Aug

2022

Focusing on what matters in Europe

DIY Investor

9 August 2022

Sam Morse and Marcel Stötzel, portfolio managers of the Fidelity European Fund and Fidelity European Trust PLC, share their outlook for regional equity markets.

Despite the uncertain macro backdrop, they outline why a focus on attractively valued dividend growers with strong balance sheets should continue to deliver strong relative returns over the long-term.

Key points

· In a falling market, our portfolios have outperformed their respective benchmarks over recent months driven by our focus on high quality businesses which tend to do relatively well in weaker macro environments.

· We believe it is likely that equity markets will continue to struggle until higher interest rates appear to be working and bring inflation under control.

· We expect stock market leadership to continue to rotate, but remain confident that focusing on attractively valued companies with strong balance sheets and consistent dividend growth will deliver long-term outperformance

Continental European equities have been hit by worries over surging inflation, hawkish central banks and the war in Ukraine over the first half of 2022. Our portfolios have delivered absolute negative returns in this period, but have outperformed their respective benchmarks. This has been driven by our focus on high quality businesses which tend to do relatively well in weaker macroeconomic environments and provide an element of downside protection in falling markets.

At a high level, a number of factors are contributing to fragile investor sentiment, including elevated levels of inflation, heightened geopolitical risks and subsequent disruptions to trade, which has led to shortages of materials. This has led the market to conclude that Europe will likely fall into recession this year. Although consumer spending has been holding up, confidence is falling, and inflationary pressures continue to rise. Most investors now seem to expect a fall in private consumption in the autumn after pandemic savings are exhausted.

We believe it is likely that equity markets will continue to struggle until higher interest rates appear to be working and bring inflation under control. The market has, of course, already discounted much of this bad news. We expect the stock market to start to recover (often inexplicably) some months before earnings bottom out, or a recession ends. When it does, it will likely be led by cyclical companies with

weaker balance sheets. While our portfolios may well lag in such a recovery, we remain confident that focusing on attractively valued companies with strong balance sheets and consistent dividend growth will deliver outperformance in the long-term.

Recent portfolio moves

We have kept trading activity low over the second quarter of 2022. Some names have been reduced, including Swedish Match following Philip Morris’ takeover announcement, as well as Deutsche Boerse, which was trimmed following a period of strong relative performance. We also moved to sell out of our remaining position in a Spanish car insurance business given the lack of dividend growth and concerns about the outlook for pricing competition.

The proceeds were redistributed across the portfolio into names that have performed less well recently, including Partners Group. The position in TotalEnergies was also increased following continuing strength in oil and LNG prices, which does not yet appear to be fully reflected in its the share price.

In keeping with our longstanding investment process, the strategy will remain balanced in terms of sector exposure and position sizes, and we will continue to focus on cash generative companies with strong balance sheets that have the potential to grow their dividends consistently over the next three to five years.

The strategy may sometimes face stylistic headwinds in the short-term and the focus on steady growers, sometimes tagged as bond proxies, can mean the strategy faces a headwind to performance when inflation expectations or bond yields rise. Over the long-term, however, these factors even out and relative performance is primarily a function of stock-picking.

Maintaining our focus

Given the uncertain outlook, we expect stock market leadership to continue to rotate, but we intend to stick to our core investment philosophy. With this in mind, we continue to defer to the legendary fund manager Peter Lynch, who opined: “Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested.”

As such, we will remain focused on the companies in which we have invested and, in particular, on their ability to continue to grow their dividends. As always, we will ask ourselves if that rate of dividend growth is already discounted in the share price.

We continue to seek new opportunities to add to the portfolio at the right price and remain confident in those names we currently hold. This approach has historically served the portfolios well – including through the recent volatility of the last few months – and we see no reason to change course.

More information about Fidelity European Trust here >

Important information

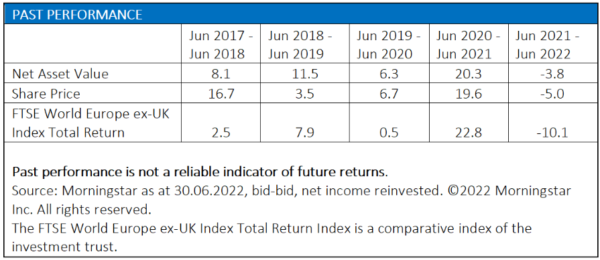

The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Past performance is not a reliable indicator of future returns.. Investors should note that the views expressed may no longer be current and may have already been acted upon. Overseas investments are subject to currency fluctuations. Fidelity European Trust PLC can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The

investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0722/371162/ISCSO00083/NA

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.