Jul

2021

Dystopia 2.0? Assessing the post-COVID landscape

DIY Investor

12 July 2021

Although COVID-19 has changed the way we live and work, it has largely been a booster rocket for changes that were happening all along. John Pattullo, Co-Head of Strategic Fixed Income, explains.

Key Takeaways

- The COVID-19 crisis has propelled the pace of structural change and the world will likely be more deflationary in the future with lower, not higher, bond yields.

- Cyclical change separates companies into growth and value but structural change separates companies into winners and losers – losers don’t ‘mean revert’, they go bust.

- The current obsession with some expected, transitory inflation is, in our view, a modest headwind for the bond market, compared to the growing disruptive secular forces, which we are experiencing more than ever.

Always look at where the puck is going, not where it is

Back in 2013, we started talking about the Japanification (referring to Japan’s experience of persistently low growth, low inflation and low interest rates) of Europe. Many people thought we were mad, but this has come to pass.

We have long been sympathetic to Larry Summers’ secular stagnation view of the world (pre-COVID), for the now well-versed reasons such as excessive debt, demographics, technology and lack of productivity. The COVID crisis has obviously accelerated many of the structural issues facing the world. Behaviours have changed; many permanently, some temporarily.

One example of a significant structural change is the environmental, social and governance (ESG) trend, which was building critical mass pre-COVID and has now gone exponential.

As bond managers, we must assess the implication of all changes impacting both our portfolios, and indeed our lives. We feel that going forward the world will be more deflationary with lower, not higher, bond yields.

Some of this change is permanent; we are not going to revert to the old way of doing things. The disruptions will likely only exaggerate winners and losers, erode margins and concentrate the limited growth we have in fewer more dominant American companies.

We always try to look where the puck is going, not where it is. The current obsession with some expected – and inevitable – transitory bottleneck inflation is, in our view, a small headwind for the bond market; it looks modest and is more than priced in, compared to the growing disruptive secular forces that we are experiencing now, more than ever.

In the sections that follow, I will discuss how we see the world changing. Warning: this is not very cheery.

New consumption patterns impacting revenues

I went into the office at the end of April — the first time for 14 months. I actually started working from home (WFH) a week before my team, as in late February 2020 I had been on a business trip in Uruguay.

I did chuckle the other day when we all received a ‘test’, disaster recovery e-mail, which required acknowledgment. Haven’t we just had a real world stress test of how useless a formal disaster recovery site can be? But, in fact, virtual working can thrive.

We are all creatures of habit, which includes the daily flat white (and often £10 lunch) from the coffee shop below our building. It is widely accepted that most of us will be working just two or three days a week in the office – which means that coffee shop’s revenue is then presumably down 40% and won’t be viable.

Who’s going to pay the rent for that unit? Sure, the landlord can throw the tenant out and leave the space void, or more likely retain the tenant and find a new and true equilibrium rent; perhaps, based on turnover. This will all be coming to a significant crunch in the next couple of months as the rent moratorium ceases (currently 30 June in the UK).

So, landlord cash flows will likely fall significantly (many pension funds are, of course, the landlords). Overall, there are major implications for cash flows and businesses serving the central business district in any city, let alone pensioner incomes.

The not so rosy outlook for physical retail

A recent British Retail Consortium survey reported that 14% of high street shops (physical stores) in the UK remain empty and the proportion of empty units in shopping centres has risen to 18.4%, though shop vacancy rate at retail parks is only 10.6%. These trends were not great pre-COVID but have become much worse as consumption patterns have changed.

I’ve always considered most retail as non-essential, but on the rare occasion that I have ventured into a shop, I was usually told that they don’t have my size in stock and I should look online. The UK does lead the world in a few things, one of them is internet shopping.

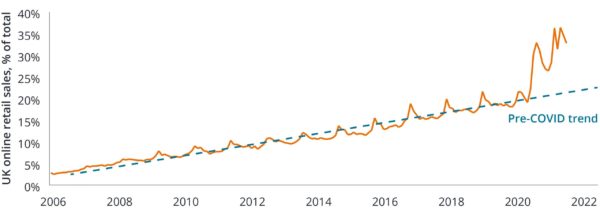

Figure 1 shows the stunning acceleration in online purchases due to COVID. As Deutsche Bank puts it, “a decade of Amazonization in just a few months”1. The rest of the world can only catch up here. Funnily enough, I have never been back to those shops that pointed me online.

Fig 1: A Decade of ‘Amazonization’ in just a few months

The list of behavioural changes impacting consumption patterns is endless and we have to think how we are all contributing to the change. I’m not a great fan of facial hair, but I am shaving half as often as pre‑COVID; guess I need a lot fewer razor blades.

