Dec

2021

Emerging markets – from uncertainty to opportunity?

DIY Investor

21 December 2021

Nicholas Price

Portfolio Manager, Fidelity Emerging Markets Limited

As investors grapple with economic uncertainty and mounting regulation, the outlook for emerging markets may seem less positive. Against this backdrop, Fidelity Emerging Markets Limited portfolio manager Nick Price outlines why he expects to find opportunities amidst the uncertainty. And while there are reasons to believe that volatility will persist, he explains why the worst may be behind us.

2021 was a period of huge bifurcation of returns across the developing world, with China in particular falling out of favour against a backdrop of increasing regulation and property sector concerns.

This is a favourable environment for stock pickers to acquire good companies at attractive valuations. Indeed, disruption, IPO activity and innovation are abundant in emerging markets (EM): investors can increasingly access fast growing companies operating in underpenetrated markets and industries. Traditionally these opportunities were largely associated with China, but activity is far broader, and entrepreneurialism is rife.

What could surprise markets in 2022?

China has always been a highly regulated and controlled market. The recent setbacks to the property and new economy sectors may continue in the near-term, but this downcycle can offer up opportunity to buy high quality names in beaten down sectors.

2022 could prove to be a challenging year as property and construction-related activities slow. However, sentiment has been very weak with a lot of bad news already reflected in prices. China’s economy appears robust – exports have benefitted as consumers spend on goods, not experiences and travel, and there are some encouraging early signs that China may be bottoming out.

More broadly, we see potential for negative surprises emerging from a less certain political backdrop. In Brazil, for example, a convoluted political scenario adds to the uncertainty around the economic recovery – a risk we are unlikely to embrace.

Positioning for what lies ahead in 2022

Tightening emissions regulations and governmental incentives are pushing demand for cleaner fuels and in turn electrical vehicles (EVs). Related industries remain an attractive area as we look forward to a decarbonised future. Accelerating adoption of EVs bodes well for copper prices as the metal serves multiple purposes in the production. Demand for copper is also being driven by the rollout of 5G. Despite being a wireless technology, 5G’s rollout requires substantial amounts of fibre and copper cable to connect equipment, along with building new base stations and data centres.

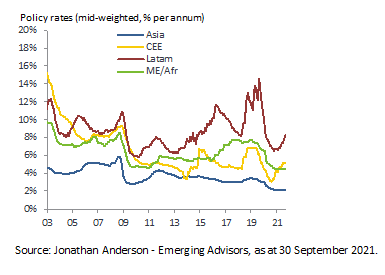

Inflation may be more persistent than we might have anticipated and whilst we have not taken a strong view on this, we have good exposure to financials. Across EM, central banks have responded to inflationary pressures with rate rises, which will in turn benefit some banks as net interest margin expands.

Interest rates across EM start to rise in response to inflationary pressures

Elsewhere, the opportunity set across tech is diverse. Consulting services are bolstered by rising enterprise spending given the acceleration towards digital transformation projects globally. The semiconductor industry is facing a cyclical downturn, but we anticipate this will be shallow. The structural growth backdrop here remains strong – memory stocks (companies that produce memory chips that run computer devices) are cheap and can generate solid profits through the cycle and the industry is highly consolidated. The market seems obsessed with a slowdown, but we are more focused on the longer-term outlook for these businesses in the knowledge that component supplies are important for any endeavours in emerging technologies.

We are very positive on prospects of burgeoning fintech stocks like TCS Group in Russia and Kaspi a key beneficiary of an underpenetrated market in Kazakhstan. Similarly, Chinese broker East Money information is a business where we are building conviction.

We remain underweight energy but maintain a ‘hedge’ or offsetting the risk against strong energy prices given the with overweight positions in oil producing countries such as Russia.

Sustainability considerations

Investors are increasingly embracing sustainable investing and we expect an accelerated trend toward greater sustainability. We believe that fundamental research-driven stock selection, focused on high-quality companies with strong sustainability characteristics gives, us a better opportunity to generate superior long-term returns both in absolute terms as well as versus the index.

Alongside traditional financial considerations, ESG factors are key to a company’s competitiveness and cost of capital and hence are an integral part of stock selection. An assessment of ESG-related risks is a critical component of the decision-making process – it influences which stocks to buy, hold and potentially sell, as well as determining focused engagement activity.

Important information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. This information is not a personal recommendation for any

particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser. Investors should note that the views expressed may no longer be current and may have already been acted upon. This Investment Trust invests in emerging markets which can be more volatile than other more developed markets. Changes in currency exchange rates may affect the value of investments in overseas markets. This trust has or likely to have, high volatility owing to their portfolio composition or portfolio management techniques. They can use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. This investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility.

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM1221/370094/ISSCSO00041/0622

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.