Jul

2023

Dude, where’s my pension? – Part 2, what’s in the box?

DIY Investor

9 July 2023

Hello and thanks for joining us for the second instalment of Dude, where’s my Pension? where we start to look at the nuts and bolts that make up your workplace pension. Through this series we’re going to help you understand how yours works and hopefully bring you closer to it.

What am I invested in?

In the first blog, we confirmed that you pay into your pension fund every month, and it in turn invests in companies. But what do the funds you invest in actually buy?

By far the quickest and easiest way to find out is through your pension provider. Hopefully you managed to get fund factsheets with your statements, or you may have found them online.

If they’re not available on your pension scheme’s website, you can find information on websites like Morningstar or Trustnet – all you need is the pension fund name (we covered how to identify this in the first blog).

While you’ve been investigating your own pensions, you may have come across terms like equities, bonds and fixed income. If these are new to you, we’ve explained what they mean in our Guide to Investments.

That and our guide on How to choose the best investments are well worth a quick read. For any other confusing terms you’ve encountered we’ve got a jargon buster that’ll explain things for you using simple words – it’s worth bookmarking it now for future use.

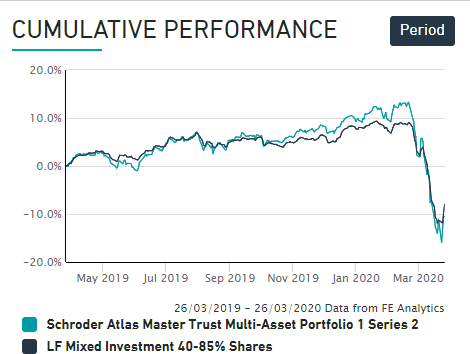

Coronavirus – time in the market and the long game

I will cover this in a future blog in more detail, but I thought it was important to start with a bit about the effect the Coronavirus has had on the markets. Some of you following this blog might be looking at your pension for the first time and see the impact it’s had on the value of your pension.

Most people will have seen some sharp falls in pension values due to the Coronavirus pandemic (mine went down by 20% almost overnight). But it’s important to remember that you’re invested for the long term and that your pension pot will eventually recover and grow even further.

The key is to maintain your pension contributions and not panic. Buying when investments are cheaply valued means that when the market recovers, your pension pot will be worth a lot more.

It’s also important to understand that time in the market is one of the most important factors for long-term growth. For a more in-depth look at this, see our recent blog on the Coronavirus’s effect on investments.

And with that, let’s get cracking.

Pension documentation – three ways

The information provided by schemes can differ widely, as my friends’ experiences will show. We’ll look at Rob’s pension with Nest, George’s with Atlas and Amy’s with Crystal (not their real names). Each experiences was different, with some much better than others.

The easy way – Rob’s pension with Nest

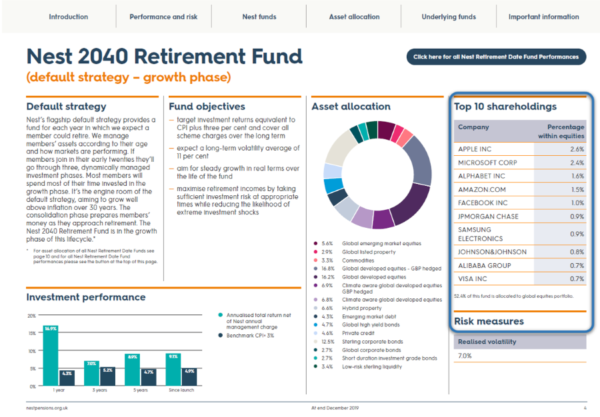

We’ll start with Rob who has a small pension from a previous job. His previous employer set one up with a pension scheme called Nest. He’d not checked it since it was opened, but it’s still alive and kicking, and invested in one of its pension funds, the Nest Retirement Fund.

Nest is the Government-backed pension scheme that was created after auto-enrolment was launched in 2012. Auto-enrolment is a government project that makes sure everyone, wherever they’re employed, has access to a pension.

It meant that every employer had to offer their employees a pension scheme. Employers can choose from the many workplace pension providers in the market or they can go with Nest, the government scheme. A lot of employers have gone with Nest and today it’s one of the largest workplace pension providers in the country.

Of all my friends’ pensions I’ve looked at, the one with Nest from a past job was the easiest to understand where it was being invested. Nest provides lots of key information for all its pension funds in a quarterly update. We found the page with details of his fund and voilà, here are the companies he’s invested in. Very nice.

As you can see, only the top ten companies (shareholdings) are confirmed, which is normal. Some funds invest in many more companies, but often the top ten make up the majority of the investment (and it saves having a long list of tiny percentages).

Nest makes a lot of information about its pensions publicly available through its website and it’s generally easy to navigate (often you don’t even need to be a member to have a nose around). Looking at your pension is much easier if you don’t need to go hunting for information or call your pension provider, especially if it’s your first time looking at it.

In addition, being transparent about how it runs its pensions, how much it charges, and other important information helps to build trust between the scheme and its members. Some pension providers don’t do this very well and should learn from Nest’s openness.

The not so easy way – George

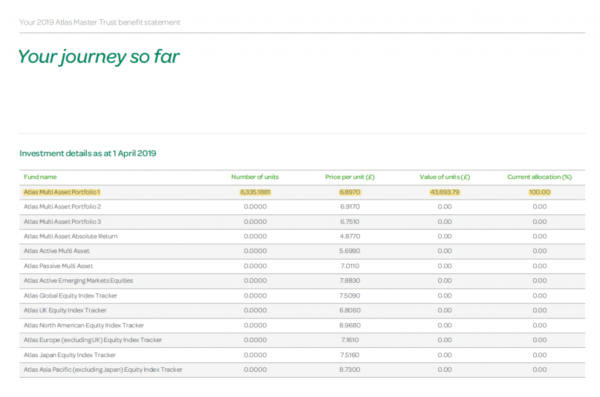

Unfortunately, finding out where your money is being invested isn’t always as easy. My friend George has a workplace pension with Atlas. From his fairly recent pension statement, we found on the third page that his pension fund was called ‘Atlas Multi-Asset Portfolio 1’.

