May

2022

Finding value in a haystack

DIY Investor

17 May 2022

Non-income value strategies are becoming increasingly scarce, but the holdouts represent attractive newr-term opportunities…..

Non-income value strategies are becoming increasingly scarce, but the holdouts represent attractive newr-term opportunities…..

ake a moment to mourn the value manager, for they are becoming an ever-rarer breed. Up until recent months true value investing seemed like a Sisyphean task as growth stocks traded at ever increasing premiums, with their advocates reaping the rewards. As value has outperformed growth in recent months, buoyed by rising interest rates and inflationary pressures, we have frequently heard investors ask what options they have for value exposure.

Sadly, in the investment trust space the options have decreased, with widening discounts and poor performance seeing a number of boards shift horses. In this article we highlight where, outside of the dedicated income sectors, value strategies are still available and where they aren’t. In our view, these gaps could be an opportunity for boards and managers in the coming years.

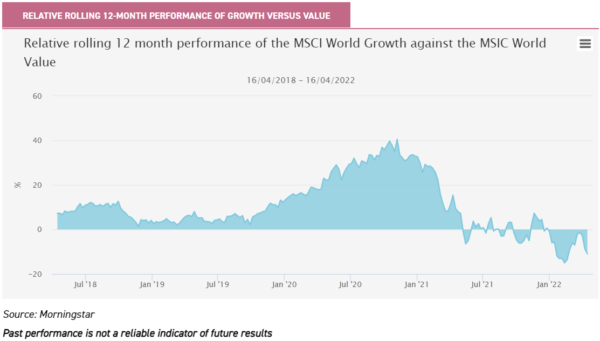

Given the long-term dominance of growth investing and corresponding underperformance of value, it is no wonder that the latter has been shunned in favour of the former. However, the performance of value has frequently been quite good in the short term since the emergence of vaccines. This is demonstrated by the below graph, which shows the relative rolling 12-month performance of global growth stocks versus global value. Yet boards and managers have not yet reacted, with more trusts shifting from a value to a growth approach over the period.

Given that value has come back into vogue thanks to rising global inflation and interest rates, what options are left for listed equity investors? While value managers are a dying breed, there are a number of stalwarts available.

The UK sectors are still well served by value options. In particular we note that in the UK small-cap sector, nearly a quarter of the strategies have a clear value bias.

One example is Aberforth Smaller Companies (ASL), managed by a seven-strong team at Aberforth Partners. The team aim to buy fundamentally sound, cash-generative companies when they are out of favour, and hold onto them until sentiment improves and valuations revert. ASL’s team have been successful in executing their approach, and it is one of a handful of UK equity strategies (excluding income strategies) which have been able to generate positive NAV returns over the last year.

Investors do have options in the North American sector too, however, through trusts with an income remit. While these do offer exposure to the value sector, their yield targets may constrain their ability to pursue capital growth.

Of all the trusts available to investors, a sustainable US equity strategy would seem the most at odds with a value mandate, given the inherent growth biases those factors carry with them, although BlackRock Sustainable American Income (BRSA) is bucking that trend. BRSA adopted an explicit sustainability mandate earlier in the year, through retaining its focus on high-quality value stocks. BRSA’s managers believe that the incorporation of explicit ESG targets will act as a tailwind for the trust, given ESG’s ability to improve return profiles.

Regardless of the recent shift to sustainability, the BRSA team have long believed that the valuation gap between US growth and value has been becoming increasingly unsustainable. BRSA has begun to benefit from this trend reversing as the market is increasingly scrutinising highly valued companies in the light of rising US interest rates. It should come as no surprise that BRSA has posted strong performance figures over the last 12 months, returning 16.0% in NAV terms and 4.8% over 2022 alone (as of 24/04/2022).

BRSA has only been beaten by another of its value peers, albeit one with a different regional focus: Middlefield Canadian Income (MCT). The Canadian market has a strong value bias, with around 60% of the index in financials, energy and materials. MCT offers investors a concentrated exposure to these sectors and also to the REIT sector, where it has its largest overweight.

Given the wider tailwinds behind value stocks, it is no surprise that MCT has posted an impressive performance over the last 12 months, returning 35.3% – by far the highest of any North American trust. In fact, MCT ranks as one of the best-performing regional trusts over 2022, only lagging behind Latin America trusts and a Gulf states trust.

One thing that BRSA and MCT share is their attractive yield profile, with both currently offering a c. 4% yield, while both are also on wide discounts. In the case of BRSA, its 4.6% discount represents a widening from its pre-pandemic levels despite the tailwinds behind value investing, making it an arguably attractive entry point. MCT has fared slightly better, having seen its discount narrow; however, at 9.6% its discount is still attractively wide, and wider than that of its average peer despite its sector-leading performance (as of 24/04/2022).

We think MCT is well placed to benefit from the structural tailwinds supporting Canada’s economy, such as the country’s shift towards independence from its reliance on US energy. Canada also benefits from the strong fundamentals of many of its largest companies, particularly as its banking sector has been far more resilient than those of the US and UK in past crises. We will be publishing a full note on the trust in the coming weeks.

