Jan

2022

Four funds we’ve bought, and three we’ve sold

DIY Investor

27 January 2022

Saltydog has been increasing exposure to cash in response to market volatility. Here are the latest buys and sells.

Stock markets have just had another difficult week. The FTSE 100, which had a reasonable start to the year, fell by 0.6%, while the FTSE 250 lost 2.1%. The Paris CAC 40 was down 1.0% and the Frankfurt DAX dropped by 1.8%.

In the US, the situation was even worse. The S&P 500 fell by 5.7% and the Nasdaq went down by 7.6% – it is now 12% lower than it was at the beginning of the year. The Chinese and Japanese stock markets are also reporting year-to-date losses.

As active investors, we believe in reacting to market conditions and we have been reducing our overall exposure to the markets for some time. In the Ocean Liner portfolio, our cash level went from 9% at the end of September to 37% at the end of December. It is now more than 60%. Our Tugboat portfolio is slightly more cautious. Cash accounted for 20% of the portfolio at the end of September and by year-end it had risen to just over 40%. Since then, it has also gone above 60%.

In the last few weeks, we have sold, or significantly reduced, a number of our long-term holdings including the Janus Henderson Global Responsible Managed fund. This is one of the funds, from the Mixed Investment 40-85% Shares sector, that we bought in February 2019 and held until the beginning of March 2020. We then reinvested in April 2020 and have held it ever since.

We have also sold the two funds from the Technology and Technology Innovations sector that have been in the portfolios since last June: L&G Global Technology Index and AXA Framlington Global Technology.

Although most of the Investment Association (IA) sectors have been struggling this year, when we did our analysis last week there were some funds that appeared to be bucking the trend.

Last week, the Office for National Statistics (ONS) released its latest inflation data, which showed that the UK Consumer Price Index was up 5.4% in the 12 months to December 2021, its highest level in almost 30 years. In the US, the comparable figure was 7%. Much of this is being blamed on increasing fuel costs and commodity prices. This is being reflected in the performance of some of the funds in the Natural Resources sector.

Last week, we invested in the JPM Natural Resources and TB Guinness Global Energy funds. They were at the top of our table of funds from the Specialist and Thematic sectors. The two India funds were also looking promising.

| Fund | Subzone (if applicable) |

4 Week | 12 Week | 26 Week | ||||

| Decile | Return | Decile | Return | Decile | Return | |||

| JPM Natural Resources | Nat Res | Nat Res | 1 | 8.3% | 1 | 8.1% | 1 | 15.3% |

| TB Guinness Global Energy | Nat Res | Nat Res | 1 | 11.1% | 1 | 6.9% | 1 | 30.2% |

| BlackRock Natural Resources | Nat Res | Nat Res | 1 | 6.8% | 1 | 8.8% | 1 | 18.9% |

| Jupiter India | India | India | 1 | 6.4% | 1 | 5.3% | 1 | 15.0% |

| Liontrust India | India | India | 1 | 7.0% | 4 | 2.4% | 2 | 14.2% |

Data source: Morningstar. Past performance is not a guide to future performance.

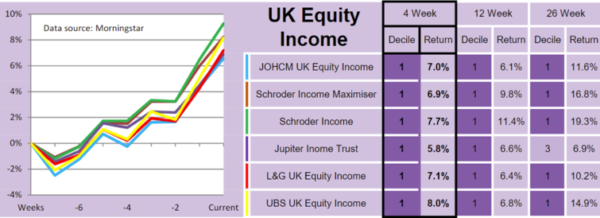

The only other sector that caught our eye last week was UK Equity Income. At the time, the sector was up 3.6% over four weeks, 4.6% over 12 weeks and 7.1% over 26 weeks. Some of the leading funds had done considerably better.

We also made a small investment into the JOHCM UK Equity Income and Schroder Income funds. If they get off to a reasonable start, we will consider adding to our holdings.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Brokers Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.