Jun

2022

Digital Assets- Bitcoin irrational hype or financial revolution?

DIY Investor

1 June 2022

Cryptocurrencies – irrational hype or financial revolution?

Bitcoin (BTC) and other digital assets have been making the headlines in recent months, polarising the investment community with an equal number of strong advocates and fierce critics (even within the same financial institution or research house). Moreover, valid conclusions, backed by in-depth research, are mixed up with ideological, poorly researched conclusions both for and against the theme. We have decided to look at both sides of the same (Bit)coin to extract the investment thesis behind this new asset class. Each part of this Edison Explains series looks at one feature of BTC and the broader cryptocurrency landscape (broadly referred to as ‘altcoins’). We conclude by summarising our subjective view on how positive or negative we believe the feature is for BTC’s investment thesis.

Bitcoin (BTC) and other digital assets have been making the headlines in recent months, polarising the investment community with an equal number of strong advocates and fierce critics (even within the same financial institution or research house). Moreover, valid conclusions, backed by in-depth research, are mixed up with ideological, poorly researched conclusions both for and against the theme. We have decided to look at both sides of the same (Bit)coin to extract the investment thesis behind this new asset class. Each part of this Edison Explains series looks at one feature of BTC and the broader cryptocurrency landscape (broadly referred to as ‘altcoins’). We conclude by summarising our subjective view on how positive or negative we believe the feature is for BTC’s investment thesis.

How is BTC supply determined?

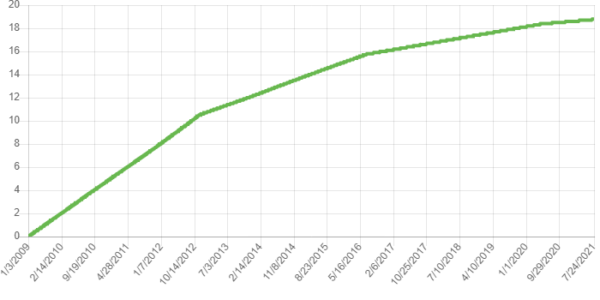

BTC stands not only for a new type of currency, but an alternative monetary system in which the prospective money supply is capped. There can only ever be 21m BTCs, which represent the total possible supply programmed into Bitcoin’s protocol at the time of inception in 2009. This stands in stark contrast to fiat money as major central banks are free to issue any amount they deem appropriate as part of their monetary policy after abandoning the Bretton Woods system in 1971. So far, around 18.8m BTCs have been mined (ie awarded to entities in exchange for providing their computing power to secure the BTC blockchain network).

Moreover, the pace at which new BTCs are mined is also set out in Bitcoin’s protocol, with the current reward being 6.25 BTC per every mined block (ie containing a batch of transactions to be added to the blockchain) which, on average, happens approximately every 10 minutes). This mining reward is reduced by half every 210,000 blocks, which roughly means every four years (the last such event called ‘halving’ occurred in May 2020). See our Blockchain adoption report for details.

Total circulating supply of BTC (in millions)

Why is BTC’s scarcity important?

Because of its scarcity, BTC may be perceived as an ‘inflation hedge’, even if a link between its price and inflationary expectations has not yet been definitively proved. It may also be treated as an ‘insurance policy’ against a significant distress in the traditional financial system and certain government decisions. It is particularly appealing to residents of countries with a poor track record of monetary stability (and resulting high inflation) and where governments used to prohibit holding foreign currency (eg US dollar) deposits and/or impose forced conversions into the local currency at official exchange rates (which differed visibly from market rates), resulting in the loss of private wealth. This is well illustrated by the high rankings of Latin American countries such as Argentina or Venezuela in the Global Cryptocurrency Adoption Index published by Chainalysis. Another example is the surge in the BTC price in 2013 following the bailout of Cyprus’s banks (and the associated blocking and ‘haircuts’ on customer deposits).

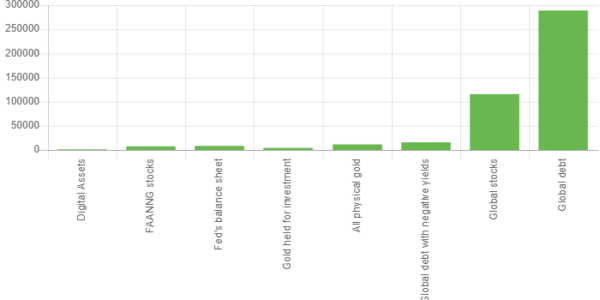

The finite supply also has implications from an investor perspective. Digital assets remain a relatively small asset class by market capitalisation, which currently stands at c US$1.40tn. BTC’s market cap alone equals c US$0.7tn, versus the value of all gold held as an investment at c US$4.7tn or the market cap of all global equities at c US$113tn.

