Apr

2023

Fallen Kingdom?

DIY Investor

28 April 2023

Since the UK was described as a ‘Jurassic Park’ stockmarket, it has outperformed. Is this a new age for the stockmarket?…By Ryan Lightfoot-Aminoff

In November 2021, Paul Marshall wrote in the Financial Times that the UK was the ‘Jurassic Park’ of stock markets. Predictably perhaps, the UK then began 12 months of solid outperformance, being the best-performing major stock market in the world in 2022.

We don’t mean to highlight Paul’s unfortunate timing – in January your analyst forecasted a market fall, which was promptly followed by a six-week rally – but rather to highlight what a remarkable turnaround the UK has had.

Paul Marshall was certainly not the only commentator suggesting the UK market was becoming irrelevant. In this note, we consider whether this is the start of a new age for the UK, or just a blip on its path to becoming a lost world.

An equity income market?

Firstly, it is important to look at why the UK has been labelled a ‘Jurassic Park’. Paul argues that the index is losing its relevance amongst global investors because of its focus on income.

He argues this is a result of demand from domestic investors who are rewarding companies paying out a higher proportion of their earnings as dividends, rather than those companies reinvesting to create future growth.

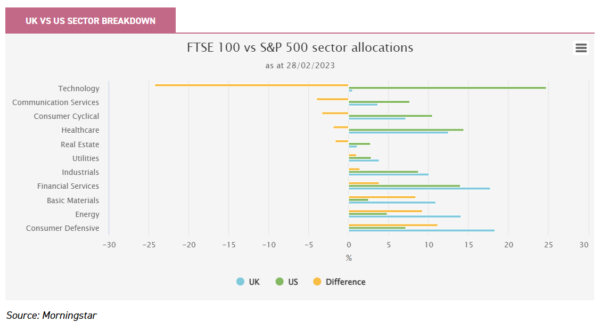

As such, the index’s constitution has drifted to have high weights in industries such as oil & gas and banking, and almost nothing in areas of growth, such as technology. This has been a big driver of the success in other markets, such as the US and, latterly, China.

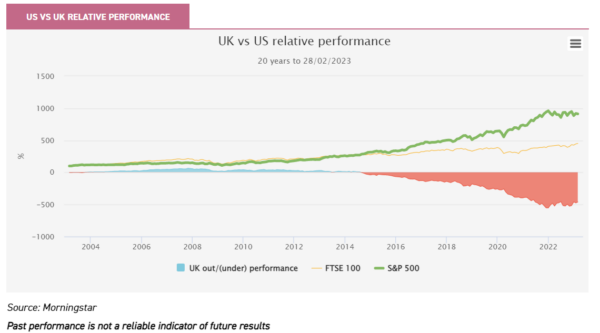

This has led to the UK significantly underperforming these more growth-focussed peers. Over 20 years, the FTSE 100 Index has risen 100.4% in price terms. This compares with the Shanghai A-Share Index’s rise of 236.8% and the United States’ S&P Index increase of a staggering 488.5%.

However, when dividend reinvestment is considered, these returns climb to 315.5% for the UK, 236.8% for the A Shares in China and 675.6% for the US. The graph below shows that this underperformance versus the US started around 2012, shortly after the commodities supercycle ended and around the time technology really started to accelerate, buoyed by low interest rates and attractive growth. Meta, then Facebook, was listed in May 2012, and Twitter in 2013, for example.

As this underperformance has persisted, there have been growing concerns that the UK is losing its place as a market for companies wanting to grow and this has created considerable negative press for the index.

There have been occasions when firms, announcing plans to grow their businesses by reinvesting earnings, have had negative share price reactions, whereas those just paying out more in income have been welcomed. Paul provides an example of this in his article. When SSE published first-half results in November 2021, they announced a rise in capital spending.

This was primarily into expanding their promising renewables business, and yet the shares traded down 5% on the day. This, critics argue, has created a pool of stagnant companies, which have hit maturity and are unwilling to expand further. Consequently, this is discouraging firms which, increasingly, are looking outside the UK.

