Jul

2023

Five of the best: UK sector leaders for tough times

DIY Investor

23 July 2023

It is hard to find a developed country where the pressures facing business are collectively more acute than they are in the UK. We single out five companies which we think are better placed to cope than most. By Bill Casey and Nick Kissack.

Businesses in the UK, and globally, have had to deal with many headwinds and forces of change in the past few years. After nearly a decade and a half of “ZIRP” (zero interest rate policy), and now in the face of rapidly rising financing costs, many companies are having to reassess their business strategies amid a major shift in the economic regime.

You’ll quite often hear companies complain of the rising cost of doing business – and they’re not wrong. Interest rates are much higher, and hence so is the cost of capital. In addition, labour shortages are commonplace, as is high staff turnover.

Meanwhile, companies are also facing rising costs of materials and goods, coupled with limited supplies. To add to all of the above, tax rates are much higher than they were just a few years ago.

As a result of these changes, the barriers to compete and operate in many industries continue to rise. And we haven’t even mentioned generative artificial intelligence (AI), ever-more complex regulations and the need to invest in sustainability.

More competitive landscape – potentially good for industry leaders

The barriers to entry in many industries are rising rapidly, and are higher than at any time that we can remember in our 20-plus years of investing. In fact, it is harder to find a developed country where these pressures are collectively more acute than they are in the UK.

From our perspective as long-term investors we don’t necessarily see tough corporate times as a bad thing. We spend our days identifying and meeting management teams of the well-funded industry leaders with the scale and profitability to overcome such challenges.

The advantages of such companies are now becoming more apparent as the rising cost of doing business, and cost capital in particular, drive industry shake-outs and lessen “competitive intensity”. In many industries, competitive intensity is falling from high levels after ZIRP had favoured the challenger, or maverick business models for so long.

In this vein, we highlight leading companies from five completely different industries, spanning travel & leisure, retail, housebuilding, construction and real estate.

For each of these industries we’ve identified the leaders within them that we think are benefitting from the current environment. The highlighted companies typically have a particularly strong culture and the advantage of management teams with longer term vision and patience.

1. Travel & leisure

The hotel group: Whitbread Plc

The hotel industry in the UK has been through a particularly difficult time in recent years for obvious reasons. There are a number of large hotel groups, but much less so outside of London and the major cities. Premier Inn, Whitbread’s core asset, competes with larger groups such as Travelodge outside the large city market, but the majority of the market is occupied by independent hotel chains/individual owners.

Whitbread, we believe, is experiencing a reduction in competitive intensity as some of the independent hotel groups shrink for lack of funding. On the other side of the equation, new hotel openings are very limited. In the past two years, data we have seen from UBS Evidence Lab suggests the competitive intensity has fallen for Premier Inns if we measure it in terms of number of competitors within a 10-minute drive.

This is allowing Premier Inn more scope to grow and invest. In fact, not only is Whitbread investing heavily in its hotels in both the UK and Germany, but it can also afford a generous share buyback and dividend to boot. The result is a YouGov brand index score that is unrivalled in the industry.

2. Retail

The clothing and household goods retailer: Next Plc

Next operates in a highly competitive space where barriers to entry have historically been low (plenty of retail space available and many Eastern-based clothing manufacturers). The shift to online shopping has decimated the High Street and many retailers and brand owners have failed to make the leap online in a profitable way.

Next has done this very successfully, helped by the fact that the old Next Direct business was in fact an e-commerce business from the outset, with the logistics infrastructure and knowhow to operate in a post High Street world.

Astute brand management and investment from CEO Lord Simon Wolfson over the past 20-plus years has allowed Next to not only take more market share, but a much higher share of the value chain of the competition. There is Next the brand, and then there is Next the total platform which offers infrastructure, systems and technology to other consumer brands that do not have the resources or scale to operate in a world of digital shopping.

The recent cost of living squeeze, the rapidly rising cost of funding, the abundance of global supply chain issues, and the sharp increase in supply chain standards (e.g. Leicester sweat-shop allegations) are making the barriers to compete ever higher to climb. It is no surprise to us that the market share of the Next brand continues to grind upwards versus its key competitors. It is also no surprise to us that Next recently increased its profit guidance for 2023.

