Oct

2014

Eight Things To Know About Short and Leverage ETFs/ETPs

DIY Investor

27 October 2014

Introduction to Exchange Traded Products

Exchange Traded Product (ETP) is an umbrella term which encompasses Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs) and Exchange Traded Commodities (ETCs).

ETPs can provide exposure to all asset classes including equities, commodities, fixed income, currencies and alternatives.

ETPs have existed since 2005 and leverage for many centuries; today there are almost $61bn of assets in leveraged and short ETPs which are traded on most of the major global stock exchanges.

Due to the combined features of leverage and daily compounded returns, these types of ETPs are trading instruments which need to be clearly understood before an investor should invest. However, once understood they can be highly efficient tools, providing magnified long and short exposure in an efficient product wrapper.

Boost ETP (www.boostetp.com), is one of only a few specialist providers of short and leveraged (SL) ETPs to the European market with a focus on delivering added value by issuing highly innovative products.

The company has education, transparency and thought leadership at its core and herein considers eight key things that it believes investors need to know about short and leveraged ETPs, using its own products as examples.

-

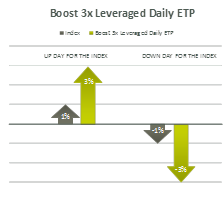

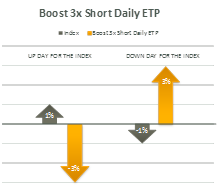

Leveraged Returns

Leveraged returns magnify the daily returns of an unleveraged investment. For example, the charts below show that if the FTSE 100 rises by 1% in a day, the Boost FTSE 100 3x Leverage Daily ETP (3UKL) will rise by 3% (excluding fees and adjustments).

Conversely, if the FTSE 100 falls by 1%, the Boost FTSE 100 3x Short Daily ETP (3UKS) will rise by 3%.

Leverage returns allow an investor to either use less of their capital to achieve a similar investment (2/3 less in the case of 3x leverage) or to magnify returns using the same amount of capital.

(Source: Boost ETP LLP)

-

What Indices do SL ETPs Track?

Boost SL ETPs track a range of liquid, blue-chip indices; they either track a specially designed 3x daily leveraged or 3x daily short index (such as the ShortDAX X3 TR EUR Index) that calculates the leveraged return inside the index, or they track an unleveraged index (such as the NASDAQ Commodity Crude Oil ER Index) and for which the 3x or -3x daily leverage is applied in the same way that the short or leverage index is constructed.

-

How is the Short and Leverage Position Achieved?

An investor buying £100 of a 3x Leverage Daily ETP receives £300 of exposure consisting of £100 cash and £200 of borrowed funds (charged at the interbank lending rate) to achieve an investment of £300. The borrowing cost is deducted from the daily return and is either incorporated into the index or the calculation of the ETP price.

An investor buying £100 of a 3x Short Daily ETP effectively borrows £300 of the index which is sold short; £400 (£100 from the investor and £300 from the short sale of the index) is then invested at inter-bank cash rates. The cost of the stock-borrow and interest income on the cash is incorporated into the calculation of the ETP price each day.

-

Daily re-Balancing

Boost Short and leverage Daily ETPs rebalance their leverage at the end of every index trading day, providing investors with a 3x or -3x daily returns. This is slightly different to using margin or buying or selling a futures contract to obtain leverage.

Daily ‘constant leverage’ is used because an open-ended ETP allows for investors to buy and sell the ETP on any day and still receive the stated leverage multiple. Leverage based on a ‘constant dollar’ amount is not possible as the amount of leverage experienced by each investor depends on the amount and day the investment was made.

Monthly leverage (or some other frequency of re-balancing) could be used but then the actual leverage an investor was exposed to would depend on what day of the month they bought the investment. Daily leverage simplifies this issue.

-

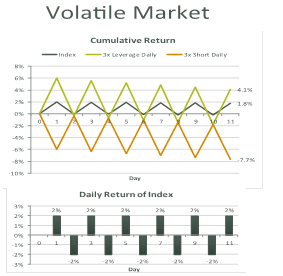

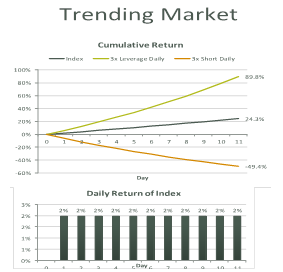

Compounding – its Effects

As with any investment, returns over periods longer than one day are affected by compounding due to market movements (like a bank account may compound interest over many months).