In recent months, there has been a spate of UK-based companies exploring listing on alternative markets, most notably Arm, a Cambridge-based semiconductor and software design company, planning to list on the Nasdaq Index. Similarly, there have been a number of firms which have moved their listing from the UK to the US to capitalise on the greater appreciation for growth, such as building firm CRH.

We think there has been more behind this than just the importance of income for UK investors. Finance think tank New Financial believes that one of the reasons for the relative decline in the UK market is technical, rather than relating to any shortcomings at the company level, and more specifically due to the retreat of UK pension funds from the equity market.

Their figures show average equity allocations falling from 73% to 27% in defined benefit pension schemes over the past 25 years, and UK equities falling from 53% to just 6%, as part of this. Instead, these allocations have been redirected to bonds, which now make up 56%, with UK pensions exhibiting the highest allocation to bonds relative to equities of any comparable pension system.

As a result, just 4% of the UK stock market is owned now by UK pension and insurance companies, compared to 39% in 2000. Considering the size of the pension market, estimated to be £4.6 trillion, the impact has been meaningful.

Making up for this reduction in capital from international investors has also been challenging, considering the political turmoil the country has been through in the past decacde. The UK has seen a Scottish independence referendum, a Brexit referendum, a fractious parliament which almost collapsed many times and nearly resulted in a Jeremy Corbyn-led government.

This has led many global investors to simply avoid the UK, rather than attempt to take a view on the future regulatory and political environment. As such, UK equities were the most underweight asset class amongst global fund managers in November 2022, according to the BofA Merrill Lynch Survey.

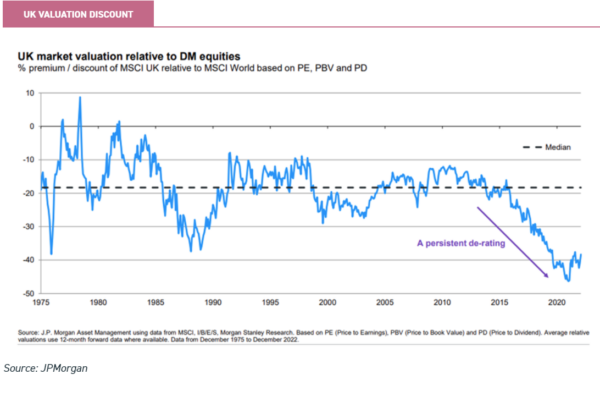

This has had a knock-on effect on valuations. There have been a number of managers who have provided examples of a Brexit discount on companies and evidence that valuations remain low versus other domestic markets.

Georgina Brittain and Katen Patel, managers of JPMorgan UK Smaller Companies (JMI) and , have evidenced this as being one of the primary factors behind the country’s underperformance. However, although there has been a sign of a bounce recently, they have described this as a once-in-a-lifetime opportunity for relative valuations.

A new dawn for the UK?

However, despite the negative headlines and some challenges for the UK economy, the UK was the best performing major market in 2022, a year when almost all other asset classes fell. The so-called dinosaurs proved far from extinct, as industries such as oil & gas came back into favour.

Much of this can be attributed to the fallout from the war in Ukraine, which caused a spike in inflationary forces, though it should be noted that inflation was a factor before the Russian invasion and there has been structural underinvestment in new fossil fuel supply for many years.

The higher inflationary environment also increased investor preference for value companies and those paying an income, over those promising future growth. This was a reversal of the trend for much of the past ten years, but has, though, provided a boost to equity income trusts.

One stalwart of the sector, who has been taking advantage of these opportunities for decades, is Job Curtis, manager of the City of London (CTY). He takes a long-term approach to investing, whilst maintaining a broad exposure to different sectors to ensure that no single factor can have an outsized impact on the portfolio’s performance.

The trust has the longest continuous period of consecutive dividend increases in the sector, the dividend having increased for 56 continuous years, and has achieved the AIC’s Dividend Hero status as a result. This demonstrates the benefits of the income investing approach, showing that this can be used for the benefit of a certain class of investor.

CT UK Capital & Income (CTUK) is another of the AIC’s Dividend Heroes, having increased its dividend every year since its launch in 1992 and maintaining a strong build-up of revenue reserves to support this going forward.

