Mar

2021

Global perspectives UK: The value of vaccination

DIY Investor

6 March 2021

The UK economy has faced a perfect storm over the past 18m as the political distraction of Brexit overlapped a very serious COVID-19 crisis. Following a poorly informed initial response, the UK government has pushed ahead with a world-leading vaccination program and looks set to emerge from the pandemic towards the head of the pack.

We believe that as social distancing and lockdowns give way to social spending the leisure, entertainment and travel sectors are set for an earnings-based recovery.

The announcements for England announced on 22nd February now provide a timetable for the easing of restrictions out of the pandemic which the other devolved nations are likely to follow. Infection rates continue to fall in the UK and encouraging vaccination data suggests a high degree of protection from hospitalisation with COVID-19.

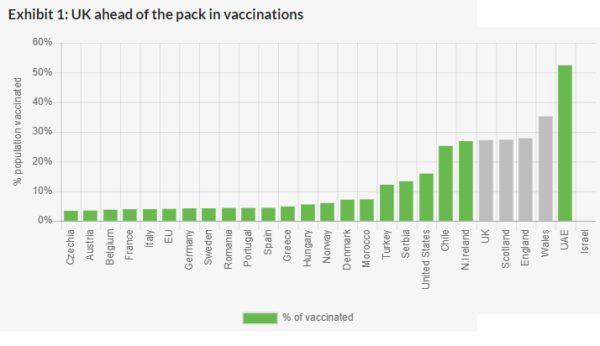

The UK has been one of the quickest nations to vaccinate with close to 30% of the population have received at least one jab, Exhibit 1. While not at the levels required to ensure herd immunity, with a further 15% of the population having naturally acquired antibodies there is some scope for the current lockdown to be the last, if the relaxation schedule is properly managed.

Source: Our World In Data, Government statistics

English schools will return on 8th March while non-essential retail is expected to reopen in April. Pubs, bars and restaurants are likely to reopen in May, albeit with social distancing measures remaining in place.

Restrictions on the tourism sector may be lifted in June. International travel remains uncertain for the summer, depending on the development of vaccination certificates and also significant further progress in vaccination rates in continental Europe, which has lagged the UK.

By December, we expect the advent of the second generation of vaccines which provide protection against a wide variety of variants of COVID-19 which should bring into prospect a progressive return to normality for international travel.

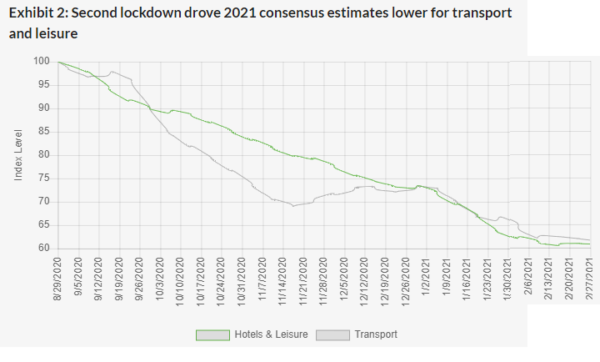

Source: Refinitiv, Edison calculations

The second wave of lockdowns has hit consensus 2021 earnings forecasts in the most exposed sectors hard. Since September the UK transport, hotels and leisure sectors have seen cuts to 2021 expected profits of in excess of 30%. Only in recent weeks do earnings appear to have stabilised, Exhibit 2.

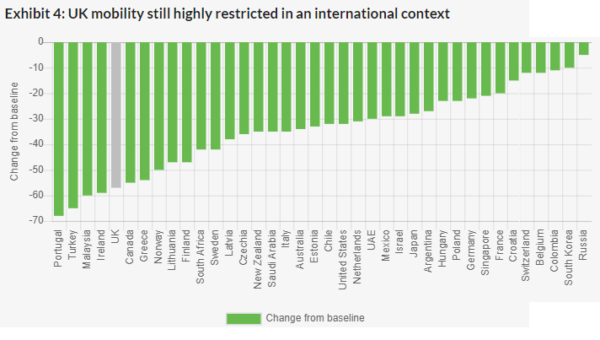

Google mobility data, Exhibit 4, shows that the UK remains under one of the more draconian lockdown regimes on a global basis. Transport hubs are operating at a small fraction of normal levels, in sharp contrast to many other nations similarly dealing with COVID-19. Retail and recreation usage is also highly depressed on an international comparison, suggesting the scope for a large bounce-back in profitability once restrictions have been lifted.

Source: Refinitiv, Edison calculations

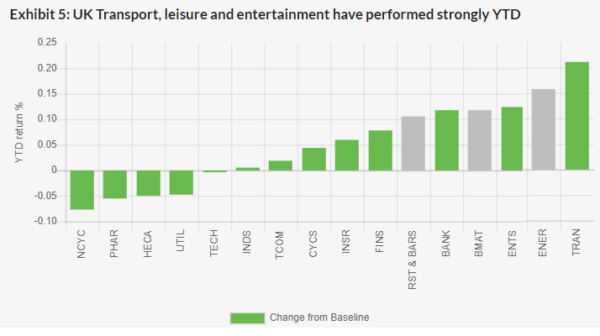

Therefore, since the start of 2021, investors appear to have looked through these downgrades and poor near-term trading.

Year-to-date, the UK’s domestic leisure and travel sectors have been among the strongest performing, Exhibit 5. Defensive sectors have lagged in comparison. There is clearly some risk in this combination of rising prices and earnings downgrades which represents a substantial vote of confidence in earnings beyond 2021.

However the fact that the UK has pushed ahead with its vaccination program provides some comfort that investors rather than going out on a limb are instead getting ahead of a substantial improvement in operating performance later in the year.

Source: Refinitiv. Return shown in GBP

With the end of lockdown in sight, the focus is shifting away from questioning balance sheet strength and instead looking towards the earnings recovery in 2022. However, funding remains an important risk given the remaining uncertainty over the timing of the reopening of the hospitality industry.

For any investment in the sector we believe balance sheets must be sufficiently robust to bear the costs of a further six months of weak trading.

On the other hand, the larger listed leisure companies are comparatively well-placed to not only recover lost profitability but also gain access to opportunities where weaker and smaller competitors have failed during the pandemic.

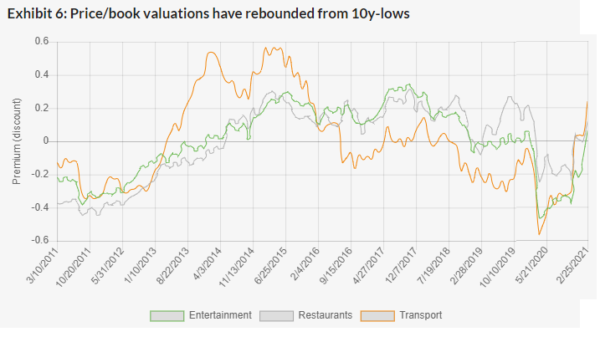

Investors have been swift to mark-up the this potential for recovery as forward price/book valuations for these sectors are at or in the case of transport even above long-term averages.

Nevertheless, the sector is still of interest as there are currently relatively few segments of the global stock market which trade close to long-term fair value and meet traditional value investment criteria, yet still have very strong earnings growth ahead.

Therefore as it is no longer the case that valuations are highly discounted, instead the theme must be that of ongoing positive earnings momentum. We believe investors will be looking to play this earnings recovery over the next six months.

The companies with the strongest performance are likely to be those which are in a position to take advantage of the new trading environment to put themselves in an improved competitive position than prior to the pandemic.

Click to visit:

Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Latest » Mutual funds Commentary » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.