3. Housebuilding

The London-focused housebuilder: Berkeley Group Holdings

When it comes to the UK housebuilding industry there are almost two separate markets, one inside the M25 encompassing London and one outside it. The mix of buyers, the labour pool, and regulations (land scarcity, mostly brownfield sites) are quite different.

The business of planning, developing, and selling in London is in many ways more complex than anywhere else in the country. For this reason, we see a limited presence in the London market from the large listed builders, who tend to focus their sights (sites!) on the regions.

Berkeley is the largest builder operating in London with an historic share of about 12%, competing mainly against a long tail of private builders. Following the fallout of the Grenfell Tower tragedy, the rise in politics around building standards has led to the unintended consequence of a sharp contraction in the number of new apartments being built/planned in the city. Housing starts are a fraction of government targets in the capital.

Berkeley has a fantastic track record of buying and developing land at the right times in the cycle, and has the enviable position of sitting on 12-plus years of a land bank with unrivalled expertise in the complex brownfield planning process. Recently, the group’s share of starts has shot up because of others retrenching. Peer housebuilders in London tend to operate with much shorter land banks, and with funding so tight, supply is likely to be severely constrained in the coming years.

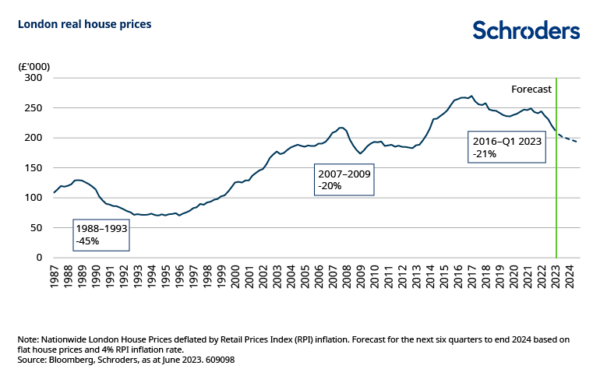

The return of the international buyer (about 50% of Berkeley’s unit sales) following the pandemic is also a support for demand in a world of high mortgage rates.With a backdrop of tighter supply, it is interesting to note that when adjusted for inflation, the “real” price of a house in London has fallen 21% since 2016, already worse than what occurred in the financial crisis in 2008/09. Assuming flat house prices until the end of 2024, and a 4% inflation rate, real house prices will have corrected by a whopping 28%.

The point being that the starting point for London house prices is not necessarily indicative of a hot market.

4. Construction

The aggregates and asphalt manufacturer: Breedon Group Plc

Breedon is one of four national players in the aggregates (quarries) and cement industry. The quarry industry has a long tail of small and mid-sized regional players but because of the heavy and low value nature of the products (aggregates, asphalt in particular), the product does not travel far from source. These dynamics afford the four national players a high local market share.

Being a highly consolidated industry it is a good one in terms of margins and returns in the UK. It is also important to note that new quarries don’t tend to get sanctioned anymore, and are in finite supply. Supply of aggregates (crushed rock/sand and gravel) in the UK market is actually pretty flat over the past 50 years. Meanwhile, the cement import market is also controlled by the same large four national players (which include the UK arms of global peers CRH and Holcim).

A number of disruptions and changes have hit the industry in recent years including the sky high cost of energy, the rising cost of carbon credits, and the need to invest heavily in decarbonisation. The latter in fact is becoming a pre-requisite to winning large national and regional contracts for road paving, in a market that has previously been dominated by price.

Market forces are pushing the industry to concentrate on the strong scale players; for example those with the cost and scale required to hedge energy cost volatility or with the balance sheet to invest in renewable technologies and fuels. Breedon is a clear winner in this space (also in terms of leading the decarbonisation drive) and will continue to take share over time. The UK has a high need for road repair, and the levelling-up agenda and investment in infrastructure will enable continued growth for the sector.

