Apr

2021

DIY Investors say Vanguard offers the best value funds according to research

DIY Investor

5 April 2021

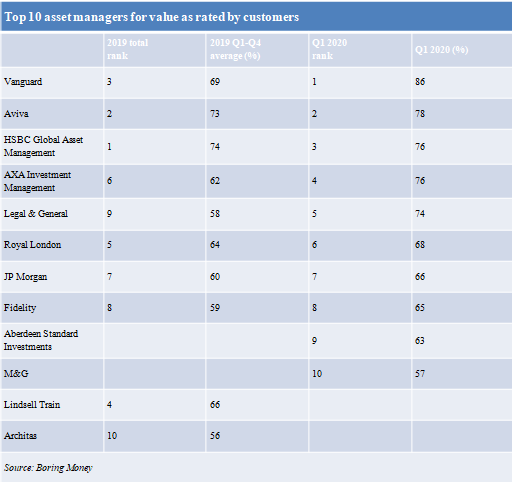

A recent study by investment information platform Boring Money which asks customers which funds they feel offer investments at a fair price has ranked passive investing giant Vanguard in top spot.

The research, which was conducted just after the coronavirus-induced crash in March, found that in general, fund managers with a large passive fund range performed well, as did those with a strong retail brand.

Regulator, the Financial Conduct Authority, is working to tidy up consistently underperforming and/or overpriced funds and share classes; it told all asset managers last year that they would have to publish ‘assessments of value’ in 2020.

Vanguard also runs an own-brand DIY investing platform which has expanded from offering stocks and shares ISAs to claim the lowest cost SIPP in the market; it is the first time Vanguard has taken the top position, having been ranked an average of third place last year.

Smaller UK-centric brands such as Lindsell Train and Fundsmith, which have enjoyed loyal followings, did not fare so well with both dropping 10% from the previous survey results; this indicates that investors consider them expensive.

DIY investing has flourished during lockdown with brokers and platforms reporting accounts being opened in record numbers

DIY investing has flourished during lockdown with brokers and platforms reporting accounts being opened in record numbers as people take personal financial control.

Vanguard’s popularity has soared during a time when stock markets around the world have been hugely volatile and seen unprecedented crashes; 86% of Vanguard investors surveyed said it offered good value at the end of March 2020 compared to an average of 69% for the survey results at the end of each quarter in 2019.

Ranked just behind Vanguard were the ‘big beasts’ of Aviva and HSBC Global Asset Management, both of which are well-known global brands; they had a 2019 average rank of second and first place respectively.

In announcing its findings, Boring Money’s MD, Holly Mackay, said: ‘We see very different responses about what value means for customers of different brands.

‘For less confident investors, there tends to be a bigger weighting on size and perceived stability and strength. For the hobbyists, performance net of all charges is more likely to be the only focus, when it comes to assessing value.

‘The crash changed the story to a much more acute focus on costs and charges- probably the only number investors felt they could control in that last weekend of March.’

Overall the average value percentage score fell from 54% in 2019 to 53% for the first quarter of 2020; the score for 13 out of the 30 brands reviewed was less than 50%.

Eight of the top ten fund managers for Q1 2020 were in the overall 2019 top ten with Aberdeen Standard Investments and M&G as new entrants; Lindsell Train and Architas dropped out of the top ten, reflecting a broader lower score for smaller and more UK-centric brands.

Across the board, it appears that most brands have some work to do in communicating with DIY investors; self-directed investors gave an average value rating of 50% compared to a generally more satisfied group of investors who had taken professional advice and gave an average value rating of 60%.

Assessments of Value are designed to give investors an indication of the value offered by a fund.

However, Ms Mackay noted: ‘The first cohort of published value assessment statements tended to gloss over the service element of value, and most managers have marked their own homework and given themselves a gold star.’

It was for this reason that Boring Money began tracking real customer views on value.

‘Performance and price are objective numbers,’ she said. ‘Value is more subjective than this. How can you ascertain value without asking the people who actually pay your fees what they think?’

In each survey customers were asked which brands they hold funds with and which of those brands offer good value. The scores are the percentage of customers of a brand who answered positively.

Click to visit our friends at:

Leave a Reply

You must be logged in to post a comment.