May

2024

From riches to rags to riches, is this time really different for Japan?

DIY Investor

4 May 2024

Japan’s decade-long corporate governance push is finally leading to significant improvements to underlying Japanese businesses…by Josef Licsauer

The recent momentum in the Japanese stock market is capturing the attention of global equity investors. After more than three decades of waiting for its time in the sun, it’s risen with a vengeance, with the Nikkei 225 surpassing its 1989 highs and reaching over 40,000 points in February 2024. The revival of Japan’s once-moribund stock market has led to it being a consensus pick among many global investors, having been an under-allocated region for so many years. In January of this year alone, foreign investors put more than ¥2tn into Japan’s ‘prime’ market which is comprised of its largest and most liquid stocks.

Given Japan’s chequered history though, caution remains amongst some investors who fear another false start, something Japan is famed for. While this is a fair concern, the Japanese market’s recent ascension is hard to ignore. A number of factors that have supported this rise leads us to think this time could genuinely be different: its attractive valuations compared to historic levels, significant earnings boost driven by a weaker yen, increased demand amid China’s lacklustre post-pandemic recovery, and the return of inflation, to name but a few.

However, in our opinion, one factor stands above them all: Japan’s corporate governance reforms. In this note, we evaluate the progress made thus far and consider its potential to continue supporting Japan’s performance momentum. Additionally, we explore some of the opportunities in the investment trust space that are benefiting. Before delving into these details, though, let’s first rewind to help better understand why these reforms were necessary in the first place.

Looking back at old-school Japan

Once hailed as a global beacon of economic prowess, Japan was poised to cement itself as the world’s largest economy thanks to its booming growth throughout the 1980s. A large driver behind this meteoric rise was the staggering increase in land prices, which rose by as much as 5,000% between 1950 and 1986. For context, despite Japan occupying the equivalent of 4% of the land mass of the entire US, the increase meant the Imperial Palace in Tokyo alone was worth more than all of California. Another equally astounding, albeit more whimsical, example was the cost of golf memberships. These were seen as tradable commodities, with a single membership commanding prices in the millions and those to the most exclusive country clubs fetching as much as ¥400 million in 1989, the height of the bubble, equivalent to roughly $3.7m.

Interesting anecdotes aside, though, nothing lasts forever. Japan’s dominance quickly eroded as its economic bubble burst in the early 1990s, ushering in years of sluggish growth. Consequently, Japanese equities fell heavily out of favour, becoming an easy underweight for global investors who largely disengaged with its market and subsequently were put off investing. Since the collapse, there have been periods of recovery, though these have been short-lived, resulting in the phrase ‘false start’ becoming a common term used when discussing the longevity of any positive developments in Japan.

As such, its economy has continued to be marred with low growth prospects and poor governance standards. But why did this stick despite Japan having some of the best-known companies on the planet, including Toyota, Sony, and Honda? Well, thanks to the bursting of its economic bubble and subsequent financial crisis, Japan entered a long-lasting period of stagnant growth, something it couldn’t seem to get out of. The country’s worsening public debt levels, ageing demographics, and challenged labour market were also dragging down the potential growth rate in Japan and creating a deflationary environment. To attempt to escape this spiral, corporate governance reforms were introduced, aiming to boost growth in the Japanese economy, removing old perceptions from investors’ minds, and helping it escape a deflationary trap.

Japan’s decade-long corporate governance push has made some progress in this pursuit, however, it is the more recent developments that have caught investors’ attention, contributing heavily, in our opinion, to its stock markets multi-decade high.

The corporate governance push

Japan’s governance reforms aim to enhance the governance standards of listed Japanese companies, emphasising improvements in corporate value, growth prospects, and capital efficiency, to boost growth in the Japanese economy. While some would argue these goals already align with most developed market standards, they mark a significant departure from Japan’s traditional practices. Historically, Japanese companies have preferred to hoard cash instead of reinvesting it or returning it to shareholders, but over the last few years, the reforms have catalysed a shift in this old-guard mindset, leading to consecutive records for both dividend pay-outs and share buybacks.

