Jan

2023

‘Finfluencers’ urge caution as increasingly risky behaviour leaves young investors vulnerable.

DIY Investor

1 January 2023

The pandemic accelerated the already strong momentum towards financial self-reliance; it has also exacerbated inequality between the haves and the have-nots – writes Tabitha James.

Those that remained full-salaried and working from home saw their disposable income receive an unexpected boon; levels of savings reached a record level of 25.9% during the first lockdown and the ONS estimates that household savings have grown by a total of £190bn over the last two years.

By contrast young people with insecure contracts of employment and often in the most vulnerable sectors of the economy have been disproportionally negatively affected.

However, whether motivated by a determination not to be caught out again, or a desire to be in control should there be a recurrence, the reaction from each group has been very similar; DIY brokers and investment platforms reported accounts being opened in record numbers, particularly by younger investors.

Anecdotally, brokers report pretty sensible ‘get rich slow’ strategies being employed as young investors take maximum advantage of being in the market for a long period of time.

However, an increase of financial education and advice content on social media apps has also hooked young investors on finance, with recent surveys showing young investors are pursuing riskier strategies than older generations.

The rise of financial influencers – inevitably ‘finfluencers’ – and a huge surge in financial content on platforms like TikTok, Instagram, Reddit and Twitter over the past 18 months has hooked a new generation on finance and investing; recent research shows that young investors are following riskier, short-term strategies to make profits and now money experts are advising caution to prevent young investors from making mistakes that can end up costing them dear.

Social media is littered with get rich quick schemes and promises of ways to beat the system and many young investors have been lured into spending their spare cash on cryptocurrencies and stocks that are ‘going to the moon’.

Videos tagged #finance, #investing or #stocktok on TikTok have been viewed a total of 7.5 billion times; consumers are being told they can easily turn £10 into £10,000 or kickstart a ‘doge revolution’ – described as a middle finger to the establishment.

Myron Jobson, of Interactive Investor, told Markets Insider: ‘The FOMO culture that dominates social platforms like TikTok, Reddit and Instagram has become a breeding ground for the marketing of high-risk investments shunned by the mainstream investment industry – often for good reason.’

Recent research from Barclays research showed 21% of Gen Z investors are investing to take advantage of current market conditions and 16% are trying to ‘play the markets’.

An Interactive Investor survey published this month showed that more than half of young investors who have purchased bitcoin or dogecoin have done so using debt from credit cards, student loans and other types of loans.

A Motley Fool study showed that amongst GenZ in particular, social media plays a key role in how they make their financial decisions.

The challenge to the untrained eye is to differentiate between solid, educational content designed to improve financial literacy and promote long-term investing and the snake oil salesmen – particularly as the message they deliver is exactly what an eager young investor may wish to hear.

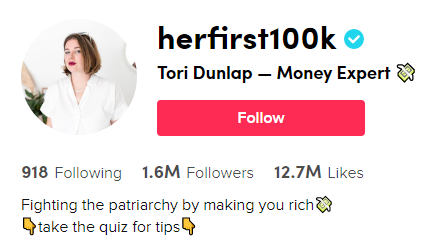

Tori Dunlap, is a finfluencer who shares content on TikTok as ‘Her First £100k’; a self-proclaimed money expert she started her first business at age nine and accumulated $100,000 worth of savings by age 25’. With 1.2m followers, Tori is on track to make $1m this year as she seeks to fight financial inequality and plots her course to financial independence.

In a recent interview with Markets Insider she said even before TikTok, bad financial advice was everywhere – it was just delivered through a different medium. Her main issue with the app is the 60-second time limit on videos. Although the limit was recently removed, longer videos remain rare.

‘I have a lot of parameters because I only have a minute and so I am using TikTok hopefully for folks as a jumping off point of like ‘I’m giving you this bit of education, now go read about it,’’

Tori highlights the problem that having received good advice once, there may be a temptation to stop questioning content in the future: ‘You have to go ‘does this seem too good to be true?’ and if it seems too good to be true, it probably is. Or, just Google the person.’ she said.

There is little doubt that some content is helpful, and if it speaks to a new generation of investors in a way that engages and inspires them, that is something to be applauded; however, consumers should approach online investment advice with caution and check the credibility of those who are giving it.

‘There are some good materials out there to help people on their investment journey, but, more generally, we have seen concerning social media posts.’ Said Mr Jobson. ‘The advent of broader online ‘influencers’ has seen rise of so-called ‘financial influencers’ – many of whom haven’t got a clue on what they are talking about to put it bluntly.’

Leave a Reply

You must be logged in to post a comment.