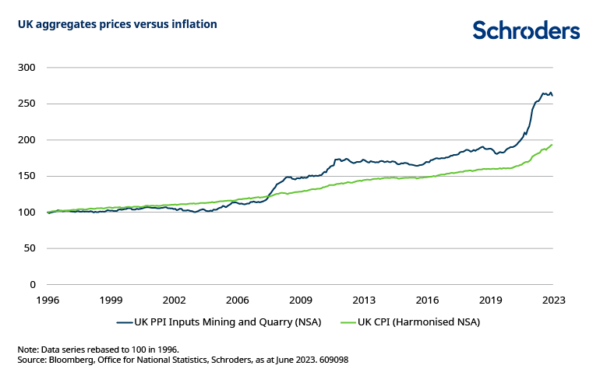

When we invest we look for pricing power as a important ingredient in judging the quality of a company. Breeden enjoys pricing power in an industry where prices have outstripped broader inflationary trends (see chart, below).

5. Real estate

The student accommodation specialist: The Unite Group Plc

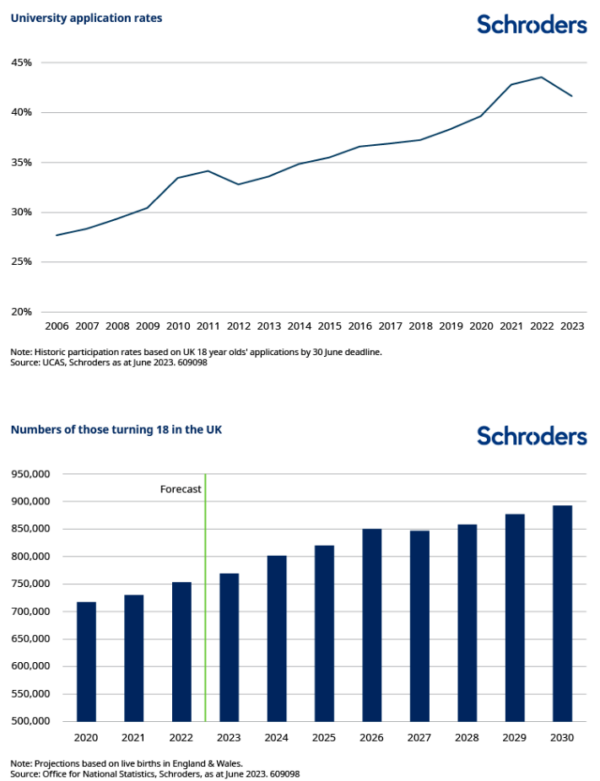

Unite is the longest serving and leading purpose built student accommodation, or PBSA provider in the UK. It is one of very few fully integrated (developer, owner, operator) players in the space, and its scale and integrated model make it the most profitable. Student accommodation is a specialist industry when it comes to real estate, and a highly focused and customer centric approach is required to make good returns. Barriers to entry in the overall provision of accommodation to students are rising rapidly at a time when demand is also rising fast.

Competitors to Unite and the other PBSA real estate investment trusts (Reits), but also the university owned digs as well as the HMO (houses in multiple occupation) market operated by private landlords.

A mixture of both local and national regulations is making it harder to be a private landlord, notwithstanding the higher tax burden and energy efficiency standards. University budgets are not lined with gold either, and development is being pushed more to providers such as Unite via nomination agreements (long term offtake contracts between the PBSAs and university groups). Unite has the relationships and the balance sheet to continue taking a higher share in this growing market.

The ever rising cost of capital and the shock of the pandemic is also putting paid to new investment in the sector, with pipelines rather thin versus history (Unite being an exception here). Unite has taken its opportunities well, having invested heavily in the London land market post Brexit when other investors were pulling back.

It is very well placed to grow over the next decade where demographics are particularly favourable, as the population of those turning 18 jumps by over 20% by 2030 (see charts, below).

Please note any past performance mentioned is not a guide to future performance and may not be repeated. The sectors, securities, regions and countries shown are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority

Brokers Commentary » Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Latest

Leave a Reply

You must be logged in to post a comment.