Jan

2021

Get ’em while they’re hot!

DIY Investor

14 January 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

We review the widest discounts in the investment trust universe and look at our selection of attractively cheap trusts…

We review the widest discounts in the investment trust universe and look at our selection of attractively cheap trusts…

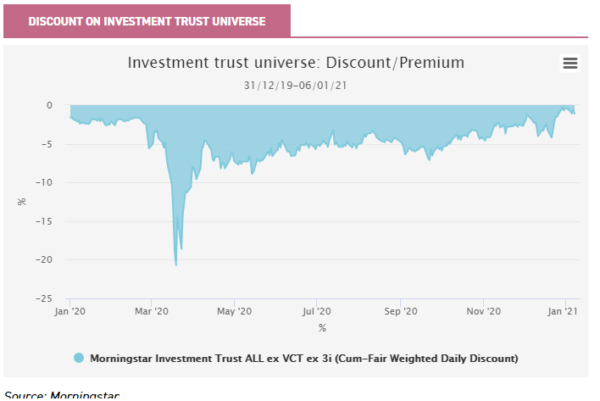

The period since our last review of investment trust discounts on 22 October has been a pretty good one for investors in trusts, and has seen the average discount on the sector narrow from 3.5% to under 1%. In fact, despite the tumultuous events of 2020, it is now almost as if the year had never happened: the universe entered the year on a discount of 1.5% and ended it on a discount of 1.1%, where it remains as of 07/01/2021.

Since our last review, many of the sectors which have seen their discounts tighten the most have been those ‘left behind’ or out of favour sectors.

There has been a value bounce of sorts, with ‘COVID loser’ sectors such as property, financials and commodities seeing their discounts come in markedly, while sectors typically seen as risk-on have also rebounded, such as private equity and the emerging markets sectors.

There have been very few sectors seeing a widening of their discounts. Environmental trusts had seen their discounts narrow (or premiums rise) over 2020 and took a bit of a breather in Q4, while Hipgnosis Songs (the Royalties sector) consolidated slightly after a strong year and a lot of issuance.

The aircraft leasing funds took a jump when the initial value rally occurred in September as positive news about vaccines filtered out, but they have subsequently sunk back slightly. They remain on some of the widest discounts in the sector.

| Sector | Difference |

| Morningstar Investment Trust Financials | 18.1 |

| Morningstar Investment Trust European Emerging Markets | 13.9 |

| Morningstar Investment Trust Private Equity | 13.9 |

| Morningstar Investment Trust Property – UK Healthcare | 11.3 |

| Morningstar Investment Trust Private Equity ex 3i | 9.9 |

| Morningstar Investment Trust Country Specialist: Latin America | 9.7 |

| Morningstar Investment Trust Commodities & Natural Resources | 8.9 |

| Morningstar Investment Trust Property – Rest of the World | 7.8 |

| Morningstar Investment Trust North American Smaller Companies | 7.2 |

| Morningstar Investment Trust Farmland & Forestry | 7.2 |

| Morningstar Investment Trust Property – UK Commercial | 6.9 |

| Morningstar Investment Trust Property – UK Residential | 6.9 |

| Morningstar Investment Trust Growth Capital | 6.9 |

| Morningstar Investment Trust Property – Debt | 6.8 |

| Morningstar Investment Trust UK All Companies | 6.8 |

| Morningstar Investment Trust Property – Europe | 6.4 |

| Morningstar Investment Trust Japan | 5.5 |

| Morningstar Investment Trust Hedge Funds | 5.4 |

| Morningstar Investment Trust UK Smaller Companies | 4.3 |

| Morningstar Investment Trust Asia Pacific Smaller Companies | 4.2 |

| Morningstar Investment Trust Japanese Smaller Companies | 4.0 |

| Morningstar Investment Trust Country Specialist: Asia Pacific – ex Japan | 3.9 |

