Jul

2021

East End boys and West End girls

DIY Investor

4 July 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Our analysts debate whether the US or Asian stock markets will deliver the best returns over the next decade…

Our analysts debate whether the US or Asian stock markets will deliver the best returns over the next decade…

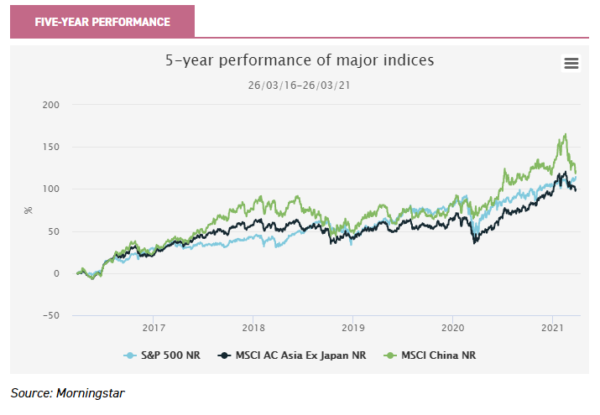

The last decade saw the S&P500 generate remarkable outperformance of its peers, the market up 307% on a total return basis compared to 127% for the MSCI AC Asia ex Japan Index.

However, over the last five years the MSCI China has marginally outperformed while the MSCI AC Asia ex Japan Index is just 10% behind (see graph below).

The decade has been a period of great change, with the emergence of technology and ecommerce giants around the globe, the increasing absorption of Chinese markets within the global system and the rising cultural and political power of Asia versus the West.

Our analysts debate whether the best opportunities in markets are now in the rising powers of Asia or the established leader, the USA.

A dead-end town: time to look to Asia for growth– Thomas McMahon

Here’s one potential reason to invest in Asia which you can ignore: the greater GDP growth potential. The link between GDP growth and stock market returns is poor, as we have discussed previously.

Just to give one example, over the ten years to December 2019 the World Bank says India’s economy grew by 90% while the US’s grew by 25%.

However, the MSCI India rose 60% on a total return basis over that period, compared to gains of over 200% for the MSCI USA. In my view this link between GDP growth and stock market returns is only likely to be weaker in the future, thanks to globalisation and the potential for technology to open up new products and industries quickly.

Nonetheless, I would say there are two key reasons why I am more excited about investing in Asia than the US at the moment.

The first is relatively boring and traditional – we can see clearly how huge markets are likely to open up in products and services more prevalent in the developed world.

The beauty of looking at a developing country such as India is that you can almost see the future. Assuming the country can get out of its own way and no events (such as a war or, well, a pandemic) get in the way either, we know in broad terms how the country is going to develop, as we have seen other countries do so.

India’s young population will require more and more basic financial services, and then more and more sophisticated financial services. We can therefore estimate the size of the market and the size of the opportunity.

One example the managers of JPMorgan Indian (JII) like to refer to is the mortgage market. Outstanding mortgages make up around 10% of Indian GDP, compared to 70% for the UK.

The Indian number will grow hugely over the next decade, and some banks are going to make a killing, growing their books by amounts the likes of Lloyds can only dream of. Specialist India trusts like JII or Ashoka India Equity (AIE) have significant exposure, as you might expect.

But some regional trusts also have significant positions in the Indian banks, and don’t bring exposure to the idiosyncratic political and economic risks in India along with them.

One example is Asia Dragon (DGN) which we profiled recently.

This sort of opportunity exists outside of India, of course. The managers of Scottish Oriental Smaller Companies (SST)are particularly excited about the potential in the company Sarimelati Kencana, the owner of the Pizza Hut franchise in Indonesia.

Sarimelati Kencana has 80% of the pizza restaurant market share in a massively underpenetrated market. The stock trades on a huge discount to its peers in other countries thanks to the impact of the pandemic.

India and Indonesia may or may not see high GDP growth over the next ten years, but I would expect their economic development to continue, providing huge opportunities for certain companies to serve new and growing markets.

By the same token, Chinese GDP growth may collapse (would we know if it did?), but that shouldn’t derail secular changes that are taking place via technology.

While some parts of Asia are still very much developing – India, Indonesia and the ASEAN countries, for example – much of North Asia has a high standard of living as well as industries at the leading edge of technological change.

This time around we haven’t needed to turn to Sinopharm for vaccines, but the astonishing success of Western scientists in producing a vaccine for a novel virus within a year was just about matched by those in the East. (I acknowledge the trial data for the Chinese product has not been forthcoming so far and we must be sceptical, but the extent of the achievement is still notable.)

Within physical technology, TSMC is now dominant in the crucial global industry of semiconductors, which are needed to power everything from iPhones to Tesla cars.

In fact, only Taiwanese TSMC and Korean Samsung are capable of producing the most advanced three-nanometre chips, purported to be 70% faster than the current state-of-the-art five-nanometre chips.

Even the US champion Intel has begun outsourcing production of its highest-specification new products to TSMC, in an effective admission of defeat.

It is important to remember when hearing about how emerging market economies will suffer if the dollar is strong or US rates rise that these macro factors are irrelevant to the long-term success of companies like TSMC.

JPMorgan Asia Growth & Income (JAGI)holds c. 17% of its portfolio in TSMC and Samsung, alongside large positions in the e-commerce stocks Tencent and Alibaba. DGN also has exposure to these tech names, alongside the Indian banks.