Manager Julian Cane has adopted a growth-orientated approach to meet a total return objective, which means the portfolio has a greater allocation to more mid-sized companies, which helps it stand out against peers. Currently, the trust yields 4.1% and is at a modest discount, despite a loyal investor base that often keeps the share price close to NAV.

Whilst this market rotation to value is supportive for income trusts, in particular, it is not the only factor supporting the outlook for investing in the UK. Fundamentally, the country still has much going for it.

The six-strong management team behind Aberforth Smaller Companies (ASL) and Aberforth Split Level Income (ASIT) have highlighted the open economy, good governance and strong rule of law as key factors. The Aberforth team point to the strong corporate sector and robust banking system as further elements of support.

This has led to the UK being the birthplace of, and home to, many world-beating companies. The aforementioned Arm, whilst deciding to list in the US, was still created in Cambridge in the UK and will be headquartered there.

If investors were to look further down the market cap spectrum, beyond just the large cap index, they would see a number of companies which are global leaders in their industries. This has been borne out in better performance lower down the cap scale, as best demonstrated by the FTSE 250 Index.

Jean Roche, manager of Schroder UK Mid Cap (SCP), highlights that the index has outperformed most developed market indices over the past 25 years, including the S&P Index, in sterling terms.

She believes that this is a result of the dynamic nature of the index, which is considerably more diverse than the large index and includes significantly bigger weightings to industrial and consumer discretionary companies.

Examples of world-leading companies include Victrex, which designs and manufactures polymers for everything from aircraft to implants, or Qinetiq, which is a leader in defence software and systems.

Despite this, many managers argue that the index is trading at a significant discount because of the negative perception. The P/E valuation for the MSCI UK Mid Cap Index is 17.8x, which compares to the equivalent European figure of 19.2x and the US’s 18.97x.

As such, they believe that the market is still very cheap with much potential value in smaller companies, especially so if a recovery in the economy starts to be seen. It is often during periods of economic recovery when smaller companies deliver their strongest outperformance and, if the last seven or so years of turmoil in the UK could be subsiding, this could be seen as a good value opportunity for investors.

International investors seem to agree with this, as has been seen with the spike in M&A in the past year. Some of this was driven by a fall in the value of the currency, which makes UK-listed companies relatively cheaper for overseas buyers.

Regardless, this has been a tailwind for the performance of UK small and mid-cap indices over the longer term and is one of the reasons for the FTSE 250 Index’s dynamism.

However, many argue that this acquiescence is a large reason for the ‘Jurassic Park’ title. The willingness of shareholders to accept M&A offers for short-term gains materially undervalues the long-term opportunity of a firm, and this is precisely why the large cap index is lacking growing, innovative companies.

If a firm that exhibits all the right characteristics is allowed to be picked off by external investors early in its journey and shareholders wave it through, then the headline index of the UK is never going to be refreshed. This will only encourage firms to continue to look at alternative listing opportunities to allow themselves to grow and, arguably, drive the UK stock market further down the path to extinction.

So, is there still hope for the UK? Think tank New Financial thinks one place to start would be to reform the pension and insurance sectors, so that they are incentivised to back equities for the longer term.

Considering the level of assets involved, this would make a marked difference. Similarly, there is a genuine sense that the UK may be turning a corner on the years of political turmoil, which may encourage international investors to bring the UK market back in from the cold.

It is likely to prove difficult to cause a shift in investor style and preference through policies, but the UK government has stated that it aims to do so. In the meantime, there is a litany of UK smaller companies and equity income trusts that are poised to exploit the inefficiencies of the market and generate attractive long-term returns for investors.

Conclusion

Last year was a strong one for the UK market. However, there are clearly still structural issues affecting its long-term future. We would argue the UK still has much going for it, including the rule of law and strong governance frameworks.

These positives continue to make it an attractive place in which to do business, while it is also attractively cheap. While the changing profile of stock market investors has led to a preference for income returns over future growth, the UK is still a great breeding ground for highly-innovative, growing firms.

If sentiment improves, this would provide a tailwind for the numerous exciting investment opportunities and show that, far from heading towards extinction, the UK could be at the dawn of a new age.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.