He’s only invested in the one fund highlighted in the image, but Atlas lazily hasn’t personalised his statement and shows every single fund in the scheme, which is confusing.

George has built up a fairly large pot for someone his age. Don’t worry if yours isn’t this big, he started early and understood the importance of building a pension (even if he didn’t know how it actually worked).

You can increase your payments at any time and it’s a good idea to invest as much as possible, especially when you’re younger.

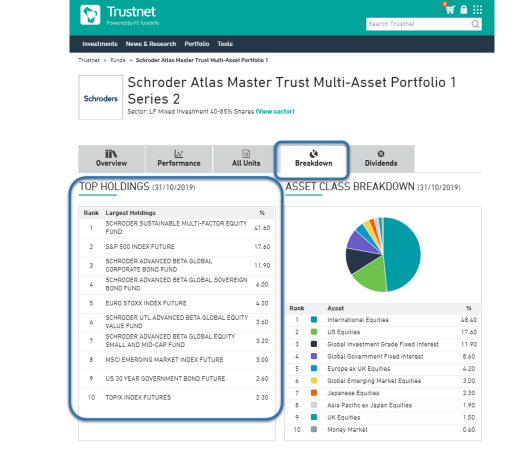

But back to the Atlas Multi Asset Portfolio 1. There was nothing on the underlying investments in his statements, so we had to dig. We went to Trustnet.com.

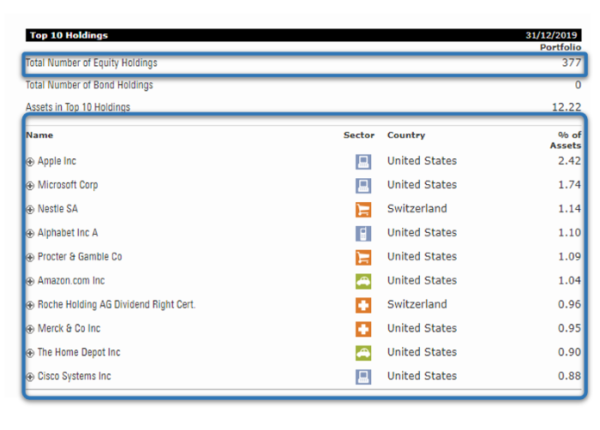

We found that the Atlas Multi Asset 1 fund had more funds within it – known as a fund of funds — which means we had to look at each of the underlying funds. We started with the largest holding, the Schroder Sustainable Multi-Factor Equity fund. Trustnet didn’t have the breakdown, so we used Morningstar. After choosing the Portfolio tab we found the top ten holdings (out of 377 in total!).

Rob and George were surprised but pleased to learn that they’re tiny shareholders in some of the world’s largest companies. Until now they had no idea where money being deducted from their pay cheque went every month. Now that they’ve understood, they want to know more about where their money is being invested.

The hard way – Amy’s pension with Crystal

Lastly, we’ll look at Amy’s workplace pension run by Crystal. She is invested in their Lifestyle fund as it’s the default choice chosen by her employer.

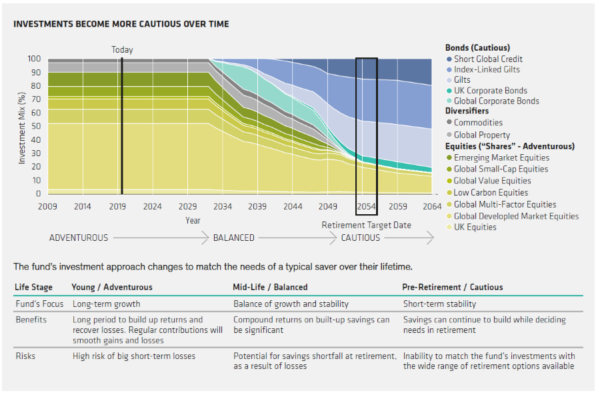

Life styling funds are common. They take more risk when you’re young and automatically move to less risky investments when you’re approaching the retirement date (often confirmed in the pension fund name).

As you can see below, her pension automatically switches from holding a lot in equities (riskier) to holding a lot in bonds (much less risky) as she approaches her retirement age (as a reminder, these are explained in our guide to investments).

Lifestyle funds move from riskier to safer investments automatically over time. It assumes that everyone is going to retire on or around the same date because they’re the same age. In reality, this is hardly ever the case.

The way people view retirement is changing. Some people want to work for longer or work part-time, others want to dip in and out of work so the traditional way of looking at retirement is increasingly outdated.

Unfortunately, there wasn’t enough information available from Crystal to determine who manages this fund and what companies it’s invested in.

We’ll be asking Crystal for more information so we can work it out. This is the kind of information that should be readily available to scheme members — Amy shouldn’t have to ask for it. We’ll be pushing Crystal to make their pension scheme much more transparent and easier to navigate.

Taking charge

The purpose of the first two blogs was to make sure we’ve all got the same broad understanding of how workplace pensions work and where your money goes each month. We’re going to build on this by looking at performance and charges next time – and to help you work out if you’re getting value for money.

You shouldn’t need anything in addition to what we’ve collected so far (pension statement and a fund factsheet) but it might be worth checking if charges are confirmed in them. If you don’t have this, don’t worry too much, we’ll have plenty of examples to share with you.

First published by our friends at:

Commentary » Latest » Mutual funds Commentary » Pensions commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.