James Anderson, the long-term manager of Scottish Mortgage (SMT), has pointed out that the creative energy within the technology industries which used to be found in Silicon Valley more than anywhere else is now more and more found in China and North Asia.

New technologies and new ideas will increasingly come from China. Can we be sure that Tesla will beat out NIO as the world’s leading electric-car manufacturer over the next ten years?

In looking out over a decade, we have to recognise that the short term could be troubled. The Chinese market in particular had a great 2020, and valuations are high.

On a P/B level the Asia ex Japan index has been trading above long-term averages this year. The pandemic could linger. But as should be clear from the above, what I think is really exciting about Asia is the secular growth potential in individual companies and sectors, and so I would not be looking to buy an index anyway.

Active managers who can find the best opportunities, avoid the industries in structural decline and maybe even gear up are the way to go.

Here today, built to last: the US will remain the most dynamic market – David Johnson

“Make America Great Again” has certainly been a divisive catchphrase, but in my opinion it is a redundant one – at least from an investment standpoint.

Over the last five years America has already proven itself to be great, with the S&P 500 having generated 117.2% in total returns (to 25/03/2021), eclipsing the 60.5% of the MSCI World ex USA Index.

I therefore think there are good reasons to believe US equity markets can continue their dominance well into the future.

The simplest reason why I have faith in the US is that the country cares about its equity markets, arguably more than any other nation.

Approximately 50% of the US population actively participates in stock-market investing, whereas in western Europe this figure ranges from 15% to 25% depending on the country.

This means a strong stock market translates to a greater wealth increase for the population (although admittedly with an uneven distribution). This has led to the US having a clear pro-business attitude, both from Capitol Hill and the Federal Reserve (the Fed).

Since the taper tantrum in 2013, the Fed has largely avoided any material restriction of monetary policy, and even last week it signalled it was unlikely to raise rates until at least 2024, demonstrating its commitment to ensuring US economic growth[1].

While the tone of policy does change with the political tides, I believe there remains a strong bipartisan commitment to a pro-business policy even if Biden looks set to increase corporate taxes in the short term.

I will admit that the growth story behind many emerging markets is exciting, but the US is still home to many companies which are dominant in their global industries, and emerging market competitors will have a mountain to climb to outcompete them.

The US makes up 57% of the MSCI All Cap World Index for a reason. Many emerging market companies have come to prominence not solely through their own dynamism but rather due to state aid and protective policies which have prevented competition from the Western giants.

For example, 2021 marks the first year China will start allowing foreign investors to take majority ownership of domestic companies.

Despite this, US companies remain increasingly dominant in overseas markets, with Amazon having reported its first ever profit from its overseas operations in 2020, while a report by Standard & Poor’s estimates that in 2018 43% of the S&P 500’s sales came from overseas.

There is also the benefit that US companies are less politically exposed than their Chinese peers. When investing in US companies you are ensured continuity of management, with little to no fear of politics disrupting the day-to-day running of a company, allowing shareholders to sleep easier at night.

The idea that US companies will rest on their laurels while emerging markets pass them by is farcical, and there remain plenty of up-and-coming opportunities in the US which can challenge their Asian peers.

Just look at Stripe, the privately held electronic-payment company based in Silicon Valley, whose recent $95bn valuation would make it the seventh-most-valuable company in the MSCI Emerging Markets Index.

A great way to capitalise on the strength of Silicon Valley is through Allianz Technology Trust (ATT). While it has a global remit, ATT retains a major overweight to the US and a bias towards mid-cap technology, a refreshing change from the prevalence of mega-cap tech stocks.

The team have long set out to identify disruptive players in the technology space, investing in the sort of dynamic companies which will drive the dominance of the US over the long term.

Being underweight to mega-cap tech hasn’t cost the trust, with ATT having generated a 332% NAV return over five years, far in excess of the Dow Jones Global Technology Index’s 232.3%.

The strength of the US consumer provides a reason to invest in the more domestically focussed areas of the US market. At the current time the US consumer has never been stronger, with an average US household net worth of $128,151, an 80% increase from its 2007 level.

This has been a long-sustained trend, with household wealth having risen consistently since 1990, bar the four years after the global financial crisis.

I therefore see no reason for the trend not to continue, with consumer assets being an 8.8x multiple of their liabilities and debt repayments being only 9% of disposable income (good indicators of the financial strength of the consumer).

A strong US consumer is music to the ears of small-cap investors, whose companies are disproportionately reliant on domestic consumers.

One such set of investors will be the managers behind JPMorgan US Smaller Companies (JUSC), whose investment process focusses on high-quality smaller companies with an overweight to industrials and financials, sectors primed to take advantage of the strengthening US consumer. Conversely, they avoid the more speculative, binary-outcome companies in biotech and early-stage technology.

This has translated into enviable long-term performance, with a five-year NAV return of 119.1% and the ability to capitalise on the imminent tailwinds supporting US small caps, thanks to the fiscal stimulus from the Biden government.

For US exposure with an all-cap approach, JPMorgan American (JAM) looks interesting. Since 1 June 2019 the trust has been managed in an innovative fashion, with the portfolio split between growth and value allocations managed by separate managers.

Performance has been strong since then, with NAV total returns of 41.2% compared to 34.2% for the S&P 500. This is impressive given the trust’s inability to go all in on growth stocks, which means it does offer an option for investors wanting a ‘core’ exposure to the US.

[1] The Federal Reserve has a dual mandate of both economic growth and inflation control, which can conflict with each other when setting monetary policy.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

Commentary » investment trust commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.