Feb

2021

Explain it to a Golden Retriever – World ETFs Review

DIY Investor

17 February 2021

You don’t need much knowledge to put your cash to work

In fact, to get exposure to World Equities you only need a single ETF

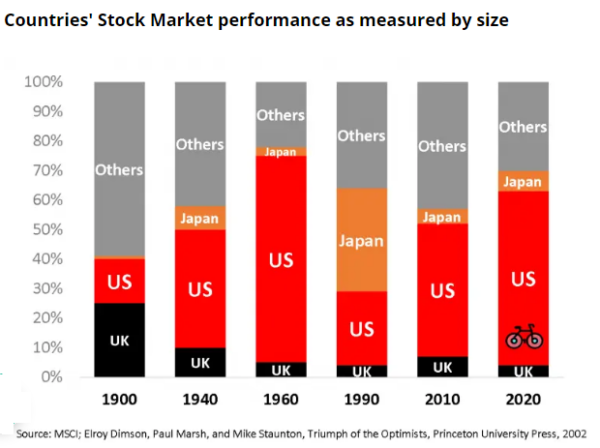

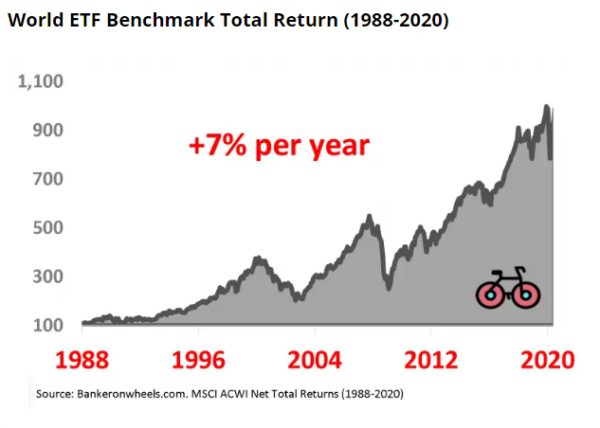

And this exposure evolves with the markets as certain countries grow or decline in World ETF Benchmarks

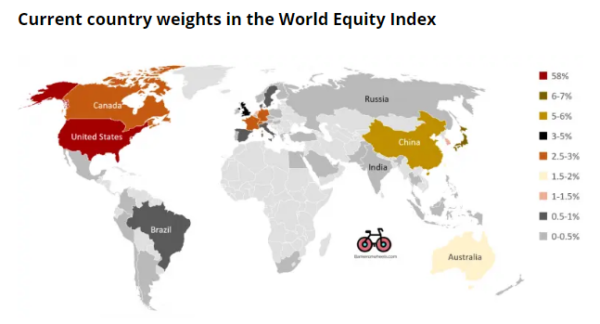

Currently, c. 60% of all World Stocks as measured by market capitalization are US Equities but it wasn’t always that way and…

It may not always remain so. While there are certainly reasons for the current allocations, imagine if China or/and India accelerated opening up (and transparency) of their Capital Markets (China’s current weight is only c. 5% in the Global Stocks whereas its GDP is 65% of the US GDP). The mix of Emerging Market sectors is getting interesting as well

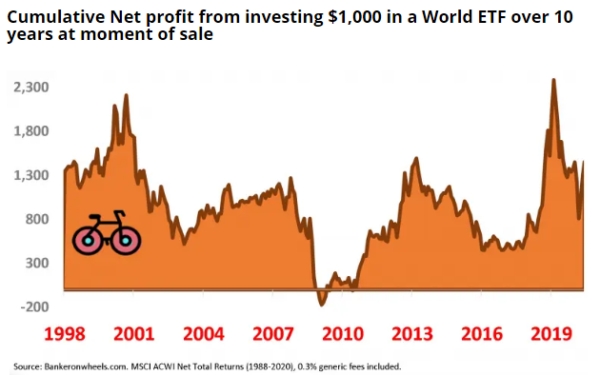

If you assume your investment horizon is 10 years…

… by investing $1,000 and keeping it for the entire 10 year period it would have on average returned c. 7% per year (after 0.3% fees) and your portfolio would have doubled (on average) during those first 10 years

Click to read the entire article:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.