Oct

2023

Epic Stock Market Crashes – How to take advantage of a recession

DIY Investor

9 October 2023

Epic Stock Market Crashes – How much can you lose? How long will it take to recover? Guide on how to take advantage of a recession

Epic Stock Market Crashes – How much can you lose? How long will it take to recover? Guide on how to take advantage of a recession

How do people lose money in the Stock Market?

In the wrong place…

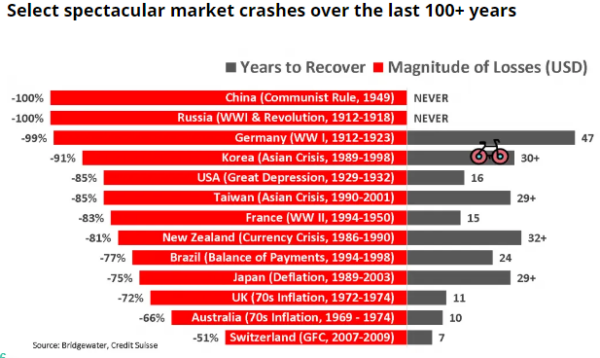

- During some of the most spectacular market crashes investors lost all their money – circumstances have been quite extreme in most cases: wars, revolutions, changes in political regimes – all seemingly remote in today’s developed markets

- A lot of others were restricted to very specific countries – unlucky were those that didn’t hear about diversification

… At the wrong time

In any conversation about long term investing the Great Depression or Japan’s Lost Decades will come up

Below are a few facts you need to know

I also describe what would have worked in the past – the goal is not to forecast how the next downturn will look like but be robust to most scenarios

The Three Grizzlies – profiles of painful downturns: Crashes brought opportunities

This guide is not meant to be exhaustive but gives you the possible profiles of recoveries

Why did I select those? It largely boils down to answering the questions:

- How you can prepare for the unpredictable?

- How do you take advantage of a recession or a market crash?

With that in mind, I listed best practices to help you construct a portfolio

There are also theories that the rise of algorithmic trading may amplify future crashes (and may make them shorter) with possibly shorter recoveries as well similar to what witnessed during COVID-19

Key Takeaways

- The Stock Market is a powerful money-making machine that can make you rich and financially independent

- How much can I lose? Let’s face it, in theory you can lose it all. There have been instances in history when some investors lost all their savings

- How long will the downturn last? It can be quick. In the US the worst day was a 23% loss for the Dow Jones Index. More often it will take a year or two.

- How quickly can I recover my savings? What’s poorly understood is that in reality, it’s almost impossible to lose money in the long term if you follow common sense investing rules and you will likely recover your money relatively quickly

- Can I do something to prepare for it? Absolutely – it’s all about prevention and limiting the damage. If you review some of the previous market crashes you will understand that there are powerful weapons at your disposal to mitigate downside risk without technical knowledge

- Preparing for a crash includes diversifying (but not too much), getting international exposure and ‘hedging’ with some Bonds/Inflation Protection to protect your portfolio from your emotional decisions

- Can I take advantage of a market crash? Yes – Dollar Cost Averaging with additional injections trumps any crisis (yes, Japanese style, too), reinvesting dividends and re-balancing will also help tremendously

- What else is at my disposal? It’s also prudent to have an emergency fund before investing and one of (i) spending flexibility and/or (ii) additional income can make you even more robust during a downturn. Tax loss harvesting can help, too.

- Should I prepare for the worst? You need to strike a balance between long term gains from the market and some downside protection

- A too conservative portfolio can hurt you. Frankly, if an extreme event strikes all markets at the same time, you will have other things to worry about than checking your broker account

- In the meantime, learn how to benefit from stock market crashes, take calculated risk and enjoy the returns of the Stock Market – probably the best source of passive income

Click to visit:

Commentary » Equities » Equities Commentary » Equities Latest » Latest » Mutual funds Commentary » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.