Another example of Japan’s historically inefficient use of capital comes is cross-shareholdings. Japanese companies often hold shares in each other’s stock, which, while historically playing a role in fostering stable business relationships, have become impediments to competition and growth, diverting focus from maximising shareholder value. This is now starting to change, though, something Aisin Corp has recently demonstrated. It produces components and systems for the automotive industry and is part of the Toyota Group, which controls roughly 40% of the company. Historically it acted in unison with the Toyota management and gave limited focus to its minority shareholders. Pressure from the reforms and the Tokyo Stock Exchange (TSE) has seen it completely selling out of its cross-shareholdings and ramping up its share buybacks and dividends.

Last year the TSE called on companies to improve capital efficiency, particularly those with a price-to-book (P/B) ratio below 1.0 and a return on equity (ROE) of 8%. It ramped up the pressure on those failing to commit or comply with these requirements, publishing a monthly list of firms that have voluntarily disclosed plans to improve their use of capital, effectively naming and shaming those who don’t. While reforms have aimed in this direction for many years, perhaps it was the explicit focus on valuation metrics and threats to delist that finally convinced many overseas investors to invest in Japan. The approach has driven improvements at the stock level, contributing to Japan’s stock market P/B ratio rising from approximately 1.2 to around 1.6.

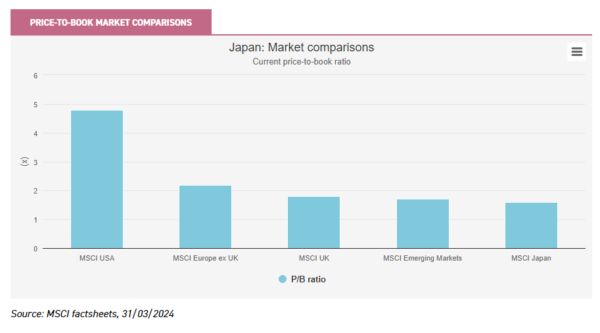

While progress is clearly underway, half of the companies listed on the prime and standard TSE market segments are yet to meet requirements, which means there is potentially still plenty of opportunity. With over 1,600 companies below P/B and ROE requirements, we believe Japan could be in the early stages of a multi-year opportunity. An increase in the percentage of companies meeting these requirements could potentially propel its stock market higher and thus, improve its P/B ratio. In fact, despite Japan reaching a 34-year stock market high, it remains cheaper than some of its developed market peers, highlighted in the chart below. It even falls below that of the MSCI Emerging Markets Index, which captures large- and mid-cap representation across the 24 emerging markets.

How to take advantage of these opportunities?

All the Japan fund managers we speak with, despite employing different investment strategies, have seen tangible improvements coming from the reforms and have subsequently capitalised on some of the rising opportunities.

AVI Japan Opportunity (AJOT) was launched in 2018, in order to take advantage of the corporate governance reform programme and its potential to unlock value in deeply discounted Japanese companies. Joe Bauernfreund, lead portfolio manager, focuses on the small-cap sector of the market and takes an activist approach, a strategy that’s helped deliver strong performance since it launched, delivering NAV total returns of 41.4% versus the total return of 17.5% for its benchmark (to 25/04/2024) . Following a trip to Tokyo this year, Joe observed that management appears to be actively listening to the strengthening regulations and guidance from the TSE and METI (Ministry of Economy, Trade, and Industry) last year. Furthermore, he notes that investors’ focus on large-caps has come at the expense of small-caps, which have been overlooked, prompting new opportunities to come forth at more attractive valuations, including BEENOS, a global e-commerce platform the trust recently invested in.

Another strategy in the small-cap space is Baillie Gifford Shin Nippon (BGS), led by Praveen Kumar. Praveen’s high growth-focused style means he tends not to invest in the cheaper stocks that are benefiting most from the reforms. However, he has still observed a decisive shift in the attitudes of corporate management teams and a change of focus towards profitability. He notes improvements are being seen across the market, and so even growth strategies like his are feeling the benefits.