| Morningstar Investment Trust Insurance & Reinsurance Strategies | 3.8 |

| Morningstar Investment Trust Debt – Structured Finance | 3.6 |

| Morningstar Investment Trust Infrastructure Securities | 3.5 |

| Morningstar Investment Trust Asia Pacific | 3.3 |

| Morningstar Investment Trust Europe | 3.1 |

| Morningstar Investment Trust UK Equity & Bond Income | 3.0 |

| Morningstar Investment Trust Biotechnology & Healthcare | 2.9 |

| Morningstar Investment Trust Global Emerging Markets | 2.9 |

| Morningstar Investment Trust Debt – Direct Lending | 2.5 |

| Morningstar Investment Trust Global Smaller Companies | 2.2 |

| Morningstar Investment Trust Flexible Investment | 2.2 |

| Morningstar Investment Trust Country Specialist: Europe – ex UK | 1.8 |

| Morningstar Investment Trust UK Equity Income | 1.4 |

| Morningstar Investment Trust Global Equity Income | 1.3 |

| Morningstar Investment Trust Global | 1.2 |

| Morningstar Investment Trust Technology & Media | 1.1 |

| Morningstar Investment Trust Latin America | 0.9 |

| Morningstar Investment Trust Asia Pacific Income | 0.8 |

| Morningstar Investment Trust European Smaller Companies | 0.7 |

| Morningstar Investment Trust North America | 0.5 |

| Morningstar Investment Trust Debt – Loans & Bonds | 0.3 |

| Morningstar Investment Trust Infrastructure Securities | 0.3 |

| Morningstar Investment Trust Liquidity Funds | 0.2 |

| Morningstar Investment Trust Country Specialist: Rest of the World | 0.0 |

| Morningstar Investment Trust Property Securities | -0.2 |

| Morningstar Investment Trust Leasing | -0.3 |

| Morningstar Investment Trust Renewable Energy Infrastructure | -0.4 |

| Morningstar Investment Trust Environmental | -3.2 |

| Morningstar Investment Trust Royalties | -4.6 |

| Morningstar Investment Trust Global High Income | -15.0 |

Widest discounts in the investment trust universe

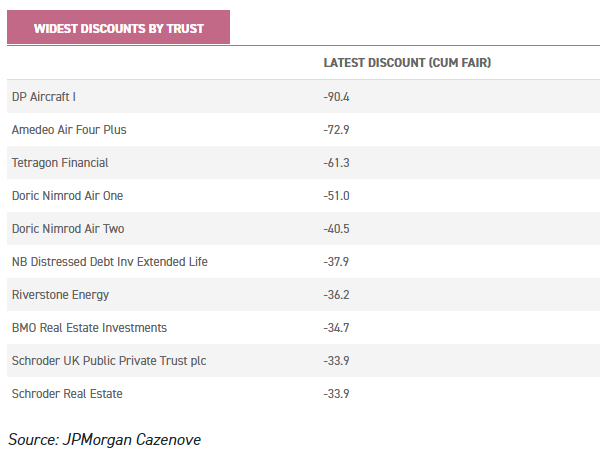

Looking at the trust level, there are some extreme discounts in the aircraft leasing funds. While there has been a small bounce in their discounts following the proof that vaccines work against COVID-19, significant long-term challenges remain.

In the case of the Doric Nimrod funds, much of the NAV reflects the expected value of the A380 planes they own and lease to Emirates Airlines at the end of their current contracts (in other words their resale value, whether whole or for spare parts).

Problematically, the huge drop in demand for air travel is likely to severely reduce demand for both whole planes and spare parts in the coming years. Most of the leases end in 2021 and 2022 across the three funds, with the remainder concluding by 2025, so it is close to crunch time.

Notably, supported by the Kingdom of Dubai, Emirates has remained in operation and paid all its lease obligations to the companies so far. The key question for investors remains – will Emirates keep a sizable fleet of A380 aircraft into the future?

A positive resolution on this point will be the key catalyst for discounts to narrow. In our (non-specialist) view, this is currently more of a gamble than an investment certainty.

Tetragon Financial (TFG) is trading on a 61% discount at the time of writing, one of the widest in the sector despite its strong long term NAV track record. TFG is a complicated fund, which may deter some investors, but it has delivered excellent returns over time as we discussed in our last note. However, the discount has proven persistent, and over the period in review has slightly widened.

