks to support remote working and enhance customer experiences, but it is also a concern for governments and national security.

A study published in March 2022 by McKinsey and Co. projected that $101.5 billion will be spent on cybersecurity service providers by 2025. Alongside this, governments continue to invest in the sector with the UK government having allocated additional funding to improve cyber resilience across government as part of the National Cyber Security Strategy and the National Cyber Force.

This Force is supporting UK firms not just to grow and scale up, but also to maintain and extend the UK’s competitive edge as a ‘responsible, democratic’ cyber power on the world stage. The sector has been, increasingly, an area of focus for technology-focussed trusts, including Herald (HRI). They are investing through companies such as GB Group, a global leader in digital identity which helps companies and governments to fight fraud and cybercrime.

At the other end of the market cap spectrum, Walter Price, lead manager for the Allianz Technology Trust (ATT), cites the use of cyber warfare by the Russians in response to sanctions as an example of the threat. Companies that feature in the top ten of ATT’s portfolio include the world’s largest cloud-based information security provider, Zscaler, and Okta which uses cloud software to help companies manage and secure user authentication in applications.

Conclusion

What constitutes a credible ESG-investment solution has evolved considerably and we believe that it will continue to do so. We are not quite so cynical as to say that the huge wave of interest in ESG in 2020/2021 was caused by its outperformance, but there was undoubtedly a sweet spot in which investing seemed easy: investors could have their cake and eat it.

It can’t be a coincidence this was the period of the Johnson premiership! Now the decisions seem harder and the trade-offs more apparent. Climate change is going to continue to be a key ESG concern of many investors, but it is likely that in the aftermath of the Russian invasion of Ukraine, more will be sympathetic to the argument that fossil fuels will be necessary during the transition and managers will be looking for alternative ways to display their ESG credentials.

We do not believe investors are giving up on ESG, however it will remain up to the investor to consider the opportunity cost of investing in strict ESG mandates which may underperform during certain economic environments.

In the end, there is no substitute for investors examining whether a manager’s ethical stance mirrors their own enough for them to be happy to invest in their funds. Perhaps we should hedge our bets and say whether it is ‘sustainable’ or not to invest in defence, our societies may be, literally, unsustainable if nobody does.

We asked our audience “Should investing in the defence sector be considered good for ESG purposes?” and 65% voted no.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Alternative investments Commentary » Alternative investments Latest » Brokers Latest » Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.