Feb

2024

Extra chips with that

DIY Investor

3 February 2024

We take a closer look at the booming semiconductor sector and how investors can tap into its growth potential…by Jo Groves

The world has an insatiable appetite for chips (the semiconductor variety that is, although arguably the potato kind as well given expanding waistlines). The next time you’re stuck on the hard shoulder in the driving rain while the AA man fumbles under your bonnet, spare a thought for the 1,500 chips he’s grappling with (or double that if you’re the proud owner of an electric vehicle).

Chips have become a key ingredient for a whole host of products and applications, from smartphones to cloud services and MRI scanners to fighter planes. Technology megatrends, such as the rise in remote working, have also helped to send demand for chips soaring, with McKinsey forecasting that semiconductors will become a $1 trillion industry by the end of the decade.

On the supply side, chips have become a hot potato for companies and world leaders alike given their role in the smooth functioning of global supply chains. The US may be a leading chip consumer but manufactures only 10% of global chips, behind Japan, Taiwan and South Korea. Against a backdrop of continued geopolitical tension, President Biden signed the CHIPS Act in 2022, which promotes ‘on-shoring’ via a $53 billion investment to incentivise chip makers to set up base in the US.

These secular growth trends have rewarded investors willing to hang on tight for a sometimes hair-raising ride, with chip giant NVIDIA bouncing back from a 50% loss in 2022 to chalk up a 239% return in 2023. Looking at the broader sector, the SOX (Philadelphia semiconductor index) is a market-cap weighted index of 30 US companies involved in the design or manufacture of semiconductor chips, and includes the likes of AMD, Intel and Broadcom.

The SOX has signalled the start of bull and bear markets in advance of wider equities on occasions, with the SOX falling ahead of the S&P 500 before the stock market crashes in 2000 and 2007. It’s also used as an indicator for the wider economy, with the recent rise in the SOX suggesting that markets are anticipating a ‘soft landing’ for the US economy as recessionary fears subside.

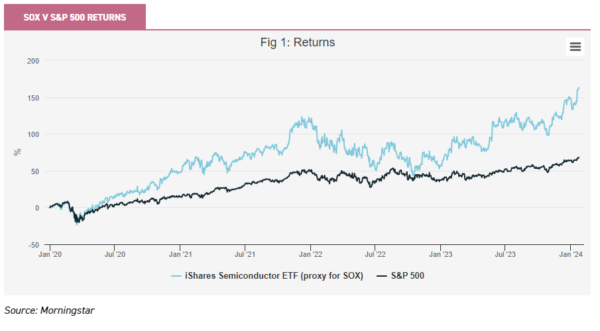

Overall, the SOX has outperformed the S&P 500 over the last four years, as shown in the graph below, which is a particularly impressive achievement given the stellar performance of the US technology mega-caps over this period:

It may have monopolised financial headlines in 2023 but excitement over the power of AI continues unabated. From a chip perspective, there’s one big winner in this space and that’s NVIDIA. The company cut its teeth making GPUs (games processing units) for gaming consoles but had the vision to invest in the combined software and hardware to process and store vast quantities of data at lightning speed well ahead of its peers.

A recent Bank of America note described the company as the “picks and shovel leader in the AI gold rush”, in reference to the equipment sellers often making more money than the miners themselves in the 1850s gold rush. NVIDIA chips power the ChatGPT and Bard chatbots, as well as a staggering 95% of the GPUs used in the data centre market (according to Business Insider).

Allianz Technology Trust (ATT) aims to capture secular themes in the technology sector with high growth potential. Artificial intelligence, and semiconductors in particular, form a core allocation, with NVIDIA comprising the trust’s second-largest holding at c. 7% (as at 31/12/2023). American semiconductor companies Broadcom and Micron Technology also sit among the trust’s top ten holdings, alongside Microsoft, Apple and Alphabet.

That said, the trust invests broadly across the market cap spectrum, with just under half of the trust invested in sub-$100 billion companies. The team, led by Mike Seidenberg, looks to identify smaller companies with the potential for a longer runway of growth. This approach has certainly paid off, with ATT delivering a five-year share price return of 142% (as at 26/01/2024) relative to 80% for the AIC Technology and Technology Innovation sector (albeit this is a small sector). The current discount of c. 10% (as at 29/01/2024) may therefore present an attractive entry point for investors.

But NVIDIA and its fellow US chip makers aren’t the only show in town. Europe has its fair share of semiconductor specialists too, with ASML in the Netherlands and UK-based ARM Holdings topping the table by market cap. The long-awaited European Chips Act is also likely to provide a tailwind for the sector, aiming to double Europe’s share of the global semiconductor market by 2030 through €43 billion in public funding.

BlackRock Greater Europe (BRGE) offers a European angle on the semiconductor story, with c. 13% of the fund invested in Dutch chip manufacturers ASML and ASM International and French-Italian STMicroelectronics (as at 30/11/2023). BE Semiconductor, another portfolio company, designs and makes equipment for semiconductor manufacturers and, as a result, is less susceptible to geopolitical interference in the form of export controls on chips.

This sectoral exposure has proved a tailwind to returns, with BRGE rewarding investors with a five-year share price return of 87%, comfortably higher than the 56% return for the IT Europe sector (as at 26/01/2024). Despite challenging market conditions, the trust has achieved positive returns in four of the last five calendar years, which is testament to its focus on long-term structural trends.

Beyond the US and Europe, the semiconductor industry is also thriving in Asian markets such as Japan and Taiwan. Templeton Emerging Markets (TEM) offers exposure to this region, with almost 80% of the fund invested in Asia (as at 31/12/2023), with its largest holdings being Taiwan Semiconductor Manufacturing Company (better known as TSMC) and Samsung respectively. TSMC dominates global semiconductor manufacturing, with a market share of more than 55% in 2023, according to Statista. The company is a maker, rather than designer, of chips and is the primary manufacturer of chips for NVIDIA.

Emerging markets typically offer an attractive combination of rapid economic expansion, a burgeoning domestic market and plentiful resources, creating the potential for above-average earnings growth. However, investors should be aware that emerging markets tend to be both more volatile and cyclical than developed markets.

Against this backdrop, TEM has achieved a share price return of 80% over the last 10 years, comfortably exceeding the 71% return for the MSCI Emerging Markets Index. Due to mixed sentiment towards emerging markets, the trust is currently trading on a discount of 14% (as at 29/01/2024).

Looking ahead, chips are likely to remain a vital component for pioneers of new technologies, fuelled by the widescale potential of generative AI. However, this is a cyclical sector and, as such, better suited to a buy-and-hold strategy than a shorter-term investment horizon.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.