Nov

2020

Emerging Markets, Evolving Opportunities

DIY Investor

24 November 2020

When it comes to seeking out the best new investment opportunities in emerging markets, your key focus should be on companies rather than countries and sectors.

‘BRICs’, ‘The Next 11’ – everyone likes a neat acronym or a catchy label, but it’s important not to underestimate the vastness and complexity of emerging markets. For us emerging markets investing has long since moved on from trying to exploit the next country with a large population and a growing economy, which can deliver inconsistent results and exposures.

This is not to negate the importance of understanding local markets.

To fully appreciate the investment potential of a company you need of course to have a strong grasp of the environment in which it operates: its sector, its competitors, even geographic and political factors which could affect its ability to grow: through market regulation or access to export markets for example. However, as long-term investors we’re strongly focused on finding the highest quality, sustainable businesses.

Spotting emerging markets investment themes

To find investments’ long-term potential we focus on secular trends, that is, those which aren’t a result of seasonal or cyclical situations.

Over any five-year period, factors such as fluctuations in valuation and currency tend to be cancelled out, so that only the intrinsic value represented by earnings growth and dividends remain.

‘By combining these factors, we’re able to explore beyond the benchmark to confidently identify companies which have the ability to deliver outstanding returns over the long term’ – Austin Forey

It’s in the nature of emerging markets that consumption will tend to grow at a rapid pace. This makes sectors like e-commerce particularly attractive, as well as financial services in under-banked markets which have plenty of headroom for growth.

Another interesting area is IT software and service, where cost-effective access to expertise makes emerging markets companies potentially both innovative and highly competitive in terms of price.

With distance not a significant disadvantage, the best IT businesses from emerging markets have the potential to penetrate markets globally.

To emphasise our thematic focus, collectively these three sectors account for around 80% of the assets in the JPMorgan Emerging Markets Investment Trust.

What to look for in an emerging markets company

In a growth sector, poorly run companies can flourish in the short term, but as a sector matures and weathers the economic cycle, only businesses with strong fundamentals will prosper.

In the long term, growth in market share trumps market growth every time.

While this is true in all markets, in emerging markets where new sectors are developing quickly and experiencing rapid growth it can be even more relevant.

This makes in-depth research at both a quantitative and qualitative level vital to success. Crunching the numbers can be done from a desk up to a point, but to properly explore the underlying quality of a business we like to get face to face with management teams, so we can fully understand both the rigor of their governance and their strategic intent.

Fortunately we can call on the expertise of a 37-strong team who not only have detailed local knowledge but can collectively speak 21 different languages; together they carry out around 5,000 meetings a year.

The importance of countries for diversification

Finally, while we don’t focus on specific countries as an investment strategy, we do recognise the importance of diversification by region as well as by sector.

We maintain a policy of holding no more than 50% of the fund’s assets in a single region and are invested in a long list of markets, including China, India, Brazil, Taiwan, South Africa, Indonesia, Mexico, Russia, Peru, Chile, South Korea and Saudi Arabia.

Bringing it all together

Here are some examples which illustrate our approach in action:

MercadoLibre

Argentina-based MercadoLibre Inc (Spanish for ‘Free Market’) is Latin America’s leading e-commerce platform, with almost a third of the region’s entire population registered as users.

NASDAQ listed and growing rapidly, the business reported a year-on-year revenue increase of 48% for the first quarter of 2019, yet the true figure is arguably even higher (having to report local earnings in US dollars means figures are affected by US dollar strength).

Much of its current growth is thanks to its e-wallet product MercadoPago and the company is planning further financial services products such as loans and financial transfers to exploit the large unbanked population in the region.

Capitec

A South African bank, Capitec Holdings is a prime example of how an innovative approach can cut through even in an apparently heavily commoditised and poorly differentiated sector.

Capitec’s low cost, no frills approach is not only highly disruptive but also highly profitable, delivering over six times the increase in share price of much bigger rival Nedbank, which is one of the largest financial services groups in Africa.

Globant

Software development business Globant is a good example of our ability and preparedness to buy relatively small companies where we see strong potential.

When we first invested in Globant four years ago it was worth around $500m. At the time of writing its market capitalisation stands at $3.8 billion. Working for companies including Google, LinkedIn and Coca Cola, Globant now has a presence in 17 countries and employs more than 9,200 people.

With these and other firms we’ve been able to build an emerging markets portfolio which is truly unique in its holdings and has resultantly outperformed the benchmark over 3, 5 and 10 year periods.

Important Information

JPMorgan Emerging Markets Investment Trust plc

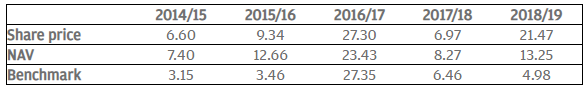

Quarterly rolling 12 months – as at end of June 2019 (%)

Past performance is not a guide to current and future performance. Source: J.P. Morgan Asset Management/Morningstar. Net asset value performance data has been calculated on a NAV to NAV basis, including ongoing charges and any applicable fees, with any income reinvested, in GBP.

Key risks

Exchange rate changes may cause the value of underlying overseas investments to go down as well as up. Investments in emerging markets may involve a higher element of risk due to political and economic instability and underdeveloped markets and systems. Shares may also be traded less frequently than those on established markets. This means that there may be difficulty in both buying and selling shares and individual share prices may be subject to short-term price fluctuations. Where permitted, a Company may invest in other investment funds that utilise gearing (borrowing) which will exaggerate market movements both up and down. External factors may cause an entire asset class to decline in value. Prices and values of all shares or all bonds could decline at the same time, or fluctuate in response to the performance of individual companies and general market conditions. This Company may utilise gearing (borrowing) which will exaggerate market movements both up and down. This Company may also invest in smaller companies which may increase its risk profile. The share price may trade at a discount to the Net Asset Value of the Company. The Company may invest in China A-Shares through the Shanghai-Hong Kong Stock Connect program which is subject to regulatory change, quota limitations and also operational constraints which may result in increased counterparty risk.

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Investor Disclosure Document, Key Features and Terms and Conditions and Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust. This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP. Material ID: 0903c02a826fade6

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.