TFG is certainly not dull, and is currently suing an investee company (Ripple Labs) for the repayment of their investment and to prevent it paying out cash to cover other costs. We note that the NAV includes a valuation of Tetragon’s underlying assets managers, which may add some uncertainty, but fundamentally the wide discount seems anomalous to us, even if it has proven persistent.

Last quarter, some commercial property trusts would have been nearer to the top of the table, with discounts at the time in the mid-40s. There has been significant narrowing in recent months in the sector, although discounts remain wide in the context of the whole universe. BMO Real Estate (BREI), Schroder Real Estate (SREI) and BMO Commercial Property (BCPT) all have discounts over 30%.

All three have high retail weightings compared to the peer group average which is likely weighing on sentiment. However, we believe the rebasing of the dividends in the sector is likely to also be playing a role.

With the roll out of vaccines looking likely to end lockdowns over the next few months, and enable a return to normal life before too long, we think there may be value in this sector, although long term challenges remain in the retail sector.

Schroder UK Public Private (formerly Woodford Patient Capital) is on a 33% discount having traded 10 points wider last summer. This trust has benefitted from some very good news for individual portfolio companies.

Also notable to us are the private equity trusts. There are a handful trading on a discount in the mid-20s, which we think could prove interesting. As we have discussed previously, in a rising market the discounts are often understated due to the infrequent posting of NAVs, so the real discounts could easily be in the 30s given the strong rally in the markets over Q4 of 2020. We will be conducting a thorough review of the sector in an upcoming strategy note.

Kepler’s Discounted Opportunities Portfolio

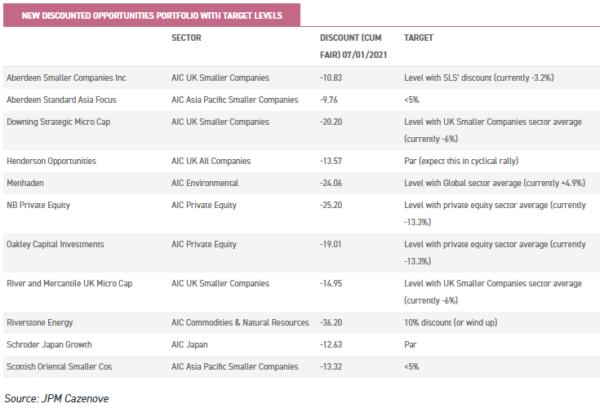

Unsurprisingly given the market context, it has been a strong period for our portfolio of discount opportunities. They have seen share price returns of 20% on average compared to a return for the FTSE All Share of 17% and the MSCI ACWI of 8% (all data from 16/10/2020 to 07/01/2021).

The best share price returns were for Henderson Opportunities Trust which made 45% and River & Mercantile UK Micro Cap which has made 31% since mid-October. Discounts have narrowed by 4% on average on our portfolio, a little more than the universe. However, some trusts have seen more substantial narrowings.

Oakley Capital Investments (OCI) has seen its discount come in by 8.6%, although this is in a period in which no new NAV has been reported. River & Mercantile UK Micro Cap’s discount has come in by 7.4%, Henderson Opportunities by 4.8% and Aberdeen Smaller Companies Income by 4%.

Our conviction that there was value in UK assets has been justified to some extent by the reaction to the Brexit agreement which has given the UK sectors an extra boost.

Another major development since our last review has been the continuing bounce in sectors and funds which were left behind by the COVID winners. Schroder Japan Growth (SJG) has more of a value-tinged approach than its growth peers in the Japan sector, and has done well in the recent period. The Asian smaller companies funds, Aberdeen Standard Asia Focus and Scottish Oriental Smaller Companies, AAS and SST have also seen decent reductions in their benchmarks as they caught up with the large-cap dominated rally in Asia.

Changes to portfolio

Despite this strong period, none of the trusts has hit our target discount (see table at the end of this note) and so we still think there is much more to come.