In the large-cap sector, Richard Aston, lead manager of CC Japan Income & Growth (CCJI), highlights a significant uptick in corporate governance disclosures, with approximately 40% of stocks listed on the prime segment complying compared with just 20% in July 2023. He also notes a continuous surge in dividends from Japanese companies, alongside expanding share buyback plans, approaching previous record highs. While acknowledging that larger, established firms have initially benefited more from the reforms, Richard argues that these improvements are now trickling down to small and mid-cap companies, creating additional opportunities. One such mid-cap opportunity in his portfolio is Carta Holdings, a provider of internet advertising, which has reiterated its commitment to shareholders through consistent dividends and share buybacks, contributing to a rise in its P/B from around 1.0 in August 2023 to 1.9 at the time of writing.

Masaki Taketsume, lead manager of Schroder Japan (SJG), shares a similar sentiment, noting that he’s found increasing value in the small- and mid-cap space. Over the past 12 months, this has prompted him to add TPR Corporation to the portfolio given its management has begun leveraging its balance sheet more effectively, leading to improvements in shareholder remunerations. As a result, TPR’s P/B has slightly increased from around 0.3 to 0.5.

Nicholas Price, lead manager of Fidelity Japan (FJV), comes at things a little differently. He approaches the index in an agnostic fashion but has a particular affinity with small- and mid-cap growth stocks, which may not initially benefit from the reform improvements due to their typically higher P/B and ROE. However, he highlights that many of the Japanese growth companies he identifies, trade at a discount compared to their overseas counterparts and have started to demonstrate improvements spurred by the reforms. For instance, Osaka Soda, a basic chemicals company that is transforming into a niche, value-added functional materials player, has consistently reported above-consensus quarterly results, enhancing its ROE over the past year and increasing its P/B from 1.2 to 2.3.

Nicholas Weindling and Miyako Urabe, managers of JPMorgan Japanese (JFJ), have also observed encouraging developments on the ground in Japan. They note a series of announcements revealing substantial increases in dividends and share buybacks, prompting them to make some changes to the portfolio, adding companies like Secom, Japan’s largest provider of security systems. Secom recently announced its first price increase in over two decades and two buybacks, its first for nearly 15 years, signalling improved capital efficiency. The managers purchased the shares in anticipation of significantly enhanced shareholder returns. Along with their colleagues who manage JPMorgan Japan Small Cap Growth & Income (JSGI), they continue to view the corporate governance reform programme as one of the key reasons to invest in Japan.

Each trust mentioned approaches the market slightly differently: CCJI maintains a core focus, SJG opts for a slight value tilt, FJV and JFJ seek investments through a more growth-oriented lens, and AJOT and BGS specifically target the small- and mid-cap part of the market. Despite these differences, each manager acknowledges the positive impact of the corporate governance reforms in their underlying portfolios. Given their differences, though, performance has varied which in turn has impacted the discounts. FJV and JFJ’s style has acted as a bit of a headwind to performance recently, whereas BGS has felt pressure from growth and small- and mid-caps remaining out of favour with investors. As such, each trust is trading at discounts wider than their five-year averages.

CCJI and SJG, on the other hand, are displaying slightly narrower discounts, given their styles have been in favour and performance has been stronger. Similarly, AJOT continues to trade near par, reflecting the fact that its strategy is clearly perfectly suited to the current market trend.