I don’t fancy manufacturing suits or formal shirts (my need for them have diminished) or even running a dry cleaning business in the UK (the latter was hit especially hard when smoking was banned in the UK, for obvious reasons). By the way, I have a patio heater for sale if anybody is interested. It did a great job and kept us warm for our outside team lunch in December.

The future of offices and travelling to get there

Do I need a season ticket for the train (Transport for London is already £2 billion behind budget)? Jenna (Barnard) and I used to travel quarterly to Jersey for a board meeting. We tried video conferencing years ago but it was awful and the connection broke down. The ubiquitous Zoom is exceptionally good and will likely replace many trips to Jersey and other places.

COVID has proved how easy it is to work from home. Barbados are offering one-year work permits for anybody to WFH. Given the appalling London spring weather I think we should have tried it. This digitalisation of the workforce may lead to an expansion of the workforce and presumably will lower costs per Deutsche Bank’s ‘Labor supply is going up, up, up’.

As they point out, Australia has seen a surge in labour force participation, led by women, where the benefits of flexible working may be greater. Perhaps all our jobs will be offshored – not just call centres to India – enabling higher workforce participation, which only suppresses wage growth.

Let’s consider the demand for office space; HSBC has said it has 20% less demand for office space this year and 40% less longer term2.

Central London already had a lot of redundant property pre-COVID. The optimists seem to think WeWork will take occupancy and the rest will turn residential. I think not. More likely to stay vacant.

HSBC also expects to halve its business travel budget2. This is brutal, as the true profit contribution for most airlines is courtesy of business class travel. Emirates had most of its A380 double-deckers lying idle pre-COVID … and we are really worrying about inflationary airfares affecting the consumer price index?

Changing patterns in leisure

Cinemas are a classic and fairly obvious structural change story. They are high fixed-cost businesses that are very dependent on the slate of blockbuster films and a delayed ‘window’ between cinema release and streaming/DVD release. The latter window has been shrinking for years and all but vanished during the pandemic.

So, again the direction of travel is not surprising, but the pace accelerated due to COVID. Disney+ has gone to immediate streaming release, which has massive implications for AMC cinemas among others (AMC cinemas, of course, along with Carnival Cruises, became the poster children for ‘rescue bridge finance’ in the eye of the crisis). Amazon has just released results highlighting a 50 million increase in Prime video subscribers and a 70% uptick in streaming demand over the last year.

Gyms’ and personal trainers’ margins have obviously been eroded. Many online classes are free or very cheap. Incidentally, the cost of dumbbells has gone through the roof as people started exercising at home. Four people in our team of six have bought Peloton exercise bikes in the last year – there goes the gym membership forever!

In addition, within the team, we have all bought extra screens, headsets and webcams, but do we need any more? China’s exports to the US are up 30% compared to two years ago. We doubt this is sustainable as home goods expenditure has been significant, much of it one-off, and now turning to services.

Having said that, people won’t have double haircuts to compensate for not having any during lockdowns, so some of this expenditure has been lost forever. The recent supply chain bottlenecks are not a great surprise but should not be confused with a structural change in inflation.

Finally, I read in an article that over three million UK households have bought pets during the pandemic.3 (The term ‘humanisation’ is new to me; my friends tell me their dog can speak, but I am not so sure.) The same article stated that half of the UK new pet owners are aged under 34.

The Office for National Statistics has even added dog treats to the inflation basket in the UK – ruff ruff! Certain pet-related businesses and investment vehicles have benefited amid this trend. A pet care ETF, for example, outperformed the Nasdaq for the 12 months ending in May4. (A dog is not just for COVID days, by the way.)

Family values and yet more societal change

I sometimes feel that the world is simply spinning too fast. The pace of change is frightening. The average life of companies in the S&P 500 Index has shortened dramatically. I think that perhaps we have all taken a breather to consider that we are not just hamsters on a wheel; family life and friendship are vitally important.

In that vein, Bloomberg ran a piece on how affluent Americans have rushed to retire recently5, and we know millennials (or Generation Y) have very different values compared to Generation X (one of whom turned 51 on 9 May). Financial advisors also say they are seeing a ‘life is short’ attitude among wealthy clients.

But disparity is growing. French economist Thomas Piketty talks about intergenerational inequality, which he defines as the fact that some lucky people will (only) acquire wealth in the ‘inheritance society’ we live in, while others can only dream about being able to pay off their student loans, let alone being able to purchase a first house.

