Oct

2024

Investing Basics: Focus on Funds – a guide to style

DIY Investor

12 October 2024

Managers and funds are being increasingly categorised by their underlying investment approaches and the arrival of smart beta strategies will only serve to accelerate the process – writes Christian Leeming

The Morningstar style box was very formative early in my career as I am sure it has been to many fund analysts. After all there is little point in comparing a large cap value fund with a small cap growth fund.

‘there is little point in comparing a large cap value fund with a small cap growth fund’

Of course, over time the limitations of this became apparent. Can managers be pigeon holed so neatly? Is it really impossible to find growth stocks trading on below average valuations? How can low beta equities produce market or even excess returns? These are questions that I am sure that many of you will have grappled with.

Over time I have refined the way that I look at funds and I tend now to only loosely classify them into one or more styles.

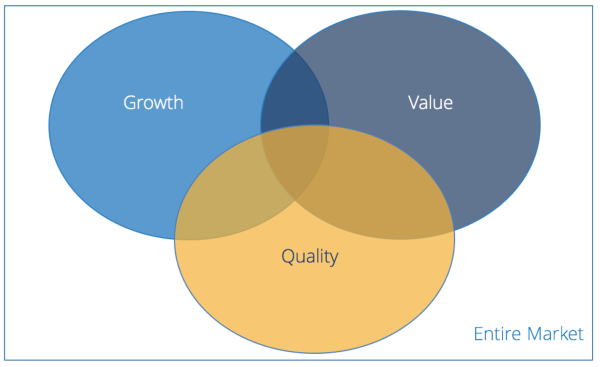

These are: value, quality, growth/momentum and size. As none of these are mutually exclusive and the relationship can be best illustrated using the schools boy’s favourite chart, the Venn diagram.

For the sake of clarity, small/large caps have been omitted.

Source: Square Mile

How can these style terms be defined? Frankly, they are nebulous concepts so let us consider them individually.

Value sounds straight forward term and suggests that something that is cheaply priced. This sounds reasonable until we turn the definition on its head; how many long only managers deliberately target over priced stocks?

I favour reserving the term ‘value’ for managers shifting through the dregs of the market, perhaps even deliberately screening for stocks trading on new lows.

Formal screens on metrics such as low price to book, earnings, cash flow, EBITDA, sales ratios etc may be used.

Some practitioners may be strict disciples of the Ben Graham approach and will only consider stocks trading well below the market average.

Others might consider individual stock valuations relative to where they have traded in the past, perhaps employing a CAPE style analysis.

‘value stocks trade on below average metrics for a reason’

Value often involves a certain contrarian nature; value stocks trade on below average metrics for a reason, whether it be problems with the business model, a string of profits warnings or the fact that the CEO is covered in warts.

Markets are driven by sentiment and negative momentum will often drive stock prices below ‘fair’ value.

It can be a lonely job buying stocks that the rest of the market hates but there is ample empirical evidence that prices often eventually revert towards the mean.

There are of course exceptions to this which are politely labelled ‘value traps’ where the businesses outlook matches that of the dodo.

Identifying such situations is an important skill for value managers.

Quality stocks are often seen as being a little dull. These are steady Eddies that compound returns over many years.

Many of these businesses will have franchises that protect them from harsh competition, or as Warren Buffett terms it ‘wide moats’.

Cash generation tends to be strong as are balance sheets, the latter often being a result of the former.

‘steady Eddies that compound returns over many years’

The businesses’ main assets are typically intangible and the value of which are rarely fully reflected in the balance sheets.

As a result, these are seen as not capital intensive businesses although the companies may need to make significant expenditure each year to retain its competitive advantage.

While the precise quality attributes of a company are best determined on a qualitative basis, there are certain quantitative numbers which might help identify such businesses.

These may include low share price volatility, low beta or more fundamental factors such as high ROCE, earnings stability and balance sheet strength.

Growth is a simple style to define but it is a very difficult quality to identify. Growth, usually defined as companies growing faster than GDP.

It may reflect the stage of the firm’s life cycle (no business can grow ahead of GDP rates indefinitely). Identifying such stocks can allow a fund to benefit from the earnings growth and a potentially powerful boost provided by a stock rerating.

There are few quantitative numbers to help identify growth stocks.

One year forward EPS growth rates can be an indicator of growth companies but sell side analysts aggregate 5 year EPS forecasts surprisingly are of little help.

This is not to say that growth companies can’t be identified as the long term success of managers such as Nigel Thomas and Alexander Darwell attests.

Leave a Reply

You must be logged in to post a comment.