Trust discounts over five years

| CURRENT DISCOUNT | FIVE-YEAR AVERAGE | |

| CC Japan Income & Growth Trust (CCJI) | -6.9 | -7.3 |

| Schroder Japan Trust (SJG) | -10.1 | -12.2 |

| Fidelity Japan (FJV) | -9.4 | -8.7 |

| JPMorgan Japanese (JFJ) | -7.7 | -7.2 |

| AVI Japan Opportunity Trust (AJOT) | -2.3 | 0.0 |

| Baillie Gifford Shin Nippon (BGS) | -14.2 | -3.7 |

| Morningstar Investment Trust Japan | -9.9 | -6.7 |

| Morningstar Investment Trust Japanese Smaller Companies | -9.3 | -4.8 |

Source: Morningstar

Are we too late to join the party?

Japan’s recent stock market surge is clearly impressive, but it raises some questions about its longevity. Are we arriving too late to the party? Has the bull market run its course? Is this another false start? These are all valid questions and, in our view, are important ones for investors to consider before making an investment in Japan.

Caution may be warranted in the near term, considering the speed and nature of the recent stock market rally. For example, large-cap stocks, which have ample liquidity, have continued to outperform recently, leading to increasing valuations, particularly among companies in the Nikkei 225 index. While some may interpret this as a potential sign of a looming bubble, others might speculate that Japanese market leadership will migrate towards mid- and small-sized companies.

However, despite some short-term concerns, there are numerous factors to consider that could serve as significant tailwinds moving forward. Corporate governance reforms, for instance, are likely to remain a structural driver. There have been significant improvements already, yet we are still relatively early stage, as many companies have either not yet hit the new targets or even committed to disclosing their plans. In our view, this means there could be plenty of headroom for improvements to come through.

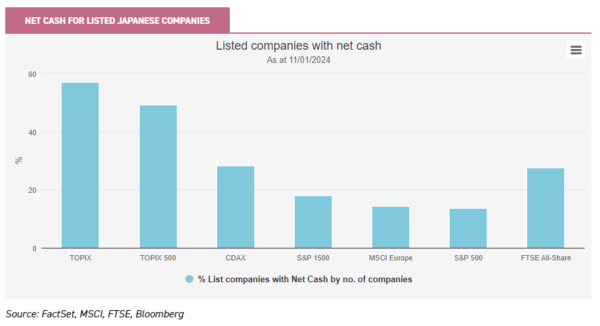

Richard Aston, from CCJI, recently pointed out that these reforms are reshaping management culture, with tangible improvements evident through a third consecutive year of record dividend pay-outs and a second consecutive year of record share buybacks. Moreover, given that Japanese companies have historically maintained high levels of cash and marketable securities on their balance sheets, there remains huge potential for income to rise even further from here, something the chart below illustrates, as the net cash of listed Japanese companies is much higher compared to other markets.

Positive inflation is also emerging as a tailwind, as it’s enabling companies to exert their pricing power for the first time in many years. This inflationary trend has also given workers ammo to negotiate wage increases during Japan’s annual wage negotiations, known as ‘shunto’. The biggest employers recently agreed to increase wages by 5.3%, the highest increase since 1991. This has helped allow the central bank to tighten monetary policy very slightly, and many commentators expect rate hikes to follow in the coming months. The very weak yen potentially creates another incentive to do this.

Lastly, Japan remains an under-research market. Nearly, 70% of the stocks in the TOPIX are only covered by two analysts or fewer, in contrast to the US market, where only around 7% of stocks receive such limited coverage. This means that for the trusts with access to on-the-ground, locally based teams, like those we’ve noted above, there could be plenty of opportunities and hidden gems to uncover.

Conclusion

The factors we’ve discussed, particularly the governance reforms, have activated a renewed appetite for Japanese shares from global investors. While there is of course a risk Japan repeats history, the multitude of factors supporting its recent ascent suggests it could sustain its impressive run, and in time, potentially reclaim its position of strength and popularity among global investors. Ongoing improvements in corporate governance serving as the cornerstone of change, coupled with its emergence from a deflationary environment, are factors increasingly shaping a Japanese market that remains exceptionally cheap. This combination is painting an encouraging economic outlook moving forward and with Japan on track to reinvigorating its role on the global investment stage, it could be a potentially exciting time to invest.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.