The Japanese equity sector has good options for value, and in its small-cap peer group we would highlight AVI Japan Opportunity (AJOT). AJOT, managed by Joe Bauernfreund and the AVI team, follows a highly activist approach to Japanese equity investing, taking substantial positions in Japanese small-cap companies with the intention of proactively resolving the governance issues that are common across many Japanese companies, thus increasing shareholder returns as a result.

The core of the strategy involves looking for deeply undervalued Japanese small caps, with the activist opportunity considered a bonus. This means that AJOT’s investors gain the benefits of both the recent value tailwinds and the idiosyncratic returns generated by successful engagement campaigns.

Another option could beSchroder Japan Growth (SJG). While its manager, Masaki Taketsume, does not consider SJG to be a ‘value’ strategy, his disciplined valuation focus and love of undiscovered growth opportunities have led SJG to have a greater bias to value than the peer group. This is reflected in Morningstar data, with SJG having averaged a growth–value score of 99 over the last five years compared to the 219 average of its peer group, indicating a value-biased portfolio because any score below 100 would be considered ‘value’ by Morningstar.

Masaki has recently applied his valuation discipline to consumer-sensitive stocks so as to capitalise on Japan’s delayed recovery from COVID-19, something which in conjunction with SJG’s lower valuations and wide discount (which is currently at 10.2%) may make it an attractive option in today’s inflationary environment (as of 24/04/2022).

In the global sector, the best option is likely to be AJOT’s sister trust AVI Global (AGT). AGT aims to capitalise on inherently discounted investment structures, be they family-backed holding companies, closed-ended funds or Japanese asset-backed special situations (which closely aligns with the opportunities exploited by AJOT).

This means that AJOT offers value investors the ability to access a wider range of investments than the more conventional value strategies can. Interestingly, this means the underlying exposure often involves companies in typical growth sectors, but which are accessed at a discount.

One example of these is LVMH, the highly valued luxury goods maker, which is AJOT’s largest underlying position. See our recent note on the trust for more details. However, there are no other realistic options for value investors in the sector. EP Global Opportunities (EPG) takes a value approach, but has a market cap of just £85m after an oversubscribed tender offer, so will likely fall below the radar of professional investors.

Furthermore, its new objective allows it to invest in other asset classes and funds as well as equities, which means it will likely not fit the bill for those looking for a global value strategy. Given how important the global sector is, we think investors could do with some more value options.

One of the glaring omissions in the investment trust space is the lack of any European value manager. The European sector now has no dedicated value manager in either its large- or small-cap sector. This comes despite the war in Ukraine having throttled energy supplies, with rising inflation having put a potential ECB rate rise back on the table, and also after negative real interest rates have existed for most of the last decade – all factors which are clear tailwinds for European value investing.

We would highlight that Henderson European Focus Trust (HEFT) has kept a stalwart ‘core’ allocation for many years, with its managers John Bennett and Tom O’Hara having long been aware of the opportunities in European value. However, their awareness of past growth tailwinds has prevented them from taking a significant value tilt, lest they jeopardise their shareholder returns.

The emerging market sectors tend not to have dedicated value strategies. We think this is because various other factors dominate how managers approach the opportunity set: country, currency and GDP growth, for example.

Of the key value sectors, banks are often used to access GDP growth, so they will sit in the portfolios of very growth-focussed managers. Energy and materials meanwhile often bring with them country-specific political and governance risks which can dominate returns.

Yet for investors looking to benefit from the broader global tailwinds supporting value equities within emerging markets, we would point to Barings Emerging EMEA Opportunities (BEMO) and BlackRock Latin American (BRLA).

While they do not have a value bias in stock selection and the managers in both cases consider themselves quality-growth managers, their regional focuses ensure their exposure to many of the sectors that capitalise on the value stock tailwinds. In the case of BEMO, Matthias Siller and the team are heavily invested in energy and materials, with the broader economies of Saudi Arabia and South Africa sensitive to the health of these sectors.

We note that after having its Russian exposure written down to zero, the trust’s 10.4% discount is arguably an attractive opportunity (as of 24/04/2022). BEMO is the only trust to focus solely on the EMEA region, which makes up less than 10% of the MSCI Emerging Markets Index.

BRLA, on the other hand, is the only trust to focus exclusively on Latin American equities. The Latin American region has displayed a high sensitivity to the global economic recovery, in the same way that many value stocks do. BRLA also has a high allocation to materials, financials and energy, which together make up nearly half of its portfolio.

This has meant that the trust has been incredibly well positioned in 2022 to capitalise on both rising global interest rates and rising raw material costs. In fact, BRLA’s positioning has been so good that it is now the second best-performing regional trust year to date, returning 22.4% in NAV terms. BRLA is also the eight best-performing trust of any sector year to date (as of 24/04/2022).

Conclusion

While value investing is not extinct, it is certainly becoming endangered. Yet in an environment that is more positive for value investing thanks to rising inflation and increased economic consumption, investors may be lamenting its decline and looking for options.

We have highlighted some above, but we still think there are gaps in the market. For a start, there is no dedicated European value strategy, and the global sector offers surprisingly few options considering its size. Meanwhile, in the North American sector the value opportunities focus on income and not capital growth. We wonder whether any shrewd investment managers will soon look to capitalise on the lack of options.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Brokers Commentary » Brokers Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.