Mar

2021

Global perspectives: Rising US bond yields? Value investors have little to fear

DIY Investor

19 March 2021

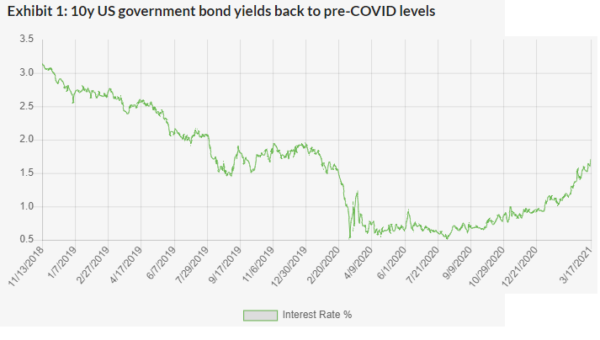

We have maintained our underweight view on US government bonds since shortly after the onset of the COVID-19 pandemic.

We have maintained our underweight view on US government bonds since shortly after the onset of the COVID-19 pandemic.

From our perspective, it was relatively clear the monetary policy response to the pandemic and depression in US GDP would be large but ultimately transitory.

As a result, it would have been counterintuitive not to expect a rebound to higher rates of interest on risk-free government bonds as the global economy recovered.

Even as we see US rates making an orderly retracement away from record lows, we are struck by the angst this is causing many investors. In our view, rising interest rates should not of themselves be a cause for alarm.

Source: Refinitiv

Value investors should have little to fear from rising rates

For equity investors, and especially those investing in value sectors of the market, rising interest rates should instead be seen as a welcome sign of recovery.

They have been accompanied by significant earnings upgrades in recent months, which more than offsets the impact of rising discount rates. Yet there is a niche of the market which may be exposed to this relatively predictable normalisation of financial conditions.

Those exposed to faster growing sectors of the stock market, where valuations remain well in excess of long-term averages, are more at risk of asset price declines in our view.

In recent weeks there has been an unsurprising although modest reversion towards valuation norms and this has driven the underperformance of ‘growth’ indices relative to ‘value’.

Outlook for long-term rates little changed by pandemic

However, we believe the more relevant question both for bond and equity investors, who discount corporate cashflows at rates derived from government bonds, is the likely level of long-term bond yields in a post-COVID environment.

If we assume as a central scenario that the scarring of the global economy is relatively limited, as is the aim of the fiscal support and stimulus packages being implemented around the globe, the basic parameter of productivity growth should remain unchanged.

Therefore, as mobility returns to the work and consumer spaces following vaccination programmes, the capacity of the economy also should remain relatively unchanged.

In this regard, we see the longer-term projections from US Federal Reserve policymakers for the growth rate of the US economy and inflation are very close to those prevailing before the pandemic.

Likely long-term interest rate levels may therefore have moved less than might have been expected, given the recent disruption from the pandemic.

While trend growth rates may have remained effectively unchanged, there are clear differences in the sector composition of indebtedness, with governments rather more indebted while the household sector has saved during the COVID period.

The rapidity of these shifts may be unprecedented outside wartime, but provided a credible path to fiscal consolidation can be established, they can be reversed over time and ‘tail’ risks such as a rapid or uncontrolled increase in inflation remain outlier probabilities, in our view.

Runaway inflation remains a tail risk

For inflation, it is not for example immediately clear why there should be an uncontrolled surge in wages at a time when national economies are still running below full capacity.

The global fiscal stimulus underway is itself a temporary affair and will give way to fiscal consolidation to repair government balance sheets out to 2030, which should also be expected to slow growth and weigh on inflation.

The bigger risks to inflation do not in our view lie in the realms of economics, but instead in trade and geopolitical tensions, notably between the US and China but also in the Brexit process.

Trade tariffs and a partial reversal of specialisation as national strategic factors become increasingly important represent an unwind of globalisation.

Taken together with the fading one-off deflationary impact of China’s accession into the World Trade Organisation, these might be better reasons to suggest proportionately higher inflation and slower real growth may lie ahead, rather than the pandemic and its policy responses.

Recent FOMC meeting provides monetary policy continuity

Fed policymakers have only recently given themselves significant room for manoeuvre in respect of near-term inflation readings, by shifting to an average inflation-targeting regime.

They have also decided to make full use of the flexibility it offers. If counter-cyclical monetary policy allowed for long deviations from neutral levels of interest rates in the past, average inflation targeting significantly extends the duration of this approach.

Furthermore, US monetary policy thinking has evolved over the past 15 years, in particular as the experience of large-scale asset purchase programmes has shown policymakers that the impact on asset prices is rather higher than that on actual inflation and the real economy.

Fed policymakers believe that they can always offer asset prices a smooth off-ramp from central bank purchases over time, so financial stability risks are not likely to feature strongly in decision making at present.

Higher priority is likely to be given to the need to keep monetary stimulus in place for longer, rather than risk prematurely tightening policy and initiating a loss of market confidence which would drive GDP further below trend, exacerbating government sector deficits and long-term economic scarring from the pandemic.

At the recent FOMC meeting the Fed delivered a confirmation of prior policy settings and no surprises. The new interest rate ‘dot-plot’ currently suggests no interest rate increases for nearly two years, close to pre-meeting market expectations.

It may have been helpful for Fed policymakers that the nascent bubble in certain growth segments of the US stock market, which could have been a constraint on doveish policy signalling, has at least stopped expanding in 2021.

While we expect asset purchases to slow during 2022 (and this to be flagged well ahead of time) there was no talk of it for now.

Fed Chair Powell’s press conference also represented continuity of policy, even as the proposed US $1.9trn fiscal stimulus has now been signed off. In our view, it is much too early to argue that this fiscal stimulus necessitates a less accommodative monetary policy.

While there might have been a minority of liquidity driven investors or short-term traders hoping for further monetary largesse, the inflection point of accommodative monetary policy was reached some months ago.

Instead, long-term investors should welcome this monetary policy stability in combination with a very strong rebound in US growth in 2021 which should support earnings estimates and the traditional ‘value’ sectors of the market.

Click to visit:

Commentary » Equities » Equities Commentary » Fixed income Commentary » Fixed income Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.