At the same time, global AUM in the asset and wealth management industry is currently in excess of US$110tn, according to PwC. Consequently, a 1% allocation of the industry to digital assets would exceed BTC’s current market cap, although we acknowledge that part of the industry’s exposure could be synthetic rather than physical. This would likely push up prices of well-established and liquid cryptocurrencies such as BTC further.

Market capitalization of selected asset classes as at 25th July 2021

Does BTC’s scarcity alone make it valuable?

Some attempts have already been made to attach value to BTC’s scarcity, including the so-called ‘stock-to-flow’ (SF) model, published in March 2019 by an anonymous author known as ‘PlanB’, which became quite popular in the cryptocurrency community.

SF examines the relationship between the total outstanding supply and the annual growth in supply (new production) of a given asset (specifically, gold, silver and BTC were analysed), as well as its ‘unforgeable costliness’ (ie scarcity determined by the cost of producing/mining an asset) as a determinant of its value. As the block reward declines over time, the stock-to-flow ratio for BTC increases accordingly. Interestingly, it has so far correlated with its price development quite well. Having said that, the SF model has been criticised, with the main objections including:

- the lack of any proof that the value of a monetary good is derived from its rate of supply

- use of linear regression, which results in a high risk of spurious correlation

- the fact that several other cryptocurrencies use the same code as BTC and thus have a similar supply schedule/SF ratio, but their market capitalisation is significantly lower

- the model provides a predictable BTC price increase after each halving, which the market is able to discount ahead of the event, but has not done so.

These all seem valid points, suggesting that the SF model should be treated with caution. We acknowledge that scarcity alone does not necessarily mean an asset has intrinsic value. BTC could be considered worthless if it had no additional utility. The purpose of this series is to discuss the potential use cases for BTC that could underpin its value.

But there are plenty of other cryptocurrencies

Some opponents of cryptocurrencies (including BTC) claim that they are not really scarce, given the tremendous growth in the number of different cryptocurrencies in recent years (there are currently 5,000+ different coins according to CoinMarketCap.com). However, an important differentiator among cryptocurrencies is the network effect associated with, among others:

- the amount of capital invested by network participants in block mining/validation capabilities

- the size of the code developer community and consequently the quality of the underlying code used by the network

- the value of cryptocurrency locked in decentralised finance projects.

Bitcoin’s importance and security is facilitated by a particularly high hashrate (the amount of computational power used for securing the network), which currently stands at c 100 Exahashes per second as a result of significant investments in mining infrastructure made in the sector. Nevertheless, we admit that in the long run, BTC could potentially be replaced by an altcoin as the dominant ‘digital gold’, although it would have to overcome significant entry barriers in terms of network effects as discussed above.

“While scarcity alone does not translate into value, it is a solid foundation which – in conjunction with additional utility of an asset – can make it valuable. An alternative monetary system with a predefined currency supply which is not controlled by the local government is appealing for residents of countries with poor monetary and fiscal governance.”

Beyond BTC: Growing role of smart contracts

Each altcoin has its own set of ‘monetary’ rules determining its scarcity (ie if the asset has fixed supply, is inflationary (and at what pace) or deflationary). For instance, Ether is currently an inflationary asset with unlimited supply, but predefined supply growth. Two coins are minted for every block mined on the chain, which as at May 2021 translated into a 4% annual issuance rate (versus 1.8% for BTC), according to CoinDesk Research.

However, after the implementation of the Ethereum Improvement Proposal 1559 (which is in progress), an amount of coins equal to the base fee paid for each transaction on the Ethereum network will be ‘burned’ (ie removed from circulation) which, in times of high network activity, may offset the new supply of minted coins and make the cryptocurrency deflationary.

There is a variety of promising digital assets offering additional utility which BTC is unable to provide (at least at this stage). One of the most compelling groups are native cryptocurrencies of blockchains enabling so-called ‘smart contracts’ ( in particular).

Smart contracts represent agreements whose terms are directly embedded within the code and are automatically executed (without the need to involve third parties responsible for monitoring the execution of these terms). We will discuss their potential use cases later in the series. The distinct functionalities of a given altcoin can, together with its scarcity profile, underpin its value.

Alternative investments Commentary » Alternative investments Latest » Commentary » Financial Education

Leave a Reply

You must be logged in to post a comment.