Feb

2020

For Innovation, Look East

DIY Investor

21 February 2020

EPAM Systems, Inc. – a Belarusian company listed on the New York Stock Exchange (NYSE) – is a good example both of the country-agnostic principles by which the JPMorgan Emerging Markets Investment Trust is run, and of the freedom the team enjoys to invest beyond the normal boundaries of the MSCI EM Index – By Austin Forey

Fundamentally, what we’re trying to do with our investments in emerging markets is deliver strong returns for the level of risk we’re taking. While we consider regional and local trends, as well as attractive consumer related themes, the focus for us is on companies.

The rise of IT outsourcing

IT outsourcing has been a growth area in emerging markets since before the turn of the millennium. Outsourcing first became popular as an idea in the 1980s, becoming a recognised business strategy in the early 90s. With advancements in communications, IT became an obvious candidate for outsourcing to developing countries, since unlike with manufacturing, no transportation costs are involved.

India became the first global hub for IT outsourcing, thanks to the presence of cheap, relatively well-educated labour and a rapidly liberalising economy with strong links to the Western world. More recently, several ex-Soviet states (most notably the Ukraine but also Belarus) have risen to prominence, a legacy of government education policy during the Soviet era which focused heavily on scientific study and research, including computing.

An enterprise software development, design and consultancy firm, EPAM was co-founded by two Belarus natives and for most of its life has based the majority of its engineers there. This has allowed the company to benefit from the availability of a strong pool of skilled software engineers while keeping labour costs low.

At the same time, being headquartered in the US (and listed on the NYSE since 2012) has improved company visibility, making it easier for the company to access international investment and capture a global client-base. The firm has grown to employ 30,000 people, including development teams in North America, Europe, Asia and Australia.

Looking for opportunities beyond the benchmark

The trust first invested in EPAM in 2014, selecting it as a company with strong fundamentals in a rapidly growing sector. As a US listed company with a global footprint which bases a large part of its workforce in an emerging market, it’s a good example of our freedom to look beyond the benchmark and the confines of the major emerging markets.

While long-term thematics and business fundamentals are of key importance, the company’s geographic location adds a strong element of diversification to the portfolio. This is particularly welcome given the impact of a continuing strong dollar on other emerging markets companies.

EPAM is just one example; the trust’s 76% active share (a measure of the difference in the company’s portfolio compared to the benchmark index) is testament to our freedom to invest not in a list of countries defined as emerging markets, but in a carefully chosen selection of high-quality, diverse companies from across the globe.

Austin Forey is lead portfolio manager for the JPMorgan Emerging Markets Investment Trust.

Important Information

JPMorgan Emerging Markets Investment Trust plc

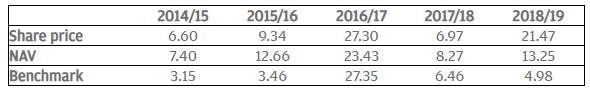

Quarterly rolling 12 months – as at end of June 2019 (%)

Key risks

Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations. Where permitted, a Company may invest in other investment funds that utilise gearing (borrowing) which will exaggerate market movements both up and down. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The Company may invest in China A-Shares through the Shanghai-Hong Kong Stock Connect program which is subject to regulatory change, quota limitations and also operational constraints which may result in increased counterparty risk.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Investor Disclosure Document, Key Features and Terms and Conditions and Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. Material ID: 0903c02a826faf0d

Leave a Reply

You must be logged in to post a comment.