Apr

2021

Disaffected savers turn to DIY investing; which shares, funds and trusts have they been buying?

DIY Investor

4 April 2021

Execution only brokers and DIY investing platforms across the board have experienced high levels of activity during the pandemic as increasing numbers of people have sought to reorganise and take personal control of their finances – Coronavirus Lockdown Fuels Spike in DIY Investing

Bristolean Behemoth Hargreaves Lansdown said that its Active Savings division saw a ‘marked impact’ on inflows when National Savings and Investments cut its interest rates on cash savings, but people are increasingly looking to stockmarket investments to deliver superior returns.

31,000 signed up for DIY investing accounts with Hargreaves in the three months to September; the company now looks after total customer assets of almost £107bn, a year-on-year increase of 3%.

Hargreaves’ revenue for the quarter hit almost £144m as it conducted almost 1m trades a month in volatile markets.

There has been a marked rise in private investing over the past six months across funds, trusts and especially stocks and shares; so, where have DIY investors been putting their money since the UK was forced to go into lockdown on 23rd March?

AJ Bell recently revealed the most bought funds, trusts and shares on its platform and how they have performed; Fundsmith Equity was its most purchased fund, Scottish Mortgage its most bought investment trust and Lloyds Bank its most popular share.

The £21bn Fundsmith Equity Fund, run by star manager Terry Smith was the most bought fund; always a firm favourite in the investing world, it has only become moreso during the pandemic – and investors have been rewarded with returns of just under 30% since 23rd March.

Nick Train’s £7.7bn Lindsell Train Global Equity fund was the second best-selling fund, followed by the £5bn Baillie Gifford American fund; they have delivered 24% and a whopping 101% respectively.

The top 10 funds have returned an average of 48% over the past six months as AJ Bell reports demand for funds considered ‘safe’ due to their global and diversified nature during such uncertain times.

Best-selling funds since lockdown

Baillie Gifford is well represented with its Positive Change and Global Discovery funds featuring in the top 10 best-selling funds over lockdown alongside its American fund.

Baillie Gifford’s £14bn Scottish Mortgage investment trust is the most bought since 23rd March; known for being a long-term holder of some of the world’s biggest technology companies such as Amazon, Tencent and Tesla, investors have reaped a 108% return since lockdown.

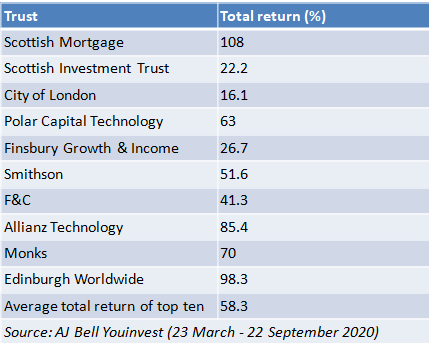

Other popular investment trusts include Janus Henderson’s City of London investment trust, Polar Capital Technology, Finsbury Growth and Income and Smithson; the top 10 best-selling trusts have returned an average of 58%.

Best-selling investment trusts since lockdown

In announcing its findings, Ryan Hughes, head of active portfolios at AJ Bell, said investors saw the stock market crash in March as an opportunity to adjust their portfolios, leading to high trading volumes at the start of lockdown.

‘But what is really interesting is that the majority of these were people purchasing investments rather than selling them so clearly investors were looking to benefit from depressed prices rather than rushing for the exit,’ he said.

‘Many of the most popular funds and investment trusts are similar to the ones that were popular before the market crash so investors clearly haven’t shifted their thinking too much and they’ve been well rewarded for keeping faith in these managers as values have bounced back strongly.’

There is a clear global emphasis among the most popular funds and trusts as the UK market remain’s largely unloved with Brexit adding to fears of the pandemic; technology is the most dominant theme.

Mr Hughes added: ‘This has been a good call by these investors as tech stocks have performed extremely well during the pandemic.

‘The question now for those investors is whether that party is over but with further lockdowns being implemented around the world, technology is still very much going to be at the forefront of people’s lives.’

This is Money recently spoke to a number of DIY investing platforms to find out how more of the nation became hooked on the stock market while in quarantine; according to AJ Bell, in terms of the shares they were buying, financial institutions, energy and aviation companies led the way.

Its best-selling share was Lloyds Banking Group, followed by BP, Royal Dutch Shell and International Consolidated Airlines; all four companies are now down since 23rd March, marking losses of 19%, 0.8%, 3.7% and 20% respectively, although in extremely volatile markets there have been times when each delivered exceptional day returns, hence their popularity.

Perhaps unsurprisingly given the circumstances, pharma and biomedical firms were also among the most purchased; GlaxoSmithKline was the fifth most-bought share while Avacta Life Sciences which came in at seventh, has delivered a staggering 832% since lockdown.

The top 10 most purchased shares delivered the highest average return of 95%, helped in no small part by Avacta’s incredible return.

Best-selling shares since lockdown

Commentary » Equities » Equities Commentary » Equities Latest » Investment trusts Commentary » Investment trusts Latest » Investment trusts Video » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.