The one widening discount in our shortlist is Baring EMEA Opportunities (BEMO). When we last reviewed the portfolio this was called Baring Emerging Europe. Our thesis for the discount narrowing was centred around the cheapness of the Russian market (over 60% of the then benchmark) and our belief that in a cyclical upswing demand for this could rise.

The name change reflects a strategy change on behalf of the board. The board has decided to broaden the managers’ mandate and explore more stock opportunities in Africa and the Middle East.

While we applaud the decisive action, it makes our original thesis redundant. With the trust in a period of change and our original thesis no longer relevant, we are removing this from the portfolio for the time being.

This clears the way for ideas in which we have greater conviction.

The other trust we have decided to remove is Tetragon (TFG). However, this is more of a substitution than a red card. TFG is currently pursuing legal action against Ripple, a constituent holding of its portfolio.

We fear this may drag on, and think it is unrealistic to see a significant discount narrowing until the action is resolved. As a result, we prefer to look elsewhere for more immediate opportunities, but have let the trust know to stay warmed up in case it’s needed later in the game.

We are making three new additions this quarter. The first is NB Private Equity Partners (NBPE). The current reported share price discount is 24%, based on an estimate on 30 November.

Writing up the NAV of the predominantly US-based portfolio by the growth in the S&P500 since then and adjusting for the fall in the USD would imply a slightly wider discount of c. 27%. Of course, this is based on the assumption that NBPE’s portfolio valuation rose by the same as the FTSE, so it is not reliable but just an indication that the discount is quite possibly wider than it seems.

In reality, NBPE has delivered outstanding long-term NAV total returns, as we discussed in our last update note.

We also think it is noteworthy that there is high demand for investing in private markets at the moment (as witnessed by the high premiums on Augmentum Fintech, Chrysalis Investments and Schiehallion), but the more traditional private equity trusts like NBPE still trade on wide discounts.

Investing as a minority investor may be in vogue, but there are clear advantages to the traditional private equity model in giving the management team much more control over the investments. NBPE’s portfolio has also been skewed towards sectors which have displayed attractively resilient characteristics in the current crisis including technology and healthcare, which should arguably reduce the discount, all things considered.

The second new addition is a very different type of fund. Riverstone Energy (RSE) has had a torrid time in 2020 on a share price and NAV basis and its oil and gas heavy portfolio seems to be facing major headwinds.

However, the managers are shifting the portfolio increasingly towards renewables and clean energy, in line with the strategy of the parent firm Riverstone LLC.

This resulted in a major investment in 2020 in Enviva, the world’s largest supplier of wood pellets for use as a utility grade renewable biomass fuel. This investment was US$25m, which we estimate to be just shy of 7% of net assets.

There are still relatively few trusts investing in clean energy equity (rather than renewables infrastructure) and we only see demand rising. This is the first point of interest for us.

RSE had 32% of NAV in cash in September ahead of a continuation vote which was won in December. The second point of interest is that as a part of the proposals ahead of this vote the board agreed to a vote in two years’ time on wind up, which should provide some protection on the downside.

However, it has to be borne in mind the shareholder register is very concentrated. AKRC owns 31% of the shares and Quilter recently bought 20%, which means these two shareholders could decide the result of the vote by voting the same way.

Nevertheless, we think Quilter’s interest is intriguing – their holding was not reportable (so sub 3%) prior to the 5 January notification.

The third addition is Downing Strategic Micro Cap (DSM). We consider this to be a replacement for TFG, although the portfolios are very different. DSM owns a highly concentrated portfolio of micro-cap companies.

The strategy is to find companies they think are fundamentally wrongly priced, take large strategic stakes and roll up their sleeves and get involved with management to change things. It sits on a share price discount just shy of 21%.

However, the portfolio companies are so out of favour that at the time of our last note in September we estimated that accounting for their discount versus the market, the look through ‘double discount’ was over 50%, when adjusting for the cash and the one loan investment made (for details see the note).

As such, we think of it as a good alternative to TFG: a potentially very high reward stock given the double discount but with obvious risks around liquidity and single stock risk.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.