Daily leveraged exposure means the compounding effect will be amplified and occur daily, which can have a positive or negative effect on returns over longer periods. If the FTSE 100 price is £100 and rises by 1%, the Boost FTSE 100 3x Leverage Daily ETP (3UKL) will rise by 3% to £103 (excluding fees & adjustments). If the FTSE 100 then falls by 1% the next day, then 3UKL will fall to £99.91.

Thus over the two days the average return is 0%, however the 2-day compounded ETP return is -0.09%. The Index would also have an average return of 0% but its price would be £99.99 and its 2-day compounded return would be -0.01%. The daily compounding effect may increase with the length of a holding period, index volatility and leverage.

These charts show the effects of compounding on returns. In the “Volatile Market” chart the index moves up and down by 2% per day.

After 11 days, the Index is up by 1.8%, the Boost 3x Leverage Daily ETP would be up only 4.1% (2.3x the Index) and the Boost 3x Short Daily ETP is down 7.7% (-4.3x the Index).

The “Trending Market” chart shows the outcome over 11 days, where the index increased by 2% each day. After 11 days, the Index is up by 24.3%, the Boost 3x Leverage Daily ETP would be up only 89.8% (3.7x the Index) and the Boost 3x Short Daily ETP is down 49.4% (-2.0x the Index).

However, on a day to day basis, the Boost 3x Leverage Daily ETP and Boost 3x Short Daily ETP has done exactly as it is supposed to do.

(Source: Boost ETP LLP)

-

Intra-day Crash Protection

Boost ETPs are designed to prevent the ETP from falling to $0 in one day. If a market move is extreme, e.g the FTSE 100 falls by 20% (60% including leverage) then 3UKL rebalances intra-day to ensure that the ETP does not go to $0.

The intra-day rebalancing reduces the sensitivity of further falls below 20% while maintaining some exposure to a rebound. Similarly, if the FTSE 100 rises by 20%, then 3UKS would rebalance intra-day.

-

Uses and Trading Strategies

SL ETPs can be used by a wide range of investors for many different trading strategies:

- Treble daily returns, positive or negative (excluding fees and adjustments).

- Hedge existing positions in one simple trade

- Use in a long-short strategy using both a leverage ETP and a short ETP

- Use in a pair trade to take advantage of undervalued assets

- Short the market/asset class quickly, efficiently and cost-effectively

- Short ETPs allows the investor to profit in a falling market

- Use tactically within a broad portfolio where an investor holds strong short term convictions

-

Leverage ETPs and Possible Risks

Leverage ETPs have been fiercely debated in investor circles as to whether they are risky and/or complex investments.

Leverage has been around for many centuries and a multitude of financial products exist to enable investors to gain leverage and/or short exposure.

An investor should understand the benefits and risks of each leverage product and see which one suits their goals and circumstances for the specific trade being considered.

SL ETPs increase the tools available to investors, and used in the right way, can enhance returns.

Boost considers its products provide a robust, transparent, exchange-traded, collateralised, secure and relatively cost efficient tool for a wide range of investors to gain leverage or short exposure, through their normal brokerage or investing channels.

| Boost ETP | Structured Products | ETFs | CFDs/ Spreadbet | Futures/ Options | |

| Underlyings / asset classes | Equities, Commodities | Many | Single commodities not possible | Many | Many |

| Leverage | Yes | Yes | Yes (only up to 2x) | Yes | Yes |

| Lose more than your invested capital | No | No | No | Yes | Yes |

| Exchange Traded | Yes | No | Yes | No | Yes |

| Multiple Market Makers | Yes | No | Yes | No | Yes |

| Arbitrageable | Yes | No | Yes | No | Yes |

| Unsecured credit risk | No | Yes | No | Yes (MF Global & World Spreads) | No |

| Over Collateralised | Yes | No | Usually | No | No |

| High fees | No | Yes | No | Yes | No |

| Transparent | Yes | No | Mostly | No | Yes |

| Highly liquid and trade in large size | Yes | No | Yes | No | Yes |

| Margin calls & close out | No | Yes | No | Yes | Yes |

| Short term dated | No | Yes | No | Yes | Yes (rolls & exercise dates) |

N.B The information contained in this article is not intended to represent all the risks associated with Leverage and Short ETPs, nor does it list all the important factors one should consider when reviewing whether a Boost ETP is appropriate. Investors should review and understand the Prospectus including the “Risk Factors” section before any investment into Boost ETPs.

This communication has been provided by Boost ETP LLP which is an appointed representative of Mirabella Financial Services LLP which is authorised and regulated by the Financial Conduct Authority. Please read our full disclaimer at www.boostetp.com/Content/Disclaimer before considering an investment in Boost ETPs.

Leave a Reply

You must be logged in to post a comment.