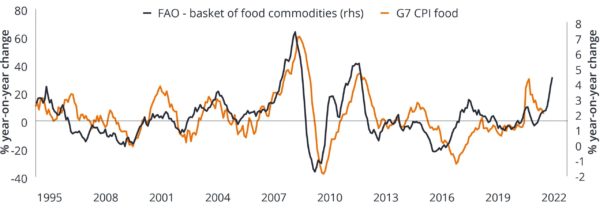

We also know COVID has fallen very heavily on the poor and the black, Asian and minority ethnic (BAME) communities. The current ‘commodity inflation’ will make weekly food shopping even more expensive. Figure 2 shows how the price of a basket of food commodities is on the rise. President Biden is trying to make society more equitable but COVID has highlighted the vast inequality more than ever – the K-shaped recovery.

Fig 2: Weekly Food Shopping Likely to get More Expensive

Source: Refinitiv Datastream, Simon Ward, Economic Advisor, percentage year-on-year (yoy) changes, as at April 2021. G7 food consumer prices (CPI) versus Food and Agriculture Organization (FAO) Food Price Index (FFOI). The FAO Food Price Index is a measure of the monthly change in international prices of a basket of food commodities.

The ‘precariat’ zero-hours workers are also more vulnerable. I would recommend Ken Loach’s new film “Sorry I missed you” (on Amazon Prime, ironically enough), about the dire plight of a zero hours delivery driver – grim …

It is the extra adoption of technology which is accelerating the pace of change. Artificial intelligence (AI), smart beta, exchange-traded funds (ETFs), 3D printers, robotics, algorithms, let alone blockchain and digital money, I would suggest are predominately deflationary and will disrupt society and equality even more.

Some industries are ripe for disruption, such as finance. Healthcare is also making significant progress here. I am a member of Babylon, the UK National Health Service (NHS) online video doctor – how efficient is that? Signing up is free and tests have shown that their expert systems are more accurate at diagnosing many symptoms than the average doctor.

Be warned and let’s not get distracted by a welcome reflationary impulse.

Population impact

You may have expected a mini baby boom due to COVID but in fact we have had the opposite, the so called ‘baby bust’. During COVID, people have understandably become more cautious about the future; those lucky enough to have retained a job have saved a lot of their income, albeit partially by choice and partially due to the inability to spend.

The French have been one of Europe’s best procreators historically; however, data for January 2021 shows a fall in births of 13% in the country over the prior period. Last year, the US birth rate fell 4%, the largest single-year drop in nearly 50 years taking the fertility rate to 1.6 (births per woman), the lowest on record6.

Turning Japanese was considered a criticism by many, but people forget that Japanese gross domestic product (GDP) per head – in our view, a more valuable measure of success than total GDP growth – has been pretty respectable in the last couple of decades. The country’s population is currently shrinking at half a million people a year, on a base of 126 million, and the fertility rate is 1.4.

Migration has also been significantly curtailed due to COVID. Australia had been the poster child for immigration – they were attracting approximately 300,000 young, educated, family forming, productive and consuming people a year to help the country grow.

More recently these levels have fallen by an estimated 70-80%7. New Zealand and Canada among others have all experienced great falls in migrants. This will have noticeable effects on longer term growth potential.

In addition, it is fair to assume mobility levels may well be impaired as some countries, including Australia and New Zealand, have closed themselves off. The UK lost up to 1.5 million workers in the last couple of years, largely due to Brexit, but more recently also due to COVID. Are these workers coming back? Some people estimate approximately half of these people will return. Let’s hope so.

Concluding thoughts: stick to structural winners

Cyclical change separates companies into growth and value but structural change separates companies into winners and losers. Losers don’t ‘mean revert’, they go bust. I’m sorry if this is all a bit depressing; it’s just the way we see an increasingly dystopian world. One of our big London clients calls me ‘miserable John’ – fair dues, I guess.

Don’t get sidetracked by the cyclical and inevitable reflation trade; try to think one step ahead and anticipate the larger and more persistent structural trends pervading all our lives. COVID has simply accelerated the structural forces we are all grappling with as well as the pace of digital, structural change for our bond investments.

We will not get sucked into illusionary cyclical, value traps; nor into illiquids, exotics or esoterics. ‘Keep it simple, stupid’, and buy the bonds of structural winners. If you look after the downside, the upside should look after itself.

1 Deutsche Bank Research, FX Blog, ‘Labor supply is going up, up, up’; 5 May 2021.

2 Bloomberg, ‘HSBC to Cut Office Space 20%, Reduce Business Travel by Half’, 27 April 2021.

3 Financial Times, ‘Pet mania’ brings out animal instincts in eager investors, 27 April 2021.

4 Bloomberg, as at 28 May 2021.

5 Bloomberg, Affluent Americans rush to retire in new ‘life-is-short’ mindset, 30 April 2021.

6 The Guardian, US birth rate sees biggest fall for nearly 50 years, 5 May 2021.

7 Financial Times, Sharp fall in global migration threatens economic recovery, 9 February 2021.

Click to visit:

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Leave a Reply

You must be logged in to post a comment.