Oct

2020

Diversifying for good and growing income opportunities

DIY Investor

24 October 2020

In its latest Dividend Monitor, looking at income paid by companies to shareholders, Link Asset Services reported an important feature that is often overlooked, dividend growth.

In this case, its report highlighted that underlying dividend growth of UK listed companies was weaker than expected. So, why is this important? Research shows that dividend growth companies tend to outperform the market in the long term.

‘the UK’s dividend clothes are starting to look a bit threadbare underneath.’

However, as Michael Kempe, chief operating officer at Link Market Services said: ‘the UK’s dividend clothes are starting to look a bit threadbare underneath.’

One way to combat this trend is to look at a wider set of income opportunities. The Diverse Income Trust plc is able to do just this as it invests across a range of larger and smaller listed companies looking to generate a good and growing stream of dividend income. One of the great advantages of this approach is the broader investment universe it can access.

Many investments that have an objective of delivering dividend income invest in the largest listed companies as these are the largest sources of dividend income.

‘a much wider investment universe and its portfolio income is therefore derived from a broader range of sectors’

However, the largest listed companies tend to operate in a limited range of industry sectors, which means that their dividend income is closely linked to the prosperity or otherwise of the relevant industries.

The Diverse Income Trust invests across a much wider investment universe and its portfolio income is therefore derived from a broader range of sectors. Importantly, this wider opportunity set also enables the fund managers to avoid participating in some industry sectors where their dividend prospects are anticipated to be less certain.

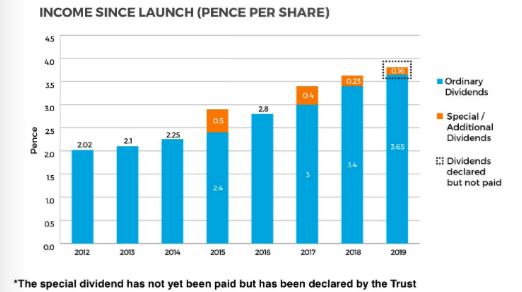

The company has demonstrated that it is able to deliver good and growing income. Since the Trust launched in 2011 it has increased its dividend year-on-year by 8.8%. The table below shows the Trust’s dividend history:

Dividend Distributions (pence per share)

Furthermore, with a larger universe of company shares to choose from there is better scope to be risk sensitive, for example through minimising the need to hold the shares of companies that have significant corporate debt.

Many of the companies in the portfolio have been selected on the basis that they tend to have stronger balance sheets, as those with excessive debts often suffer disproportionately during more economically challenging periods.

It is also anticipated that, if the Trust succeeds at delivering dividend growth, then over the longer term this could be accompanied by capital gain.

Find out more at mitongroup.com

Risks

The value of investments will fluctuate which will cause trust prices to fall as well as rise and investors may not get back the original amount invested.

Forecasts are not reliable indicators of future returns.

Past distributions of dividends are not a guide to future distributions.

In certain market conditions companies may reduce or even suspend paying dividends until conditions improve.

Miton has used all reasonable efforts to ensure the accuracy of the information contained in the communication, however some information and statistical data has been obtained from external sources. Whilst Miton believes these sources to be reliable, Miton cannot guarantee the reliability, completeness or accuracy of the content or provide a warrantee.

Investors should read the Trust’s product documentation before investing including, the PRIIPs Key Information Document (KID), the latest Annual Report and Accounts and the Alternative Investment Fund Managers Directive (AIFMD) Disclosure Document as they contain important information regarding the trust, including charges, tax and specific risk warnings and will form the basis of any investment.

We are unable to give financial advice. If you are unsure about the suitability of an investment, please speak to a financial adviser.

This financial promotion is issued by Miton, a trading name of Miton Trust Managers Limited. Miton Trust Managers Limited is authorised and regulated by the Financial Conduct Authority and is registered in England No. 4569694 with its registered office at 6th Floor, Paternoster House, 65 St Paul’s Churchyard, London, EC4M 8AB.

MFP19/377

Commentary » Equities » Equities Commentary » Investment trusts Commentary » Investment trusts Latest

Leave a Reply

You must be logged in to post a comment.