Aug

2023

The outperforming sector I’m not ready to buy yet

DIY Investor

8 August 2023

Saltydog Investor is watching the China fund sector closely but is not ready to pull the trigger yet and buy.

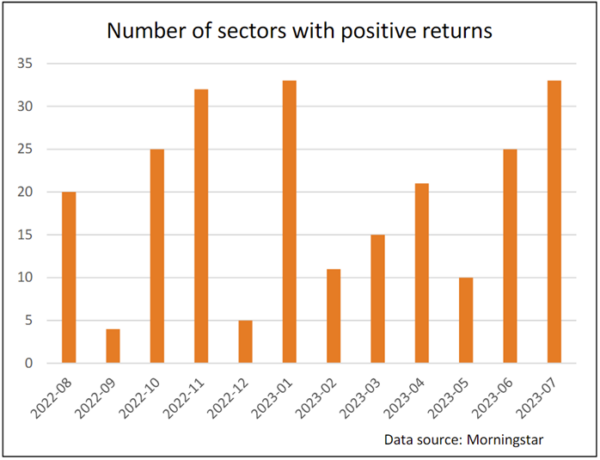

Last month, 33 of the 35 investment sectors we monitor rose in value. That is the best result we have seen since January. Now, 23 sectors have gone up for two months in a row.

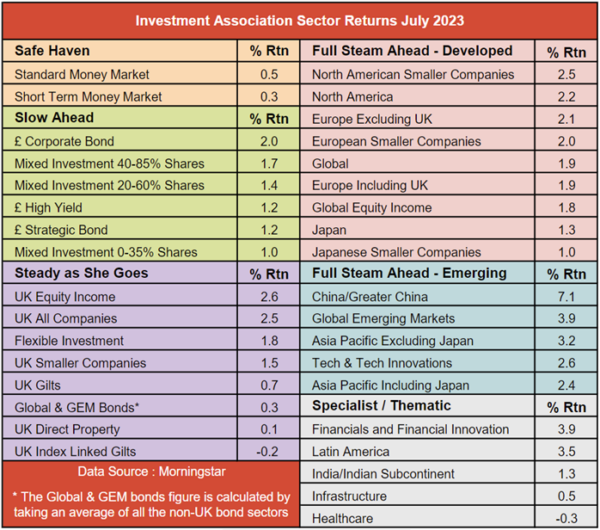

The best performing sector last month was China/Greater China, with a one-month return of 7.1%, followed by the Global Emerging Markets and Financial and Financial Innovation sectors, which both made 3.9%.

UK Index-Linked Gilts and Healthcare were the only two sectors to fall in July.

Not surprisingly, the dominance of the Chinese equities sector was reflected in our list of leading funds last month. Nine out of the top ten funds that we analyse came from the China/Greater China sector. The only exception was the Schroder ISF Global Energy fund in sixth place.

At the top of the table was the Matthews China Fund with a one-month return of 10.4%.

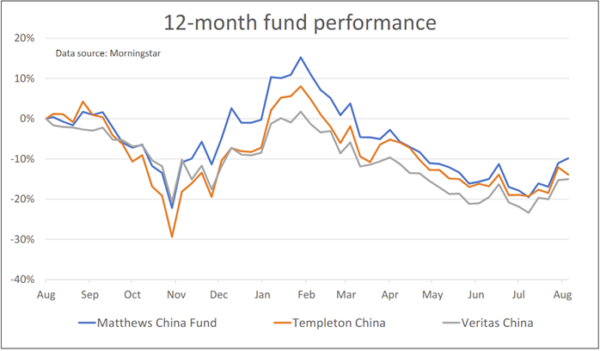

The Chinese stock market has been on a rollercoaster ride for the last year. Initially, it struggled because of the government’s zero-Covid policy, which kept much of the country in lockdown when other countries had relaxed their rules and their economies had started to recover. It then rallied strongly in late October, when the government started rolling back some of the restrictions which were finally lifted in early December.

In January, the China/Greater China sector was the second-best performing sector in our analysis, gaining 8.4%, but then the recovery started to falter. In February the sector fell 7.4%, and it then made a small loss in March which resulted in a first quarter loss of 0.02%. The second quarter was much worse with the sector losing a further 12.8%.

Even after its strong recovery last month, the China/Greater China sector is still our worst performing sector so far this year, and the leading funds are significantly lower than they were at the end of January.

The tide may have turned in the last few weeks, but we still are not convinced that the recent downward trend is over. We will be watching the funds in this sector very closely over the next couple of weeks before considering adding them to our portfolios.

See more at www.saltydoginvestor.com

Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.