Jul

2020

DIY Investors Increasingly Fuelling Demand for Investment Trusts

DIY Investor

7 July 2020

One of the few good news stories to come out of the pandemic is that with time on their hands there has been a huge increase in the number of people seeking to take control of their finances and open accounts with a whole range of DIY brokers and investing platforms –

See also: ‘Coronavirus Lockdown Fuels Spike in DIY Investing’

Now a report entitled ‘Investment Trusts: Changing Ownership Trends’ has highlighted that DIY investors are outstripping wealth managers when it comes to using investment trusts in their portfolios.

Richard Davies Investor Relations (RD:IR) and consultancy Warhorse Partners, analysed share register data for more than 220 UK-listed investment companies with a combined market value of £110bn.

‘forced to rethink their marketing and communications to better target increasingly significant DIY investors’

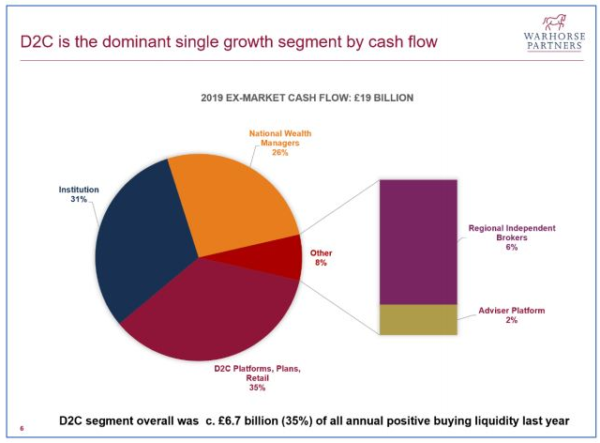

They found that retail or direct to consumer (D2C) investors accounted for 35% of total market cap, eclipsing institutions (29%) and wealth managers (28%); independent regional brokers at 6% and adviser platforms at 2% complete the picture .

Retail clients invested £6.7bn in investment trusts in 2019 taking their total stake to £38bn of investment trust assets.

Wealth managers’ investment reduced by £1.8bn over the same period, the report describing them as a ‘dominant but declining force in the investment trust sector’; several of the bigger wealth groups have reduced their investment trust exposure – the report used the examples of Investec Wealth and Brewin Dolphin, which have been net sellers of trusts for a number of years.

As a result in this shift, many investment company boards have been forced to rethink their marketing and communications to better target increasingly significant DIY investors.

Source: Investment Trusts: changing ownership trends 2019 report

DIY investors replacing wealth managers in trusts

In announcing its findings, Warhorse founder Piers Currie refuted that the investment trust sector is in decline because some of the larger wealth managers were stepping away, saying: ‘The shortfall in demand from that source has been more than made up for by the growth of retail demand through platforms. The challenge for any investment trust board today is to identify how effectively it is tailoring its marketing and communications to this new audience.’

In response to the report, Nick Britton, head of intermediary communications at the Association of Investment Companies, said many of its member companies are seeing an increased proportion of their holdings coming from consumer platforms, with the largest wealth managers reducing their exposure.

‘Direct investors are attracted to investment companies for many different reasons, including their strong long-term performance and income advantages’

‘Direct investors are attracted to investment companies for many different reasons, including their strong long-term performance and income advantages,’ said Mr Britton. ‘While large wealth managers are still among the biggest holders of investment companies, they have scaled back their holdings in recent years as they are now too large to make meaningful allocations to some of the smaller investment companies.’

The study only covers 70% of the industry by market cap, and the AIC says it would be interesting to know which companies make up the ‘missing’ 30% as this could have an impact on the results; as an example it cites that from its experience wealth managers have shown considerable interest in alternative assets.

‘The ability of investment companies to offer access to less liquid alternative assets, such as property and infrastructure, has ensured that the structure remains relevant to all investors seeking diversification across asset classes, including wealth managers, financial advisers and private investors,’ said Mr Britton.

Rapid growth of platforms as people turn to DIY investing

The report noted that the proliferation and rapid growth of DIY brokers and platforms has contributed greatly by introducing retail investors into trusts.

Whilst Bristolian behemoth Hargreaves Lansdown remains at the top of the heap with 1.2m customers and more than £100bn under management, others such as the acquisitive interactive investor have been striving to close the gap.

‘Investors can get a bargain by snapping up investment trust shares when they are trading at a discount’

Myron Jobson, personal finance campaigner at ii, which recently added TD Waterhouse, Alliance Trust Savings and the Share Centre to its fold told Portfolio Adviser that the report’s stats on investment trusts tallies with the platform’s own data, reflecting a recent trend seen among its customers.

Mr Jobson says the volume of investment trust purchases rose 107% between 1 January and 30 June 2020 compared with the same period in 2019. It is a similar story since the Covid-19 lockdown, 23 March to 28 June 2020, with investment trust purchases up 91% year-on-year during the period.

‘The allure of investment trusts is easy to see. Investors can get a bargain by snapping up investment trust shares when they are trading at a discount while the ability for investment trust managers to gear can potentially produce a better return on the capital invested – although losses can be exacerbated during periods of underperformance.

‘DIY customers, attracted by strong dividend track records, the discount and premium mechanism, and gearing’

‘In addition, being closed ended is a key advantage if the fund is invested in illiquid assets, like property, that cannot be bought and sold easily.’

According to AJ Bell investment trusts have always been a popular investment option for DIY customers, attracted by strong dividend track records, the discount and premium mechanism, and gearing.That trusts are slightly more complicated than funds means that more sophisticated retail investors are the heaviest investors in them.

A spokesman told Portfolio Adviser: ‘I think the growing share of the overall market cap of trusts by retail investors is a function of the rapid growth of DIY investing over the past few years. Our typical DIY investor has about 15% of their portfolio in investment trusts and if that is reflected across other platforms, as the DIY platform sector grows the proportion of the investment trust market owned by those investors will also grow.’

If you would like to learn more about investment trusts visit our comprehensive section on DIY investor here.

Brokers Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Take control of your finances commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.